Despite being widely anticipated to be uneventful, ahead of President Xi Jinping’s personnel shuffle later this year, the 2017 ‘Two Sessions’ (lianghui) were full of signposts.

Peter Folland, Nicholas Consonery, Mark Rushton and Kevin Ma of FTI Consulting distil six key points from the lianghui that indicate the direction that China will take over the coming year.

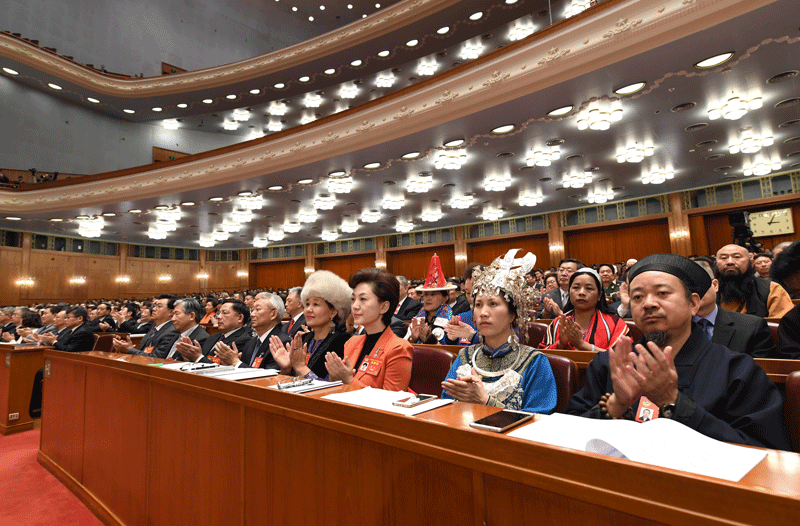

This year’s lianghui, the annual meetings of the China People’s Political Consultative Conference (CPPCC) and the National People’s Congress (NPC), provided plenty of opportunities to feel the pulse on Chinese politics amid a slew of press conferences and public briefings. Call it a high season for Chinese politics. The meetings took on a special significance this year given that they were the last major political gatherings before the upcoming leadership transition at the 19th Chinese Communist Party (CCP) Congress in the autumn.

Above all, the underlying theme for this year was the politically-driven desire to maintain stability and avoid any disruption to the upcoming transition (we’ve called this China’s ‘Stability First’ policy – in contrast to the ‘America First’ mantra of new US President Donald Trump). The government’s annual target for economic growth for the year was only very slightly reduced from last year, and in his kick-off speech to the Congress Premier Li Keqiang said explicitly that “stability is of overriding importance.” In fact, Li’s report mentioned ‘stability’ fifteen times – up from just four times in 2016.

For foreign investors and multinational companies (MNCs), the NPC did still reveal some interesting details on the reform and policy outlook in 2017, though the overarching focus on stability suggests that Beijing won’t have much appetite for reforms considered too risky. But it is also important to note that in some areas, like environmental degradation, Beijing believes that not reforming may actually be the bigger risk to stability. Those are the kinds of issues where we should expect some progress this year.

The range of issues openly discussed at the NPC was enormous. A short list would include: financial regulatory reform, environmental protection, state-owned enterprise reform, the One Belt One Road initiative, food safety, poverty alleviation, tax reform, trademark protection, foreign investment policies, promoting innovation in new and high-tech sectors, healthcare reform, anti-corruption work, legal and judicial reform, education reform and foreign relations, to name a few. The government also issued three important policy reports during the NPC including a work report from Premier Li Keqiang, which set out high-level policy goals for the year, and work reports from both the National Development and Reform Commission (NDRC) and the Ministry of Finance (MoF), which provide details on issues ranging from deficit targets to infrastructure spending.

Amid all the policy discussions, it can be tough for investors to discern the signal through the noise. Here is our list of what we think matters most from this year’s NPC:

Growth is good, more growth is better

In only slightly reducing the annual growth target (“around 6.5 per cent or higher if possible,” down from “between 6.5 to seven per cent” last year), the government confirmed that its focus for 2017 is on keeping the economy stable and managing risks, rather than unleashing radical reforms in areas like reducing industrial overcapacity and bad debt, which would threaten sharp increases in joblessness and potentially even slower growth. The message is that Beijing is willing to tolerate only incremental progress on tackling those structural issues in exchange for solid growth this year. Many media sources are saying that the target is simply “around 6.5 per cent,” but we think the actual text is more in line with last year’s target.

