The European Business in China Business Confidence Survey 2017

The European Business in China Business Confidence Survey 2017

The purpose of the European Chamber’s European Business in China Business Confidence Survey is to take an annual snapshot of European companies’ successes and challenges in China. Published since 2004, the survey has enabled the European Chamber to build a rich data set to serve as a broad indicator for how European companies judge the business environment in China, both now and in the future.

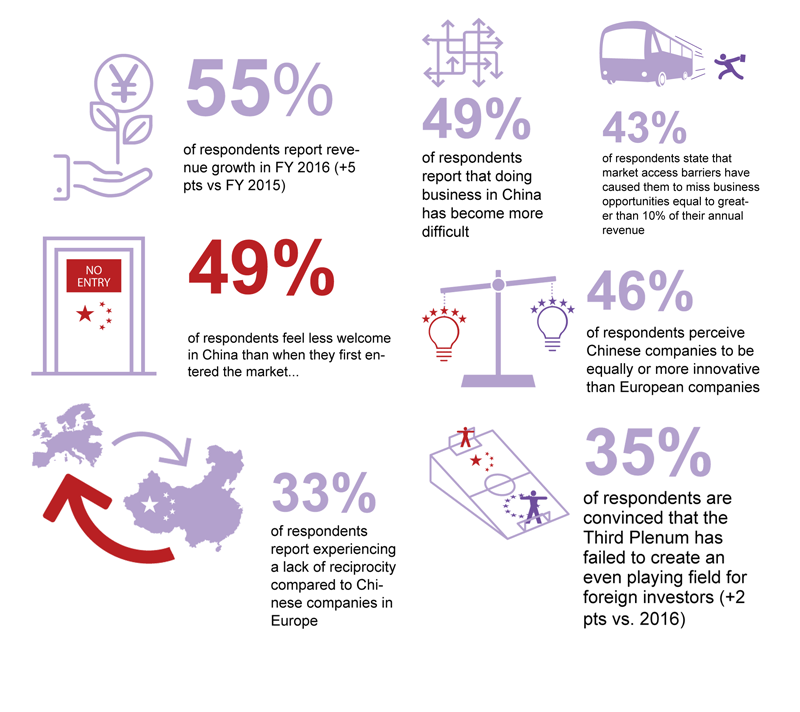

Launched on 31st May, 2017, in this year’s survey, members report that despite some improvement to their financials in 2016, conducting business in China did not become easier.

Executive Summary

In the Business Confidence Survey 2017, many European businesses report operating difficulties that remain unique to China, and a range of economic worries that have the potential to scale-back corporate profits and growth if not carefully managed. Yet despite these varied and often-repeated problems, this year’s survey also shows that in some areas there is cause for more optimism than before.

Amid recent gloomy predictions about China’s slowing economy, European companies reported that business improved last year, with over 50% of enterprises achieving higher sales than in 2015. Among those, information and communications technology (ICT), automotive, machinery, cosmetics, environmental and retail firms all saw growth in revenues. More notable still was that more businesses reported profitable earnings before interest and tax (EBIT) than at any other time since 2010. Sectors such as travel, aerospace, education, pharmaceuticals and engineering reported sharp increases in profits that ranged from 70% to 100%. These improvements were possible in part due to increased demand as well as careful cost management.

There is other good news. Although China’s technocrats still have much work to do, its intellectual property rights (IPR) protection regime saw some improvements, and President Xi Jinping’s anti-graft campaign has had a noticeable impact. Concerns waned over both the lack of legal recourse and labour disputes, too.

That said, respondents’ improved financial performance can largely be attributed to the major financial stimulus that the Chinese authorities injected into the economy during the first half of 2016. On a wide range of indicators, respondents’ sentiments rebounded from the lows of the fourth quarter of 2015 and first quarter of 2016, when China’s economy was facing severe downward pressure and last year’s survey was conducted. By contrast, this year’s survey was conducted after the stimulus had worked its way through China’s financial system.

