China is one of the world’s most attractive healthcare markets, and is by far the fastest growing emerging market. Stefan Kracht, Managing Director of Fiducia Management Consultants, looks at its development and explains the factors that are causing it to expand so quickly.

China is one of the world’s most attractive healthcare markets, and is by far the fastest growing emerging market. Stefan Kracht, Managing Director of Fiducia Management Consultants, looks at its development and explains the factors that are causing it to expand so quickly.

The nation’s healthcare spending is projected to more than double from USD 395 billion in 2014 to USD 1 trillion in 2020. One of the key drivers for this is that China will have the largest elderly population in the world by 2016, with almost 10 per cent estimated to be over the age of 60. This, coupled with the rapid growth in wealth and disposable income, has resulted in a surge in demand for medical equipment. The Chinese Government prides itself on its expanded medical insurance coverage at an official 95 per cent of the country. While this number is debatable, it shows that there is increased emphasis being placed on the healthcare sector.

The current market

The medical technology market in China is the second largest in the world after the United States, totalling over CNY 250 billion in 2014, with an anticipated 20 per cent annual growth over the next three years. While medical devices still take up the smallest share of the entire healthcare market (behind pharmaceutical sales and healthcare services), this segment is exhibiting the strongest projected growth rate and shows high potential for the future.

The medical technology market in China is the second largest in the world after the United States, totalling over CNY 250 billion in 2014, with an anticipated 20 per cent annual growth over the next three years. While medical devices still take up the smallest share of the entire healthcare market (behind pharmaceutical sales and healthcare services), this segment is exhibiting the strongest projected growth rate and shows high potential for the future.

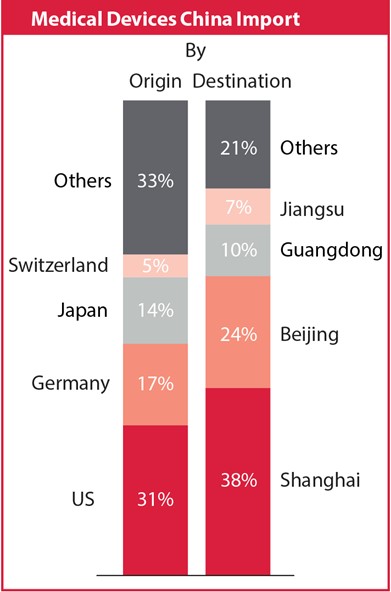

The local market consists of a large number of small-sized manufacturers geographically focused on the eastern and southern coastal areas. Eighty per cent of market revenue is driven by the provinces of Beijing, Guangdong, Hebei, Jiangsu and Shanghai.

Imported products dominate the high-end market, supplying high quality and high cost products that are not available locally. In fact, the number of new imported product registrations has increased by 49 per cent since 2010. With a total number of 9,300, over one third of all registrations came from international companies in 2014 alone, with 45 per cent being first time applicants.

Rise in domestic demand

The high-end segment is dominated by foreign products that are either produced abroad or locally but with a foreign design. These products typically have specialised functions as a result of more specific know-how from international experts. Targeted at large domestic premium customers, the main competition in this sector originates from top international and ASEAN companies.

The low-end medical devices segment, by contrast, is made up of mostly Chinese manufactured products aimed at small-to-medium domestic customers. Concurrently, there is much room for growth in the mid-end, which makes up 40 per cent of the total market. For this segment, some international companies have developed special ‘eco’ product lines adapted to the mid-range end-customer. These products can have a local design and be locally produced according to Chinese standards but incorporate specialised foreign known-how.

In China, medical devices are generally categorised into three classes:

- Class I: safety can be ensured through routine administration

- Class II: further control is required to ensure safety of use

- Class III: implanted into the human body, or used for life support, or pose potential risk to the human body and thus require strict safety surveillance

Product registration

From October 2014, the China Food and Drug Administration (CFDA) enforced a number of new regulatory reforms regarding the registration of medical devices in China. Its reasons for doing this were three fold. One, the aim was to create a more level playing field for domestic and foreign players, since previously, all domestic Class II and III devices required clinical trials whereas most imported devices unfairly did not. Second, through these reforms, the CFDA was able to prioritise its workload by focusing on higher risk devices, requiring Class I products, for example, to be filed on record only, which streamlined the process. Third, the reforms encouraged the improvement of technical standards and increased transparency of the registration process.

While in theory these regulatory reforms are a positive change, they also present a number of challenges for companies planning to bring their medical devices to China. The CFDA now requires long clinical trials for a number of products, which can draw out the registration time substantially. Moreover, the amount of mandatory documentation applicants must submit has increased significantly in complexity and amount. This, coupled with noticeably higher fees, makes the decision to register a much more serious process.

Given this is a very complex and costly exercise, it is crucial to find a suitable advisor that can help with the registration procedures. To give you some insight into what is expected, you can find the key steps below so you can prepare accordingly if you want to take the next step in bringing your medical devices to China.

The process

First, it is recommended to begin with a thorough analysis of the registration requirements, such as the classification (Class I, II, or III), the number of applications required for the portfolio and whether or not clinical trials are needed. At this stage, it makes sense to establish a project plan with your advisor. Keep in mind that several registrations per set of devices might be required, as is the case, for example, for dental implants. Your advisor must be able to compile a list of technical requirements and testing standards for your portfolio.

Testing and clinical trials precede the CFDA registration application and can be done in one of a handful of testing centres across the country. Be mindful off the fact that choosing the right one with suitable facilities and available capacity is an important decision. Only a few established agents are able to directly manage the clinical trial process, while most outsource it. Additionally, distributors are often involved in the clinical trial process, as they have access to key opinion leaders (KOLs), such as medical doctors and other experts. To save time, it is recommended that the preparation and translation of registration documents be done concurrently with the testing process.

More likely than not, after the technical review, which takes 90 working days, the CFDA will issue a notice for supplemental information, which will take another 60 working days. If the device is highly innovative or of high risk an expert panel review may be required, which will add another three to six months to the process. In addition, locally producing companies will have to undergo a quality management system (QMS) audit, at this stage.

All in all, the registration procedure is a lengthy and costly process that can take up to several years if companies fail to submit the required information and necessary documentation in time. Working with someone who is experienced in dealing with the CFDA and is up-to-date with the current requirements is essential in increasing your chances of success.

Fiducia is a professional service provider focused on Greater China. For over 30 years, our team of more than 100 consultants and specialists in Beijing, Hong Kong, Shanghai and Shenzhen has provided integrated support in accounting, corporate and trade services, consulting and recruiting, to deliver practical solutions for international mid-market clients sourcing from, selling to, or investing in China. We successfully represent clients in complicated situations and during significant transactions requiring specialised knowledge and skills.

Recent Comments