Eye catching infrastructure spending and support for social welfare

There was some optimism that Beijing might announce a wider fiscal deficit to support the economy this year. Instead, the deficit target was set at three per cent of GDP, the same as last year. Still, Beijing’s infrastructure aspirations are, as ever, impressive: some of the goals for this year are to complete railway infrastructure investment of CNY 800 billion (USD 115 billion) and CNY 1.8 trillion (USD 260 billion) in highways and waterways. The government also announced a 9.5 per cent increase in central government transfer payments to local governments with a specific aim of increasing local-level funding for social welfare. These resources are badly needed given that most provincial governments are over-burdened with social welfare obligations. For foreign firms, the government also views investments in entrepreneurship as having an important role to play in meeting its social welfare goals, through the creation of jobs and generation of upward social mobility through start-ups and innovation.

Serious language on pollution

In his opening comments to the Congress, Premier Li said that Chinese people are “desperately hoping” for cleaner air, and made strong commitments to reducing air pollution by cutting the use of coal and stepping up monitoring of manufacturing sectors. The government’s work report specifically targeted a reduction of at least 3.4 per cent in energy consumption per unit of GDP (in-line with last year’s targets), along with a promised net reduction in steel production capacity and the aforementioned target to shutter 150 million tonnes of coal production – a target not mentioned in the 2016 work report. It also promised to suspend, postpone construction on, or eliminate no less than 50 million kilowatts of coal-fired power generation capacity. The report committed to making China’s energy supply ‘greener’ through privatisations, innovation and better integration of renewables. This big push for green development means huge spending on environmental technology, which may result in increased opportunities for foreign firms. However, the government will also continue to increase investment and prioritise the development of domestic industry in these areas.

Big shift in tone on foreign investment

One major bright spot for the NPC in 2017 was a big switch in tone on foreign investment. In 2016 the government promised “innovative ways to promote foreign trade”. This year, the commitment is to “big moves to improve the environment for foreign investors”, which is significant both in emphasising the need for fundamental reform and also in specifically recognising the need to be responsive to concerns of foreign companies. This follows on from a recent 20-point State Council directive on promoting foreign investment. Still, we’re only looking for gradual steps this year in light of the focus on stability and the likely institutional pushback to greater openings. In the work report Li said explicitly that Beijing would use revisions to its foreign investment catalogue and new free trade zones to promote inbound investment, specifically identifying services, manufacturing and mining as targeted sectors.

A desire for smooth US-China relations

One major issue that was not on the official agenda but was at the forefront of the minds of all officials and NPC observers was real concern about the trajectory of the US-China relationship. Senior officials were unambiguous on their desire to keep the relationship stable: in his press conference new Commerce Minister Zhong Shan said that a US-China trade war would not be in either country’s interests; and Chinese Foreign Minister Wang Yi outlined the possibility of expanding areas of cooperation with the US stating, “As long as we…..follow the principles of no conflicts, confrontation and mutual respect….there is no reason why China and the United States cannot become excellent partners.” It was also announced towards the end of the lianghui that Presidents Xi and Trump will meet in April in Florida. Regional stability, particularly concerning North and South Korea, is likely to feature high on the agenda.

A politicised environment in a political year

In short, this year’s lianghui were decisively influenced by the upcoming 19th Party Congress. As President Xi looks to solidify his team for his upcoming second term, he has little incentive to risk policy changes that would generate slower growth or instability in foreign relations. For MNCs, the underlying message is to expect a more highly politicised environment in China this year as the government is distracted by managing the transition. Internal jockeying will intensify, and local officials will become even more avoidant of risk taking. This will mean greater wariness about engaging with MNCs, and a harder time getting needed issues on the agenda of China’s officialdom. For 2017, MNCs will need to be patient, carefully monitor the policy winds and lay the groundwork for making traction with up-and-coming officials who will be empowered during Xi’s second term.

Beyond the transition, Beijing’s recent promises to further open to foreign investors and pursue other meaningful reforms could start to bear more fruit. That, however, will likely have to be a question for 2018.

FTI Consulting is an independent global business advisory firm dedicated to helping organizations manage change, mitigate risk and resolve disputes: financial, legal, operational, political & regulatory, reputational and transactional. FTI delivers an unmatched combination of breadth and depth of expertise across a worldwide network of more than 4,600 employees located in 29 countries on six continents. To find out more, please visit www.fticonsulting.com.

Recent Comments