The effects of adopting international pharmaceutical standards

The effects of adopting international pharmaceutical standards

In recent years, China’s pharmaceutical industry has rapidly evolved. A large number of international pharmaceutical standards and best practices have been adopted by the Chinese healthcare system. Vincent Zhu, a senior partner, and Mireia Paulo, director of the European- American Market and Overseas Investment Project, from A&Z Law Firm, outline how these changes have had a drastic effect on the country’s pharmaceutical management model.

A change in China’s leadership facilitated the modern medical regulatory system taking off in 1978, six or seven decades after Europe and the United States (US) got their regulatory systems off the ground. In 2015, Bi Jingquan, former specialist at the National Development and Reform Commission, became the director of China’s Food and Drug Administration (CFDA). Due to Mr Bi’s relative inexperience with regulating pharmaceuticals, the CFDA has increasingly looked to international models for advice on how to best run the organisation.

In July 2016, the CFDA appointed Dr He Ruyi as the chief scientist at the Centre for Drug Evaluation (CDE). Dr He previously worked at the US Food and Drug Administration (FDA) and as the chief scientist in a pharmaceutical examination centre for 17 years. In June 2017, the CFDA officially joined the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH). Becoming a member marked a real turning point for Chinese medical regulation, since joining this international body put the CFDA for the first time on par with other pharmaceutical regulatory bodies. After joining the ICH, the CFDA has been striving to be included in the Pharmaceutical Inspection Convention and Pharmaceutical Inspection Co-operation Scheme (PIC/S).

On 29th August 2017, during the inaugural meeting of the 11th Chinese Pharmacopoeia Commission, Mr Bi stated that “the overall goal of reform is harmonisation with international standards”. In fact, since undergoing reform, China’s pharmaceutical management model has endured drastic changes and has consistently moved towards a more European or American-style management system.

Three steps towards improvement

China’s pharmaceutical regulatory body has taken three crucial steps for improvement.

1. China adopted a quality and consistency evaluation framework for generic drugs.

In 1971, the US launched a bioequivalence evaluation of generic drugs. By accelerating market entry and focusing on therapeutic equivalence of generic drugs, the FDA eliminated 6,000 types of drugs from the market.

Compared to the US, Chinese laws and regulations pertaining to generic drug evaluation have been executed at an extremely slow speed. Despite making remarkable improvements, China has fallen behind the international community the past three to four decades. For instance, even though a work plan was drafted on generic drugs in 2012, the Opinions of the General Office of the State Council on Quality and Efficacy Consistency Evaluation for Generic Drugs (Guobanfa No. 8) was only recently promulgated on 6th February 2016. Guobanfa No. 8 stated that the consistency evaluation of certain drugs has to be completed by the end of 2018, with the remaining having to be evaluated by the end of 2021.

Country Comparison on Enforcement of Generic Drug Evaluation

Source: A&Z Law Firm, 17 October 2017.

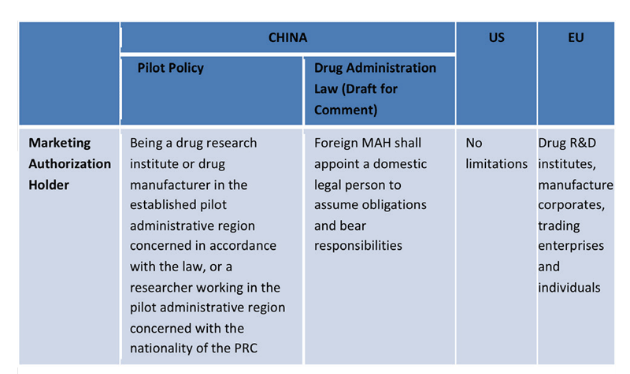

2. China has established a marketing authorisation holder (MAH) system.

The internationally available drug licensing system can be divided into two categories. The first category separates drug market licensing and production license management, which can be observed in the European and North American pharmaceutical systems. The second category, which is used in China, is a merger of the two different licences into one.