European companies therefore remain rightly apprehensive about the future of China’s economy. More than 60% of respondents rank China’s slowing economic growth as their number one cause for concern, which is closely followed by the ongoing struggle to find and retain qualified employees, a problem aggravated by demands for higher compensation among local hires.

This anxiety over China’s economy is intensified by the encroaching shadow of China’s egregious debt burden. As cautioned by George Magnus of Oxford University’s China Centre and former UBS Investment Bank advisor: “[China’s] level of debt to GDP, variously estimated at between 260-300 per cent of GDP, the speed with which it has risen, and the 8 or so years in which it has been continuing all make China a classic risk case for a fall, with all its attendant consequences on growth for several years after.”[1]

Conducting business in China also remains a challenge – in fact, nearly 50% of member firms report it became more difficult in 2016. The World Bank’s ranking of China in 78th place out of 183 countries in terms of the ease of doing business[2] reflects this reality, and is a poor showing given the economy’s global importance.

Respondents’ doubts over whether China is truly committed to creating a simpler administrative environment and ensuring a level playing field continue to deepen. European companies are succeeding in areas where they have more freedom to operate, but cumbersome regulations and vaguely-worded laws—often subject to arbitrary interpretation—continue to pose a range of challenges.

In many cases, missed opportunities due to regulatory obstacles are resulting in a significant loss of revenue for European companies in China. More than 40% of respondents state that these missed opportunities equal 10% or more of their annual revenue, a figure which can determine whether they are loss-making. In this regard, small and medium enterprises (SMEs), as well as law firms and financial services—two of China’s most tightly regulated sectors—have been hardest hit. These two industry sectors are particularly susceptible to China’s draconian control of the Internet, which also affects their performance. Furthermore, only 4% of respondents saw significant market opening for foreign companies in 2016, with 31% of respondents in the important ICT sector pointing to market narrowing or even closure.

The much-touted economic reform agenda outlined in the Third Plenum’s Decision in 2013 is also yet to meet expectations. European companies’ disappointment is highlighted by the following figures:

- Half report feeling less welcome compared to when they first entered the market.

- Over the last four years, more than half have consistently reported that compared to domestic Chinese companies foreign-invested enterprises (FIEs) are treated unfairly.

- 61% believe that environmental regulations are strongly enforced against foreign companies, while only 14% and 17% report that they are strongly enforced against Chinese privately-owned enterprises (POEs) and Chinese state-owned enterprises (SOEs) respectively.

- After another year to reflect upon it, 37% still report that national security legislation discriminates against FIEs.

President Xi Jinping’s Davos speech in January 2017, and the promulgation the same month of the State Council’s Document No.5—geared towards improving the environment for foreign business and investment—suggest that China remains committed to free trade and openness, perhaps more so than ever, at least rhetorically. Yet respondents display little optimism that China’s economic reform agenda will make much progress in the short term – only 15% of respondents believe that regulatory barriers will decrease over the next five years, while 40% believe that they will actually increase.

Reciprocity in bilateral trade and investment relations between Europe and China remains a bone of contention. As outlined in the June 2016 European Commission paper Elements for a New EU Strategy on China, the EU is China’s largest trading partner, representing about 15 per cent of its trade – China clearly needs the EU as much as the EU needs China.[3] It is therefore concerning that while Chinese investment into the European Union (EU) in 2016 leaped 77% y-o-y to more than EUR 35 billion, funds flowing in the opposite direction declined by 23% to EUR 8 billion over the same period.[4] As a useful point of reference, European investment into the US in 2016 was approximately USD 277 billion.[5]

This imbalance is compounded by the fact that 54% of respondents state that FIEs are treated unfavourably compared to domestic Chinese companies, and 79% report that the most damaging manifestation of this lack of reciprocity is market access barriers. European investment in China is simply being held back. Meanwhile, Chinese businesses in Europe face few, if any, obstacles to expansion.

