This article lay out the legal framework governing some commonly encountered IP-related competition issues by Georgia Chiu, Counsel at Hogan Lovells and vice chair of the Chamber’s IPR Working Group in Shanghai, and Ting Xiao, associate, Hogan Lovells. In March 2015, Xu Kunlun, director of the National Development and Reform Commission’s (NDRC’s) Price Supervision and Anti-Monopoly Bureau, stated that antitrust enforcement would focus on IP-related issues. Soon after, the State Administration of Industry and Commerce (SAIC) published Provisions on Prohibiting Abuse of IP Rights to Eliminate or Restrict Competition (Provisions). The Provisions echo Article 55 of the Anti-Monopoly Law (AML) in trying to set the boundaries between the legitimate exercising of IPR and abuse of IPR that eliminates or restricts competition.

Standard Essential Patents (SEPs)

The Provisions define SEPs as patents that are essential for the implementation of a standard. Business operators are prohibited from committing any of the following actions to eliminate or restrict competition in the course of developing and implementing standards (including the compulsory requirements from national technical specifications), without any justification:

- Intentionally failing to disclose patents or explicitly waiving its rights when participating in the development of standards, but later asserting its patent rights against the implementer of the standard after its patent is adopted into the standard. This conduct is also known as ‘patent ambush’.

- Abusing its dominant market position (such as refusing to license, product tying or imposing unreasonable restrictions) in violation of the principle of fairness, reasonableness and non-discrimination (FRAND), after its patent becomes a SEP.

Huawei versus InterDigital Communications (2013) became the first case to interpret the FRAND principle in China. The Guangdong Higher People’s Court held that under the FRAND principle, the patentee of the SEPs shall not refuse to license the implementer of a standard who is willing to pay reasonable royalties. The court emphasised that the core of the FRAND principle is the reasonableness of the royalties.

Compulsory licensing

Article 7 of the Provisions provides another mechanism of compulsory licensing outside the context of SEPs. Specifically, any business operator in a dominant market position shall not, without any justification, refuse to license its IP on reasonable terms that eliminate or restrict competition if the IP right is part of the necessary facilities for production and operation. The following conditions are relevant here:

- The IP rights involved cannot be reasonably substituted in the relevant market and the IP right is necessary for other businesses to compete in the relevant market.

- The refusal to license will cause an adverse impact among the competition or on innovation in the relevant market and harm consumers’ interests or interests of the public at large.

- Licensing of the IPR will not cause unreasonable harm to the business operator.

Intellectual property owners are concerned about the SAIC’s broad power to require them to enter into licensing arrangements that may be against their will.

Unreasonable contractual conditions

Operators that hold a dominant market position are prohibited from attaching the following unreasonable conditions that eliminate or restrict competition, without any justification:

- Requiring the other party to exclusively grant back the technologies that they have improved.

- Prohibiting the other party from questioning the validity of the operator’s IP rights.

- Restricting the other party from using competing technologies or products after the expiration of the operator’s IP rights.

- Requiring the other party to continue to pay royalties for expired or invalidated IP rights.

- Prohibiting the other party from trading with any third party.

Some of the restrictions imposed by the Provisions differ from those imposed by the Regulations on Administration of Import or Export of Technologies and the Supreme People’s Court’s Interpretations on Certain Issues on Application of Law in the Trial of Technologies Contract Disputes in technology licensing agreements. For example, under normal circumstances, a licensor may require the licensee to grant back improvements exclusively as long as there is reciprocity. However, in a situation where the licensor enjoys a dominant market position, it seems that it will not be permitted to require the licensee to grant back improvements exclusively, even if there has been adequate consideration paid for such grant-back.

Tie-in

When exercising IPR, business operators that enjoy a dominant market position shall not, without any justification, conduct a tie-in sale that meets all of the following conditions that eliminate or restrict competition:

- The tie-in or package sale of different commodities is in violation of trading practices or consumption habits, or disregards the different functions of the commodities.

- The tie-in sale extends the operator’s dominant position in the tying product market to the market of the tied product and eliminates or restricts the competition in the tied product market or tying product market.

In the recent, well-documented Qualcomm case, the NDRC found Qualcomm licensed its Wireless SEPs in bundle with non-Wireless SEPs in the form of a licence package, without any justification.

Patent pool

The Provisions defines a ‘patent pool’ as a contractual arrangement where two or more patentees jointly license the patents owned by them individually to a third party. On one hand, a patent pool may reduce transactional costs and promote licensing activities; on the other, such an arrangement may eliminate or restrict competition. A patent pool management organisation that has a dominant market position is prohibited from committing any of the following acts that eliminate or restrict competition, without any justification:

- Restricting a patent pool member from licensing any patent as an independent licensor outside the patent pool.

