On 3rd September 2018, the European Chamber published the results of a survey conducted earlier in the summer. Members were asked what impact the opening salvo of tariffs and counter-tariffs launched by the US and China had had on their businesses, which, at the time, were levied on USD 50 billion in imports into each market. While much has happened since that has likely magnified the survey, valuable information can still be mined from the survey. Jacob Gunter, Policy and Communications Coordinator at the European Chamber draws out the implications.

On 3rd September 2018, the European Chamber published the results of a survey conducted earlier in the summer. Members were asked what impact the opening salvo of tariffs and counter-tariffs launched by the US and China had had on their businesses, which, at the time, were levied on USD 50 billion in imports into each market. While much has happened since that has likely magnified the survey, valuable information can still be mined from the survey. Jacob Gunter, Policy and Communications Coordinator at the European Chamber draws out the implications.

Results

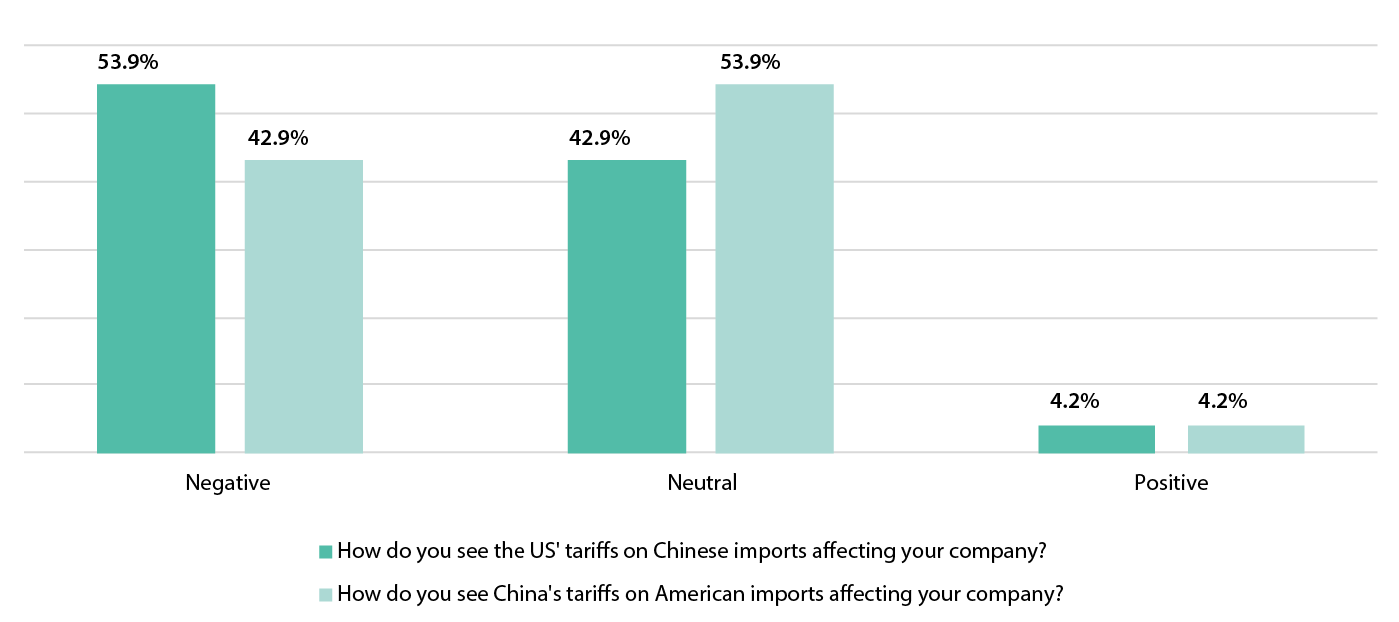

Starting from the headline numbers, it is clear that the tremors of the US-China trade conflict have hit more than just Chinese or American-flagged companies. With 53.9 per cent and 42.9 per cent of respondents viewing the American and Chinese tariffs respectively in a negative light, it is clear that disruptions are far-reaching. However, many respondents also held a neutral view on the conflict. Businesses dealing with trade in goods were, as expected, more impacted than those in the service sector but even so, many of these businesses still maintained a neutral outlook, likely indicating that their products are less intensely tied to global supply chains, especially any chain that crosses the US-China ‘border’. Interestingly, while many had speculated that European firms might find new opportunities as a result of the conflict, only 4.2 per cent reported any positive views of the situation.