Due to restrictions on M&As by foreign business in China, current expansions primarily take place through organic growth. Lowering barriers would see an influx of foreign capital into the Chinese economy, with 56% of respondents reporting that they are prepared to ramp-up investment if better market access were granted.

The European Chamber’s members understand that key to growing trade between the EU and China is a successfully negotiated Comprehensive Agreement on Investment (CAI), with a strong market-opening component forming part of any deal. It needs to be completed soon, as early as the next 12 months. The top issues that European businesses want to see the CAI address are:

- A simplified regulatory environment (36%);

- Freedom to enter into new business areas or product segments (16%);

- A reduction of barriers to making acquisitions in China (13%); and

- More leeway to take control of their China operations by reducing the need for a local business partner or joint venture (13%).

Finally, this year’s survey includes a wake-up call to the whole of Europe. Competition in China has stiffened and respondents feel that Chinese POEs have become a lot more innovative,[6] primarily in the areas of go-to-market and business-model innovation. Although in industrial goods less progress is perceived to have been made on product/service and process innovation, by about 2020, 60% of European companies in China expect Chinese firms to have closed the innovation gap.

To download a copy of the Business Confidence Survey 2017, please go to: www.europeanchamber.com.cn/

[1] Magnus, George, China Has Regained Economic Stability, But Clues are in Weeds of Finance, Georgemagnus.com, 21st March, 2017, viewed 15th April, 2017, <http://www.georgemagnus.com/china-has-regained-economic-stability-but-clues-are-in-the-weeds-of-finance/>

[2] Ease of doing business index (1= most business-friendly regulations), The World Bank, viewed 16th April, 2017, <http://data.worldbank.org/indicator/IC.BUS.EASE.XQ>

[3] Joint Communication to the European Parliament and the Council: Elements of a new EU Strategy on China, European Commission, Brussels, 22nd June, 2016, viewed 23rd June, 2016, p. 5, <http://eeas.europa.eu/china/docs/joint_communication_to_the_european_parliament_and_the_council_-_elements_for_a_new_eu_strategy_on_china.pdf>

[4] Hanemann, Thilo and Mikko Huotari, Record Flows and Growing Imbalances: Chinese Investment in Europe in 2016, MERICS and Rhodium Group, 10th January 2017, no. 3, viewed 16th April, 2017, <http://rhg.com/reports/record-flows-and-growing-imbalances-chinese-investment-in-europe-in-2016>; EU-China FDI Monitor 4Q 2016 Update: Public Version, Rhodium Group, January, 2017, viewed 16th April, 2017, <http://trade.ec.europa.eu/doclib/docs/2017/january/tradoc_155234.pdf>. While the European Chamber’s Business Confidence Survey 2016 stated the figure for 2015 to be EUR 9.3 billion, this has been updated to EUR 10 billion in the latest available figures.

[5] Hamilton, David and Joseph Quinlan, The Transatlantic Economy 2017: Annual Survey of Jobs, Trade and Investment Between the United States and Europe, Center for Transatlantic Relations Johns Hopkins University and American Chamber of Commerce to the European Union, 2017, viewed 20th April, 2017, p. vii, <http://transatlanticrelations.org/wp-content/uploads/2017/03/170223_FULL-BOOK-2.pdf>

[6] Innovation can be defined as the introduction of new things and methods that create value in the market: Fast and Furious, The Economist, 12th September, 2015, viewed 14th April, 2017, <http://www.economist.com/news/special-report/21663325-chinese-private-firms-are-embracing-innovation-fast-and-furious>; By contrast, ‘invention’ can be defined as “something that has never been made before, or the process of creating something that has never been made before”: ‘Invention’, Cambridge Dictionary, viewed 14th April, 2017, <http://dictionary.cambridge.org/us/dictionary/english/invention>

Recent Comments