The impact of COVID-19 on European banks in China’s banking industry

To assess the impact of the COVID-19 outbreak, and subsequently the response measures the Chinese Government imposed by the Chinese Government on foreign banks operating in China, the European Chamber launched a survey among its Banking and Securities Working Group members.[1] Pablo Galvez, coordinator of the Banking and Securities Working Group, outlines the results of the survey in this article.

The questions included in the European Chamber’s banking industry survey were designed and chosen to provide insight into three key areas:

- the situation on the ground for the foreign banks and the main behaviour patterns of their clients during the crisis;

- the competition foreign banks in China face from domestic banks; and

- foreign banks’ expectations for future development in China.

The survey showed that, despite all the challenges foreign banks face as a result of the crisis, they remain committed to investing in and growing their operations in China. However, they are still dealing with many constraints that go beyond the current crisis, such as market access barriers. Therefore, Chinese regulators need to accelerate the opening up of the sector and offer real solutions to the foreign banking industry. By taking measures to facilitate meaningful participation by foreign banks in the Chinese market and ease their operational burdens, regulators would be contributing to the well-being and longevity of the domestic economy. Statistics show that, as of the end of June 2020, foreign banks represent less than 1.2 per cent of the total market share in the country. Their ability to penetrate the market is further hindered by the fact that their capital is very small compared to Chinese banks.[2]

The situation on the ground for foreign banks in China and clients’ main behavioural patterns