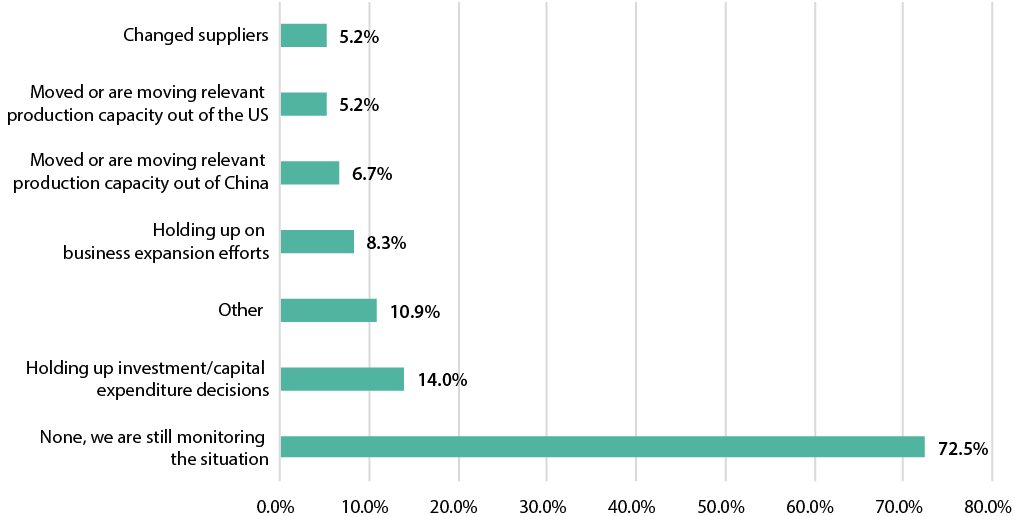

Moving on to responses, there were a variety of reactions to the bilateral tariffs. While the vast majority of respondents reported that they were merely monitoring the situation, more than a quarter were taking action. A total of 17 per cent said they were delaying further investment and/or expansion,1 causing obvious harm to growth. More drastic steps were less common, but worrisome nonetheless. Relocation of relevant production capacity out of the US and China were reported by 5.2 per cent and 6.7 per cent of respondents respectively, indicating that neither side is ‘winning’ the conflict. Finally, 5.2 per cent changed suppliers in response, disrupting some global supply chains.

Deeper analysis

Digging deeper into the data, we find an anomaly that sheds some light on the situation facing supply chains. When broken down by sector, every industry had a higher number of respondents that viewed the US tariffs negatively as compared to those levied by China, save for just one: medical devices. Further conversations with members of that industry revealed the main reason why: suppliers are often highly specialised and produce high-quality parts that simply cannot be sourced elsewhere. Many medical device manufacturers face the challenge of having only a few suppliers to choose from, and sometimes only one. Even if a manufacturer might be able to locate a supplier outside of the US, it may take time for that supplier to ramp up production to meet the new surge in demand. As a result, many China-based European medical device firms are faced with difficult choices: cut into margins, take a temporary loss or pass the price along to purchasers.

This leads to another important question: who is paying for these tariffs? Traditional understanding tells us that consumers are ultimately left with the additional price tag. That may be the case with unilateral tariffs, when one country levies a tariff on all imports of certain goods, regardless of origin. In this case, consumers end up either paying the higher cost for imported goods or losing value and/or choice when they are de facto restricted to only domestically-made products. If taking place in a vacuum (that is, without any other trading partners), the bilateral tariffs between the US and China would lead to the same result. However, with a multitude of other actors in the global market, the situation changes considerably.

Instead of the consumer footing the bill exclusively, bilateral tariffs are being paid for by consumers, end producers and suppliers alike, depending on the degree of elasticity at various points along the supply chain. To better understand this, let’s look at a few examples, all of which will be China-based companies.

Company A is an original equipment manufacturer (OEM). Currently it depends on supplies that are relatively common and can be easily sourced from many different markets, but it chooses to use a US-based supplier. China’s tariffs suddenly raise the cost of these American inputs. But with other suppliers available, Company A can change to a non-US-based alternative without having to bear considerable new costs. As a result, the US-based supplier must then either give up on sales to Company A or absorb the tariff cost to maintain market-share.

Company B is an OEM in the medical devices industry that relies on a US-based supplier that has only one competitor, which is based in Japan. China’s tariffs raise the cost of supplies, leading Company B to look to the Japanese supplier to avoid extra costs. However, the Japanese supplier cannot simply ramp up production, and even if it decided to do so, it would still have to increase prices for Company B by a rate only a bit lower than the tariff rate affecting its US-based competitor. Either way, Company B is left with considerably higher prices due to the inelastic supply chain. Company B must either eat the higher cost or pass it on to the consumer.

Company C is an upstream supplier to an American manufacturer directly affected by the US tariffs. The market is highly elastic, meaning that Company C has competitors across multiple markets that can also supply the US company. Company C must now decide between passing on the cost downstream, which will likely lead to losing considerable market share, or absorbing the cost of the tariff to remain competitive.

Company D is an upstream supplier of a high-quality part to an American manufacturer. In fact, it is the only firm capable of producing this part to the required quality specifications. After the US tariffs impact the industry, the American customer has no alternative competitor to switch to and is unwilling to accept lower-quality parts in the hope that consumers will not notice or be too dissatisfied. As a result, Company D does not have to change prices, and the American manufacturer pays the tariff bill, which it may either eat or pass on to the end-consumer, depending on demand elasticity.

In short, high elasticity is good if you’re downstream, and bad if you’re upstream, while low elasticity is good if you’re upstream, but bad if you’re downstream.

Companies at the wrong end of the situation are then left with the difficult decision of passing on prices, absorbing them to retain market share, or balancing both. Making that choice is no easy task. At the moment, the European Chamber has heard from many of its members that those negatively affected have largely tried to minimise any cost increases in order to hold on to market share. Anecdotally, many are hoping that the US and China conclude a deal soon as they are at least temporarily willing to absorb increased costs to retain market share. However, if a deal proves elusive, the calculus may change the longer the conflict goes on, leading to more significant disruptions and tough choices for those affected.

For more up-to-date data and even deeper analysis, keep an eye out for the European Business in China Business Confidence Survey 2019, which will include a section dedicated to the US-China trade conflict. It is set to be released in May.

Recent Comments