- Restricting a patent pool member or a licensee from, independently or in conjunction with a third party, developing any technology competing with a patent in the pool.

- Compelling a licensee to exclusively grant back any technology improved or developed by the latter to the patent pool management organisation or a patent pool member.

- Prohibiting a licensee from questioning the validity of a patent in the pool.

- Applying differential treatment in trading conditions to patent pool members of the same conditions or to licensees in the same relevant market.

- Any other conduct that constitutes abuse of its dominant market position, as determined by the SAIC.

Safe harbour for monopolistic agreements

Monopolistic agreements include both horizontal and vertical agreements. Horizontal agreements are concluded between business competitors whereas vertical agreements are concluded between business partners of a same supply chain. For example, IP right owners shall not enter into vertical agreements that fix the resale price or impose restrictions on the minimum resale price.

The Provisions provide the following safe harbour to IP owners who enter into such horizontal and vertical agreements:

- The aggregate market share of the competing operators in the relevant market is less than 20% or at least four other interchangeable technologies subject to independent control can be obtained at a reasonable cost in the relevant market.

- The aggregate market share of the operator and its transaction counterparty in the relevant market is less than 30% or at least two other interchangeable technologies subject to independent control can be obtained at reasonable costs in the relevant market.

The AML fails to provide such safe harbour for regular business operators and therefore this provision is a breakthrough for IP owners or users.

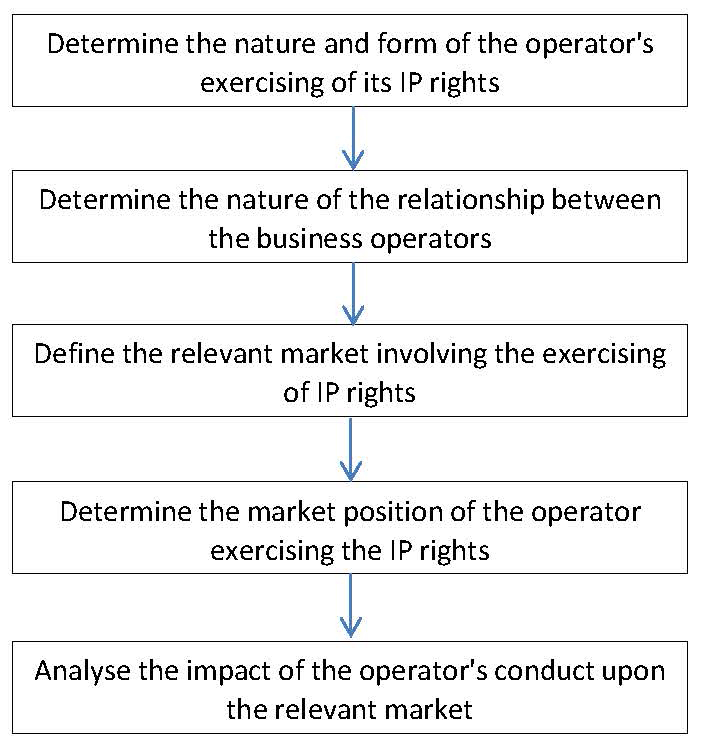

The common issue for various problems outlined above is whether the conduct eliminates or restricts competition, i.e. the impact of the operator’s conduct upon the relevant market. This may involve extensive economic analysis.

Please see below for a flowchart showing the methodology of analysis by the SAIC:

Finally, it should be noted that the Provisions are enacted and implemented by the SAIC at the ministerial level under the AML. They do not have a binding effect on courts and the courts may well interpret the AML quite differently on any specific issues. This is perhaps more so since we have seen the increase of judicial power due to the recent reforms of the judiciary. That said, the Provisions serve well as a guideline for IP owners when exercising IPR in China.

Finally, it should be noted that the Provisions are enacted and implemented by the SAIC at the ministerial level under the AML. They do not have a binding effect on courts and the courts may well interpret the AML quite differently on any specific issues. This is perhaps more so since we have seen the increase of judicial power due to the recent reforms of the judiciary. That said, the Provisions serve well as a guideline for IP owners when exercising IPR in China.

Hogan Lovells is a global legal practice with over 2,800 lawyers in more than 40 offices including three offices in Greater China, five offices in the rest of Asia and 17 offices in Europe. The Beijing, Shanghai and Hong Kong offices provide a full range of services covering antitrust/completion law, intellectual property, media and technology, banking and finance, corporate and contracts, dispute resolution, government and regulatory, projects, engineering and construction, real estate, and restructuring and insolvency.

Recent Comments