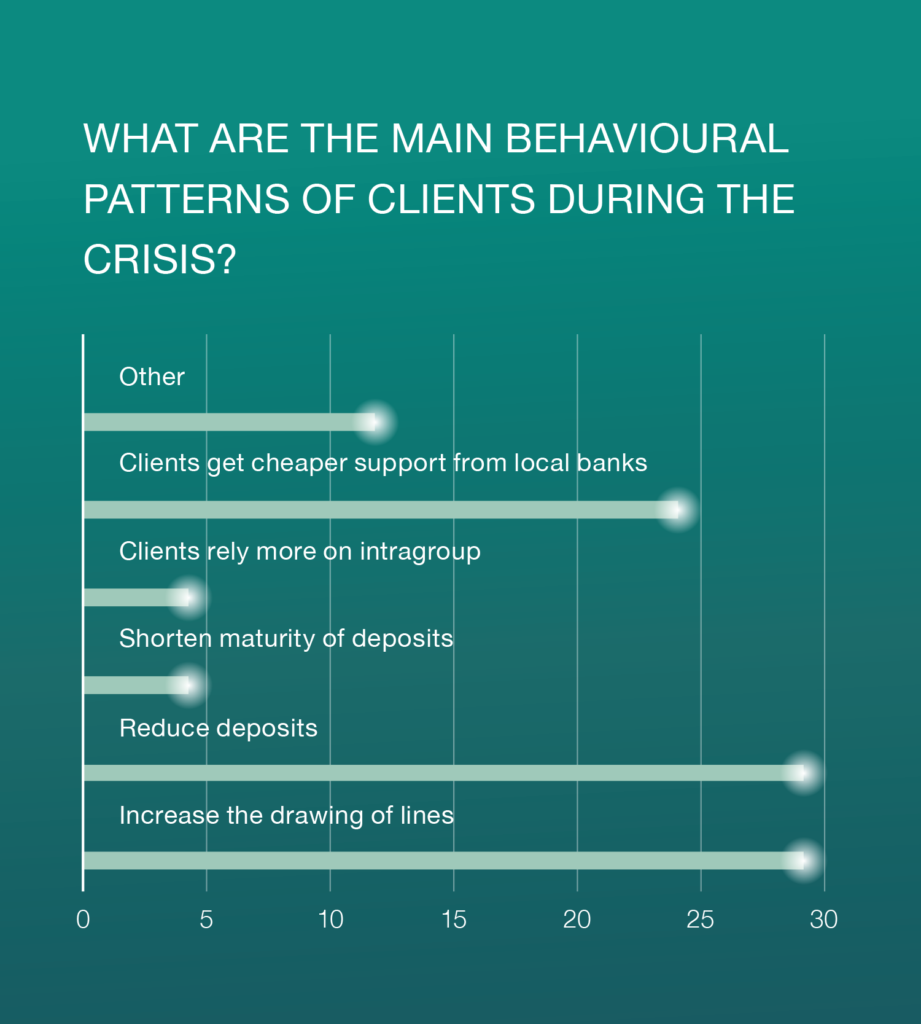

When asked how their corporate and financial institution clients reacted during the crisis, foreign banks indicated that clients had exhibited three main types of behaviour: credit lines were drawn, and corporate deposits reduced—showing liquidity needs during this period—while some foreign banks also highlighted that clients got cheaper funding from local banks. This latter factor demonstrates the competitiveness of the Chinese banking industry and the strong support local banks received from the People’s Bank of China (PBOC) and the government.

Competition faced by foreign banks in the current state of affairs

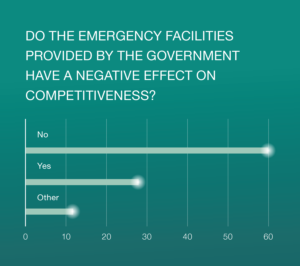

Fear has grown among foreign banks in China that the deployment of emergency facilities by the government (giving companies operating in China access to less costly funding) could have a negative impact on foreign banks, due to their inability to compete against banks that receive such subsidies.

It is worth noting that a majority of respondents to the survey, almost 60 per cent, state that they did not believe these government measures would have a negative impact on them.

The future of foreign banks in China

The answers to three key questions included in the European Chamber’s survey offer a glimpse into the future of foreign banks in China.

