On 11th December 2025, the European Chamber held its annual conference in Beijing. The event featured keynote speeches, as well as panel discussions that included business leaders, policymakers, academics and senior Chamber representatives.

Chamber President Jens Eskelund delivered the opening remarks, reminding the audience that 2025 marks the 25th anniversary of the European Chamber and the 50th anniversary of European Union (EU)-China relations. He said that the world was living in uncertain times marked by geopolitical turbulence, such as the ongoing war in Ukraine, and that some fundamental assumptions were no longer valid. Eskelund also sounded a pessimistic note about China’s forthcoming 15th Five-year Plan (15FYP), saying that a continued focus on self-reliance would do little to address concerns among China’s trade partners that trade with the country was becoming a one-way street.

Eskelund made several predictions for 2026: trade tensions are likely to increase; exchange rates will come under increasing scrutiny, with the renminbi significantly undervalued at present; European companies will focus on controlling costs; and Chinese firms will accelerate outbound investments.

Next to speak was Ambassador of the European Union Delegation to China Jorge Toledo Albiñana. Toledo began his remarks by paying tribute to the Chamber on its 25th anniversary, stating that there was no Chamber as active or effective as the European Chamber. The ambassador also acknowledged the 50th anniversary of EU-China diplomatic relations, noting that during the past half-century, China has seen its economy grow faster than any other country in history. Toledo went on to highlight some of the EU’s current problems, such as a lack of competitiveness, but emphasised that the political will to tackle the problems exists.

The ambassador was pessimistic about the trajectory of the EU-China relationship and its future prospects. He said that the recent EU-China summit had not been productive—with no progress on trade or China’s support for Russia in the Ukraine war—but it had provided the two sides with an opportunity to exchange views. On trade, Toledo stated that things had actually worsened over the past year. While the EU has taken carefully targeted measures against China following comprehensive investigations, China’s retaliatory actions have been applied broadly and in areas where the EU has a trade surplus. Toledo went on to note that China’s rare earth element (REE) export controls had harmed European companies more than American companies, and that the country’s reputation as a reliable supplier of goods was starting to suffer.

Toledo emphasised that the current trade relationship between the EU and China could not continue, pledging that if China did not take action to level the playing field, then the EU would do so through current and future trade defence instruments. He concluded his remarks by saying that the relationship needed rebalancing.

The second keynote speaker said that China and Europe had fundamentally different economic models—‘social-security enhanced’ in Europe and ‘government-enhanced’ in China—which can both support and hinder business. The speaker also noted China’s current economic difficulties and their impact on European businesses operating in the country, including the long waiting periods for payments from local governments as they try to pay down their debts. The speaker expressed optimism about the future, forecasting that the Chinese Government would end up taking many of the measures that have been suggested by economists to stimulate the economy. This would include measures to help make life easier for foreign companies and to smooth relations with major trading partners.

The first panel discussion examined whether ‘involution’ had become a permanent feature of China’s economy, initiating the discussion with a debate on what had been the most unexpected economic event of 2025. Several mentioned geopolitical events, including the ongoing Ukraine war, Israel’s bombing of Iran and the ‘Liberation Day’ tariffs. One panellist argued that current global instability was likely the result of the world moving from a unipolar to a multipolar system.

Debating the drivers of involution, one speaker mentioned that China’s limited social safety net encourages a high level of saving. Another blamed the Chinese Government’s excessive support for unprofitable companies. There was no consensus on when the situation might ease, with the panel generally seeing little light at the end of the tunnel.

The second panel of the conference looked at China’s 15FYP and where future opportunities might lie. One panellist mentioned that the 15FYP is basically a continuation of the 14FYP without any substantive changes. Another argued that the ‘high-quality development’ focus of the 15FYP will emphasise artificial intelligence (AI) and innovation. It was noted that the green economy presents a significant opportunity for European companies and that China will lead ‘green globalisation’ in the 21st century. Healthcare and advanced manufacturing were also mentioned as potential opportunities. At the policy level, it was suggested that Europe and China could cooperate in areas such as AI governance and World Trade Organization reform.