Since 5th November 2015, 10 regions in China became a part of the marketing authorisation holder system (MAH) for drugs. These areas have taken part in a three-year pilot programme that will end on 4th December 2018. The MAH system is fairly similar to approaches already taken by Europe, the US and Japan. It has given Chinese pharmaceutical research and development institutes, as well as individuals, in select areas the ability to apply for a drug product licence. Recently, the draft Drug Administration Law of the People’s Republic of China, published on 23rd October 2017, has expanded the programme’s scope to include international applicants and licence holders.

Comparison Between China, US and EU MAH Systems

Source: A&Z Law Firm, 17 October 2017.

Source: A&Z Law Firm, 17 October 2017.

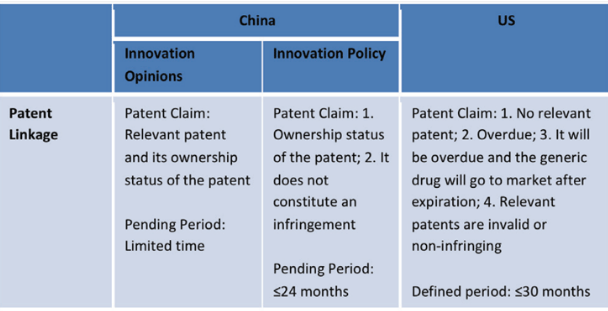

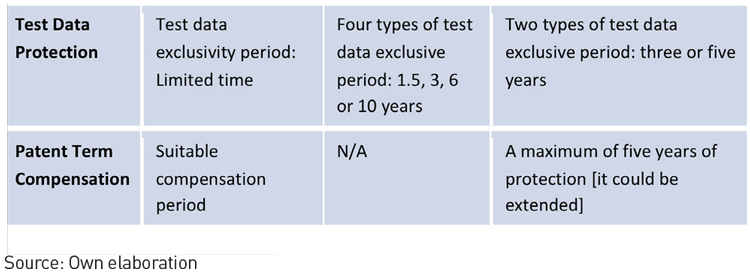

3. China has established a pharmaceutical patent linkage system, test data protection system and patent term compensation system.

Currently, these three systems cooperate with one another and were originally derived from the US Drug Price Competition and Patent Term Restoration Act 1984, otherwise known as the Hatch-Waxman Act.

To encourage innovation and the use of generic drugs, China reaffirmed the three-systems approach in the Opinions on Deepening the Review and Approval System Reform and Encouraging the Drug and Medical Device Innovation (Tingzi No. 42), published on 8th October 2017. This document intended to clarify and improve existing laws and regulations. After publishing Tingzi No. 42, the CFDA issued on 11–12th May 2017, four circulars pertaining to drug and medical device innovation. Included in those drafts was the Relevant Policies on Encouraging Innovation in Pharmaceuticals and Medical Devices, and Protecting the Rights of Innovators (Innovation Policy). After ending the call for comments, the assessment of the Innovation Policy was that it improved both the pharmaceutical patent linkage system and data protection system.

Pharmaceutical Patent System Comparison

In summation, the accelerated internationalisation of the pharmaceutical management model can be best represented by Mr Bi leading the CFDA. He has continued to gradually modify domestic policy and explore international models. An illustration of this is the conditional acceptance of using multi-regional clinical trial data to approve market entry with certain conditions for preferential approval and examination of rare diseases. This is to ensure that foreign innovative drugs can enter and adapt to the Chinese market. This will inevitably result in strong market competition between domestic and foreign pharmaceutical companies. Those companies that take the initiative to adapt to new market conditions now, will conquer the pharmaceutical market in the future.

A&Z is a leading Chinese law firm, which employs over 55 experts consisting of attorneys, legal practitioners and business analysts across 11 jurisdictions. The Shanghai, Beijing, Dalian, Wuhan and Tokyo offices provide a full range of services covering foreign investment, overseas investment, competition and antitrust, intellectual property, M&A and corporate restructuring, labour and social security, dispute resolution, compliance and corporate social responsibility, finance and capital markets, customs logistics and maritime commerce, and environment, health and safety.

Recent Comments