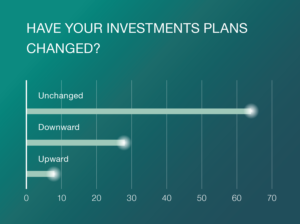

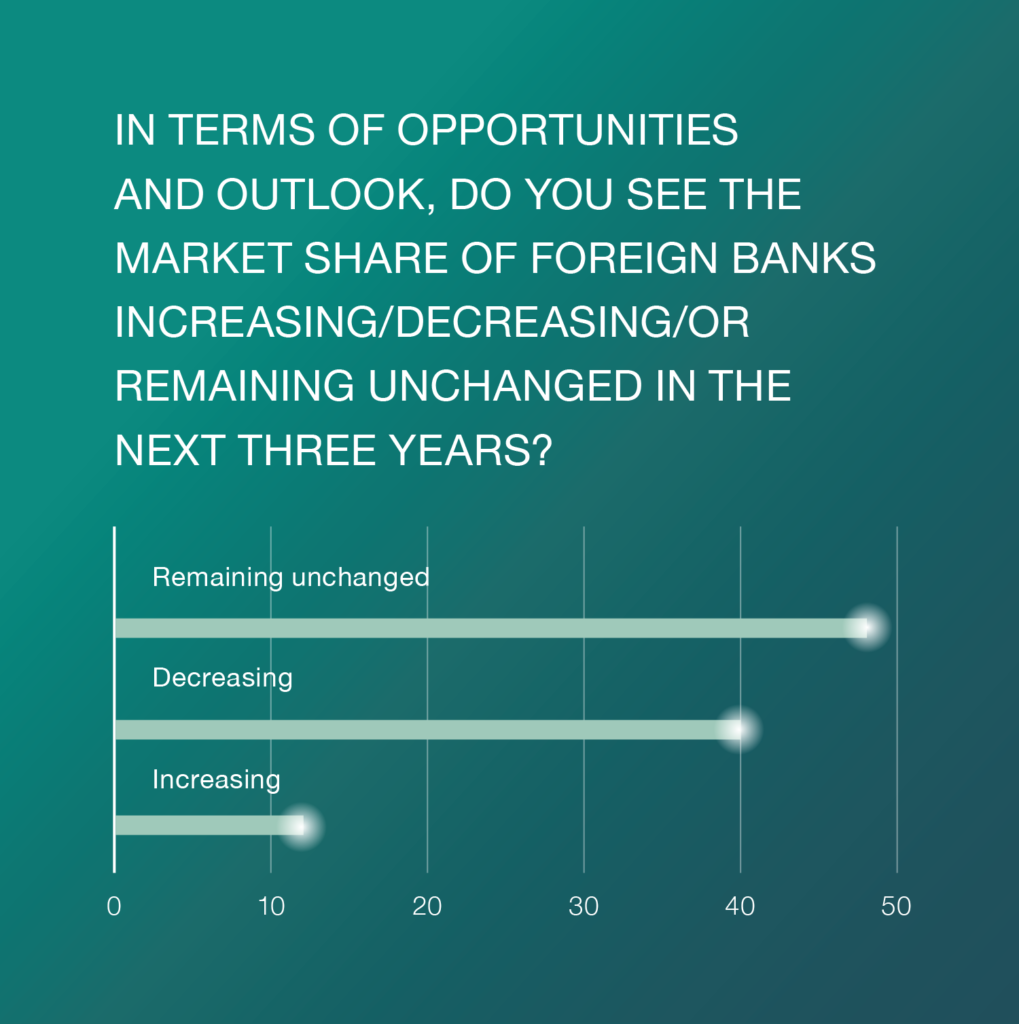

While most foreign banks remain committed to keeping their investment in China (more than 64 per cent stated that their strategic plans have not been altered by the crisis), they are worried about a further decrease of their already tiny market share.

This pessimism could in large part be due to the slow opening up of China’s financial services market. Although there has been an acceleration of new measures (such as lifting of foreign ownership limits on securities firms and opening up in the custody licences field), which is a very welcome development, many of these reforms have come too late to make any real difference for a number of European banks, as they cannot capitalise on many of these new opportunities.