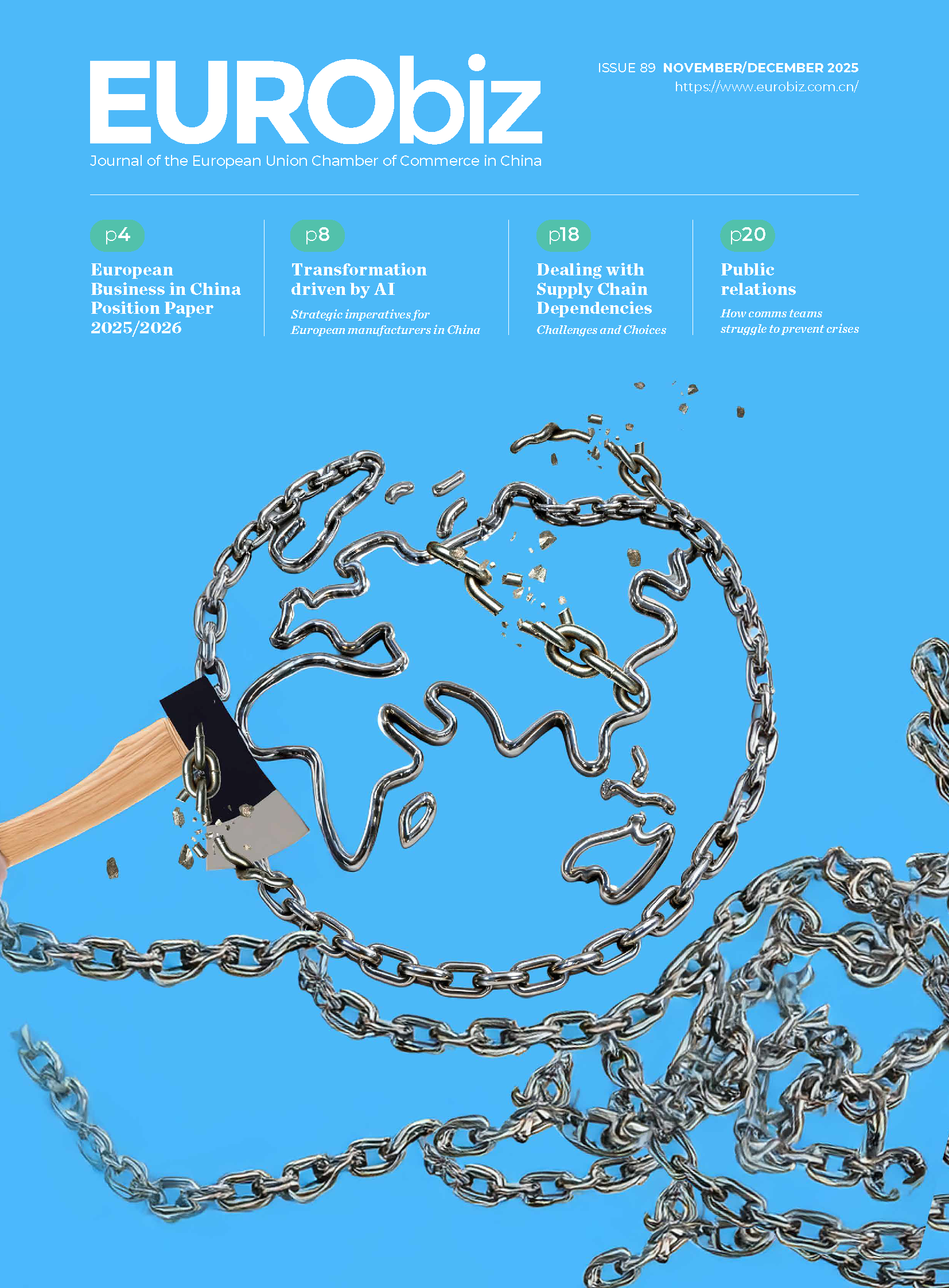

The final panel looked at supply chains in an unstable world. One panellist argued that China continued to support globalisation and wants to improve it, but the discussion quickly moved to recent trade tensions. The panel were in agreement about the level of disruption China’s REE export controls had caused, with the controls seen as China’s main card to play against the United States. There was agreement among some panellists that China was attempting to map key supply chains and dominate critical technologies. However, one panellist claimed that China did not have ambitions to become a great power and its trade measures were simply a response to measures taken by other countries.

Recent Comments