How to finance your business in China

Companies have different financial needs in each phase of their life cycle. During the start-up period in particular, cash flow can be tight as the revenue may be insufficient for covering the initial set-up and daily expenses. Financial planning is, therefore, necessary to avoid cash flow problems. This article by Francesca Scortichini and Manuela Mesa Salazar of Hawksford explains how a company should define its financial needs and how they can be fulfilled.

—————-

Running out of cash can have serious consequences for companies, such as missing business opportunities due to not being able to; honour contracts with clients; purchase raw materials; arrange the delivery of goods by an agreed-upon date; or pay wages, custom duties and taxes. Suppliers could also take legal action if a company does not meet its payment obligations, while goods could be stuck at customs, which can damage perishable items in particular, if the import tax is not paid.

Meanwhile, customers may not pay in time, which could also affect the cash flow of a business. Furthermore, due to the strict capital flow controls imposed by the banking authorities, financing a business in China may be slower and more difficult than expected.

It is therefore particularly important for companies to define their financial needs and make cash flow projections before registering in China. This is in order to assess the suitable capital value to register in the first place, and also to understand when additional funds may be needed and how they can be procured. For instance, capital increases and intercompany financing can be alternative tools to a bank loan.

Registered capital

Peculiar to China, when setting up a wholly foreign-owned enterprise, it is necessary to declare a total investment value, which refers to the total amount of funds—including capital and debt—required for the planned business project.

Besides this, companies have to define the registered capital, which refers to the total amount of capital contribution from shareholders for use at the beginning of a company’s life cycle. These funds will be used to pay for rent, salaries, goods and so on until the company is able to generate cash reserves and independently finance its operation.

There is usually no minimum requirement for the registered capital, except for specific sectors such as freight forwarding, fund management, insurance companies and e-commerce, when operating on certain platforms. It is not necessary to inject all the registered capital at the time of incorporation, but this must be done within the terms stated in the company’s Articles of Association (which can be up to 20 or 30 years).

This capital is vital for successfully starting and sustaining a business. Therefore, it would be a mistake not to measure it according to the company’s financial needs and strategic plans. For a proper assessment of capital, companies should be familiar with Chinese business practices and take into consideration all the expenses that could occur in daily operations, such as rents, salaries, social insurance and housing funds, customs duties, direct and indirect taxes, logistics and marketing costs.

It is common for a company’s registered capital to not be sufficient to cover its cash flow needs. Once the registered capital is fully paid and used up, companies need to inject more funds into the business. As obtaining a bank loan may be difficult for newly-established businesses, capital increases or intercompany loans may be the solution.

Capital increase

Financial needs may change over time for several reasons, such as extraordinary or unforeseen costs; the company not reaching its expected growth; deciding to enter a new market segment; or wanting to attract new clients. On occasion, businesses may have to resort to a capital increase to finance these needs.

