An opportunity as well as a cost

In today’s global economy, decarbonisation has become one of the fundamental considerations in relation to supply chains. Increasing numbers of businesses are working to reach net zero greenhouse gas (GHG) emissions by making environmentally conscious purchasing decisions. Investors, stakeholders, customers and authorities are all taking greater interest in individual companies’ decarbonisation performances. Therefore, decarbonising supply chains seems to be a ‘game changer’ for businesses. In this article, Kenneth Leung, Richard Lin and Nat Lin of KPMG China discuss how to transform carbon costs into supply chain opportunities.

GHG disclosure: on the radar for regulators

Over the past few years, demand for company disclosures on GHG emissions has been significantly increasing from all sides – regulatory, financial and consumer. In capital markets, key stakeholders—such as the International Sustainability Standards Board, the United States’ (US’) Securities and Exchange Commission and the Hong Kong Exchanges and Clearing—have proposed rules to enhance GHG and other climate-related disclosures.

One of the key proposals is to include Scope 3 emissions (indirect emissions other than imported energy), which would mean an organisation would have to manage ‘cradle-to-gate’ or ideally ‘cradle-to-grave’ carbon information across the supply chain. In the procurement area, more vendor engagement programmes are now requiring upstream suppliers to provide carbon emission information for their products.

Carbon pricing: likely to be implemented across the globe?

In July 2021, the European Commission proposed expanding the scope of the European Emission Trading System (ETS), a cap-and-trade system that sets an annual cap on the amount of GHGs companies in the sectors covered by the ETS may emit. The Commission also introduced the Carbon Border Adjustment Mechanism (CBAM), which is designed to mirror and complement the ETS in relation to imported goods. The CBAM is intended to prevent ‘carbon leakage’, which would occur if consumers switched from buying European Union (EU)-produced goods to purchasing substitutes from non-EU countries where a lower (or no) carbon price is levied, or if firms shifted production activities from EU producers to such countries for the same reason.

In June 2022, the CBAM proposal was adopted by the European Parliament, which pushed for a broader emission scope, stipulating that the calculation of embedded emissions in products should also include “indirect emissions”. Though the final legal text will be subject to negotiations with the EU Council, it is expected that the CBAM will come into effect from the start of 2023.

Interestingly, in early June 2022, a few senators in the US also tabled a bill for a CBAM on products made in the US and those from abroad. The bill, titled the Clean Competition Act, included key components such as a narrow-based domestic carbon tax and corresponding import taxes and export rebates. It would not be surprising to see carbon pricing or carbon taxes (such as the ETS and the CBAM), which aim to promote and incentivise decarbonisation, eventually being implemented across the globe.

Carbon pricing is a supply chain cost, direct and indirect

It stands to reason that carbon pricing will give rise to direct tax costs, and ultimately an increase of the landed costs of goods. The question is who is going to absorb such costs? Will consumers need to pay more, or do manufacturers have to adapt to slimmer margins?

Another question is how the carbon tax will be worked out. Fundamentally, the level of tax would depend on the GHG embedded in the goods, the data on which must be provided by the manufacturers. That said, with the CBAM in place, manufacturers will have to design systems and build teams to manage GHG emissions. Based on experiences in the EU and some other developed countries, monitoring, reporting and verification (MRV) is the preferred system, but of course, it will be costly for an enterprise to set up internal MRV processes for this purpose.

Transforming carbon costs into a supply chain opportunity

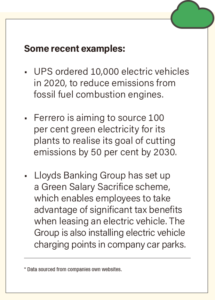

There is also an upside in supply chain decarbonisation for businesses. There are several theories already on how decarbonisation can be a source of business opportunities:

- In a world of carbon pricing, decarbonisation would give a price advantage and/or higher margins in the market.

- With the development of carbon peaking and net-zero policies, decarbonisation would mitigate business uncertainty.

- As governments and financial institutions would like to ‘green’ their portfolios, decarbonisation would give rise to opportunities for green incentives and green loans (with much lower financial costs).

- Like the nutrition information on packaged food, a tag with details on the carbon footprint of a product may also become a standard element on packaging in the future.

For businesses wondering how to plan their next steps, one of the first actions should be to quantify their GHG emissions baseline and set up MRV. This means understanding the GHG status of the organisation and mapping out how its internal GHG management will work. With this foundational infrastructure in place, the following opportunities may then be explored:

- Identify potential emissions reduction opportunities, assess the feasibility of emissions reduction technologies/projects from a quantitative perspective and then implement emissions reduction initiatives.

- Apply for government incentives and/or low-interest green loans from financial institutions based on the aforementioned emissions reduction technologies/projects, with special attention to anti-greenwashing compliance.

- Design a sourcing strategy for emission reduction purposes, integrate emissions metrics into procurement standards and track performance, and work with suppliers to address their emissions.

- Quantify and certify product-level carbon footprints for branding purposes.

From green to gold

In a world of carbon pricing, it is easy to envisage that carbon will become both an asset and a liability for businesses. Efforts made today on GHG management and decarbonisation may lead to a fortune in the future.

KPMG China

has developed a leading practice in the field of GHG Emissions and

Reduction. Most importantly, we do not see ourselves as mere consultants. KPMG

professionals want to work collaboratively with clients on the journey to a low

carbon future. Kenneth Leung is partner and head of KPMG China’s Supply

Chain practice. Richard Lin is partner of KPMG China’s Supply Chain

Practice (responsible for GHG emissions and reduction related services) and

Head of Compliance Carbon Market. Nat Lin is associate director of KPMG

China’s Supply Chain Practice and Lead GHG Engineer.

Recent Comments