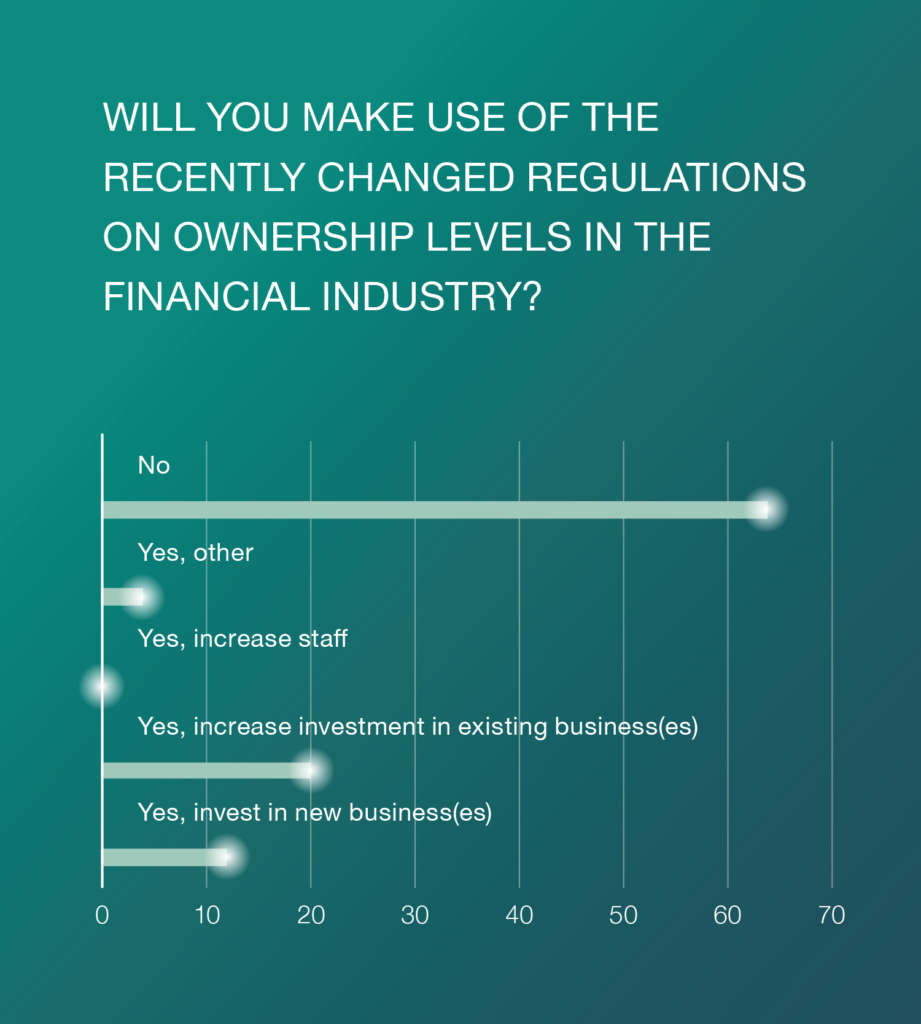

In this sense, an overwhelming majority of the Banking and Securities Working Group members said that they will not make use of the recently released new regulations on ownership levels.[1] Only a fifth replied that they would increase their investment in existing businesses given these changes, and another 10 per cent indicated that they would be looking into new opportunities.

This clearly shows just how limited the recent opening in the financial services sector has been.[3]

The pessimistic outlook of foreign banks on their future standing in the country is very worrisome, as their market share is already significantly lower when compared to that other emerging markets. Taking into account the commitment of foreign banks to the Chinese economy, local regulators should consider implementing thorough measures to facilitate these banks’ operations, which would in turn allow for an actual increase in their market share and ability to service Chinese clients.

China’s financial sector has come to a point where it is increasingly necessary for regulators to take a systematic approach to facilitating investment. This will require the reduction of constraints and implementation of many essential reforms—for example, overhauling the Bankruptcy Law and ensuring that the bankruptcy mechanism is enforced, setting up a clearer market governance framework, allowing more international rating agencies into the market, implementing better auditing regulations—in order for foreign banks to better fund the real Chinese economy.

The Banking and Securities Working Group represents around 40 banking and securities financial institutions in China. The working group engages with the China Banking and Insurance Regulatory Commission (CBIRC) and other financial services regulators in order to improve the operating environment for European banking and securities enterprises in China.

[1] With the lifting of foreign ownership limits on securities firms, as of April 1st 2020, foreign companies have been allowed to set up wholly owned units in Mainland China. See China Lifts Foreign Ownership Limits on Securities, Fund Management Firms, Xinhua, April 1st 2020, viewed on 3rd April 2020, <http://www.xinhuanet.com/english/2020-04/01/c_138938273.htm>

[2] The latest figures show that total assets of foreign banks in China are CNY 3.37 trillion, less than 1.2 per cent of the total assets of China’s banking industry. See, Foreign Banks Establish 41 Legal Person Lenders in China, Total Assets Approach $480 Billion, China Banking News, January 2020, viewed 7th July 2020, <http://www.chinabankingnews.com/2019/12/12/foreign-banks-establish-41-legal-person-lenders-in-china-total-assets-approach-480-billion/>

[3] Members have noted an acceleration in the number of opening up measures in recent times, for the most part as a consequence of the US-China ‘Phase One’ Trade Deal. It could be argued though, that many of the recent released measures had already been under preparation of the regulators, and that their impact for foreign banks is, in general, not very significative. For more information on the US-China Phase One Trade Deal, see: Economic and Trade Agreement between the Government of the United States of America and the Government of the People’s Republic of China, USTR, 15th January 2020, viewed on 11th May 2020, <https://ustr.gov/sites/default/files/files/agreements/phase%20one%20agreement/Economic_And_Trade_Agreement_Between_The_United_States_And_China_Text.pdf>; Chinese version: <http://images.mofcom.gov.cn/www/202001/20200116104122611.pdf>; see also: US, China Sign Phase One Trade Deal: How to Read the Agreement, China Briefing, 17th January 2020, viewed on 11th May 2020, <https://www.china-briefing.com/news/us-china-phase-one-trade-deal-takeaways-businesses-global-trade/>

Recent Comments