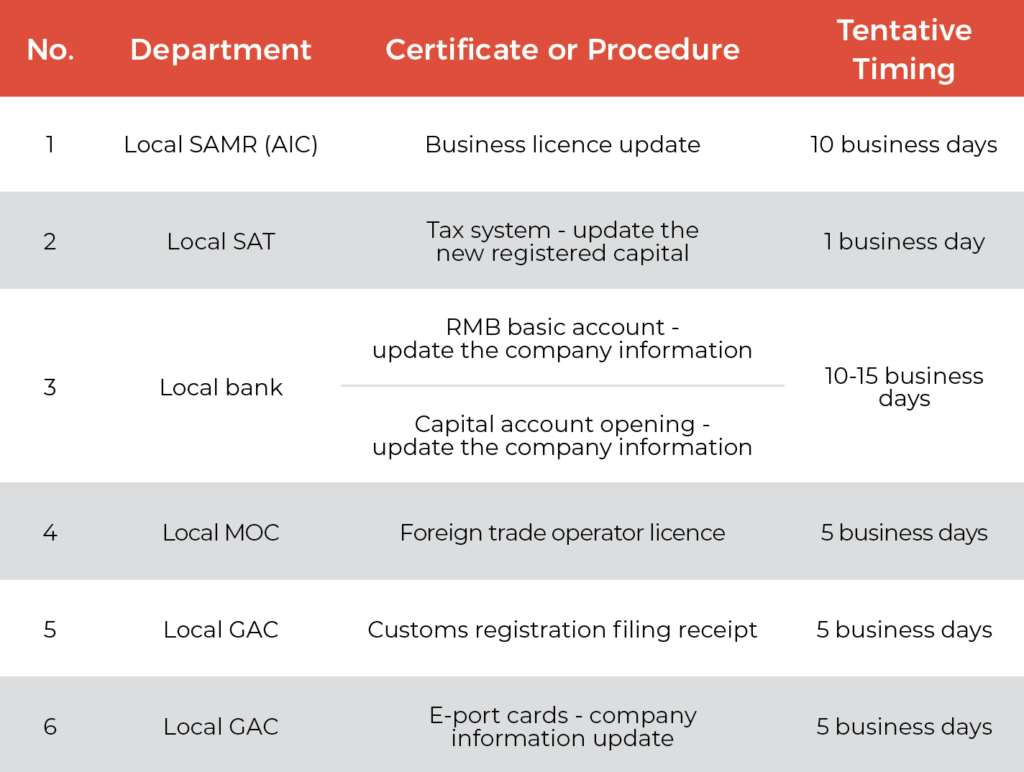

To increase its registered capital, a company must procure multiple authorisations from different government departments. This process may take from six to eight weeks to complete, from the beginning of the capital increase process to when the new capital can be injected and used in the bank account. This timeframe is long, especially if the company has a tight cash flow and, for this reason, it is advised to pay attention to cash flow and implement reliable financial controls to avoid having to take this route.

After the company has updated the new registered capital information with the bank, the shareholder(s) can inject new capital into the capital bank account. According to regulations from the State Administration of Foreign Exchange (SAFE)—which supervises overseas funds inflows, outflows and currency exchange—banks need to submit a ‘foreign direct investment (FDI) report’ in order to register the foreign capital inflow. After three to five days, once the registration is completed, the capital can be converted into renminbi (RMB) and settled to the company’s basic account to be used for daily business expenses.

If the company does not need the additional funds in the end, due to a change of business plans or any other unforeseen situation, it is possible to decrease the registered capital, provided that the accumulated cash reserves allow for payback without impacting the company’s cash flow or harming creditors.

Intercompany loans

Intercompany loans can be granted to a Chinese subsidiary from other companies in the corporate group, usually for temporary financial support purposes. In China, the borrowing amount for foreign intercompany loans is limited to the ‘borrowing gap’, which is the difference between the total investment and the registered capital for the foreign-invested enterprise.

To obtain a loan from a company in the same corporate group, it is necessary to sign a loan agreement that specifies the conditions, the interest rate, duration and repayment terms of the loan and to file an application with the SAFE. Once the loan is approved and all necessary documents from the SAFE have been received, an intercompany loan account can be opened at the bank.

The approval time for loans at the SAFE is around 20 working days, while an additional 10 to 15 working days will be required to open the loan account. Finally, the company headquarters (the lender) can then transfer the funds, which will be subject to FDI registration, to the subsidary. Specific requirements for the account opening will depend on the bank, but the original passport of the company’s legal representative may be needed.

Conclusion

There are different financing solutions for companies in China, depending on their specific needs, as alternatives to other bank financing tools (such as credit lines, bank guarantees and cash pooling), which can be difficult for foreign companies to obtain.

Moreover, a detailed and accurate financial statement is essential for companies, in order for them to constantly monitor expenses, forecast cash flow movements and plan in advance the most suitable financing structure that can support the smooth and efficient growth of the business.

———————-

Francesca Scortichini is associate director of China Account Management at Hawksford. Francesca has considerable experience in advising Italian and international clients from trading, retail and industrial companies on investments in China and Asia. Francesca joined the Hawksford Shanghai office in June 2014.

Manuela Mesa Salazar from Colombia is an International Trade and Economics graduate from the University of international Business and Economics of Beijing with studies in Chinese language and culture. She has more than three years of experience in the trade and consulting industry, and is dedicated to providing corporate, tax, and business assistance to Spanish and Latin American clients in China at Hawksford Shanghai.

Hawksford is a leading provider of corporate, private client and fund administration services. We help clients to make the most of their business decisions and their wealth by taking on the burden of regulatory, financial and tax compliance, corporate governance and reporting obligations. We have helped families to take care of their wealth, entrepreneurs to succeed, multinational companies to operate and transact, and funds to maximise their returns.

Recent Comments