The EU-China Comprehensive Agreement on Investment

The European Union (EU) and China announced their political approval of the Comprehensive Agreement on Investment (CAI) on 30th December 2020. Political consensus around the market-opening agreement was reached seven years after negotiations began in 2013. The China Briefing team at Dezan Shira looks at how the CAI developed and why acquiescence on the agreement was reached at this stage.

Following a video conference on the CAI on 30th December with Chinese President Xi Jinping, Charles Michel, president of the European Council, and Ursula von der Leyen, president of the European Commission said in a statement: “This agreement is of major economic significance… China has committed to an unprecedented level of market access for EU investors, giving European businesses certainty and predictability for their operations.”

Meanwhile, Chinese state media reported Xi’s affirmative position on the agreement and its importance to China: [The CAI] “demonstrates China’s determination and confidence in advancing a high level of opening to the outside world and will provide greater market access for China-EU mutual investment, a higher quality business environment, stronger institutional guarantees and brighter cooperation prospects.”

What to make of the announcement and its timing?

Looking further ahead into 2021, the relevance of the CAI is clear. Despite widespread doubt consensus could be reached, the EU and China still managed to positively conclude negotiations to the agreement before the end of 2020. This, in and of itself, is a clear testament to both sides’ commitment to doing business with each other and increasing mutual trust, at least on the economic front.

It is also interesting to note that the agreement was not delayed by the then-incoming administration of United States (US) President Joe Biden, which indicates that perhaps the EU may no longer be as considerate of Washington in determining the scope of its future ties with Beijing.

Further, the EU has reportedly secured important concessions on major sticky points: forced technology transfers and the need for transparency on China’s state subsidies for the services sector – the latter, in particular, has prevented a level playing field between private foreign-invested enterprises (FIEs) and China’s state-owned entities (SOEs), according to EU negotiators.

Now Beijing will be obliged to publish a list of the subsidies it will provide to specific sectors every year, such as real estate, telecommunications, banking and construction. In return, the EU will ensure relatively free access to its market, a major win for Chinese investors and businesses that is not easy to secure – as can be attested by anyone embarking on market access negotiations with Brussels.

And, while Beijing still appears unwilling to completely remove restrictions in select sectors (automotive, health and aviation), industry analysts are confident that EU businesses in the manufacturing, engineering, new energy vehicles, financial services, real estate, telecommunications, cloud-computing services, health and consulting industries will stand to benefit the most from the market-access agreement.

In 2021, European investors are expected to make more inroads into Asia, tapping into emerging economic opportunities and taking advantage of large markets and other operational considerations.

Given the experiences of the pandemic and the US-China trade war, the shift to localise supply chains and geographically de-risk investment will continue, complimented by a doubling down in focus on important markets like China.

The outline of the CAI

The EU and China agreed to the essential principles that both parties want reflected in the CAI. Such alignment sets the foundation for strong development of international cooperation and for the increase of bilateral investments. It may also boost EU economic growth, especially in the post-COVID-19 recovery period.

The European Commission issued a document summarising the results of the negotiations that need to be considered ad referendum – hence are subject to that finalisation of details.

Under the preamble of this document, the parties reaffirm their commitment to the Charter of the United Nations (26th June 1945)—principles articulated in the Universal Declaration of Human Rights (10th December 1948)—and agree to promote investment in a manner that supports environmental protection and labour rights’ protection.

The document then reports that the CAI will focus on the following aspects:

- Market access and investment liberalisation.

- Level playing field (SOEs, forced technology transfers, transparency in subsidies).

- Domestic regulation.

- Transparency in standards-setting.

- Financial services.

- Sustainable development.

- State-to-state dispute settlement mechanism.

- Institutional and final provisions.

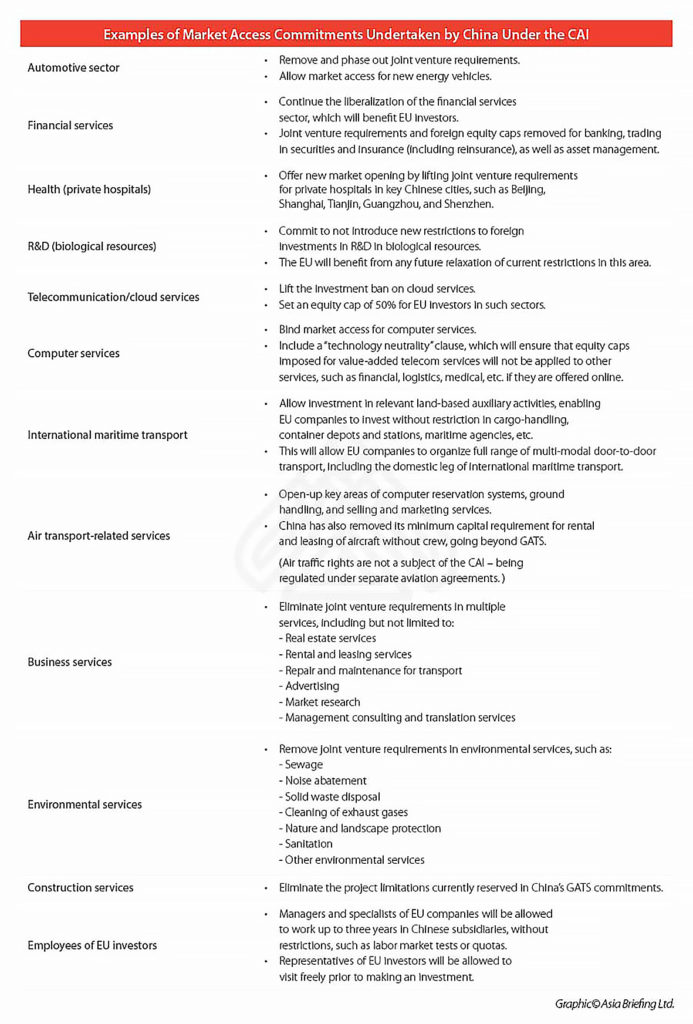

The principles mentioned in the document seem to positively respond to the EU requests from China, thus paving the way for an unprecedented level of access for EU investors in the China market. EU investors will be allowed to set up new companies in key sectors. The elimination of quantitative restrictions, equity caps, and/or joint venture requirements in various sectors will level the playing field for EU companies in China, providing rules to discipline SOE behaviour, guaranteeing transparency in subsidies and facilitating sustainable development.

The CAI, by binding China at the international level, will enhance the protection of foreign investors’ rights and interests that will be guaranteed by the treaty.

In other words, it makes the conditions of market access for EU companies independent from China’s internal policies. Also, the parties to the CAI have agreed to establish a dispute resolution settlement mechanism in case of any breach.

Conclusion

The EU and China are now working towards finalising the text of the agreement, which will need to be legally reviewed and translated. It is expected to be signed during the French presidency of the EU in 2022 and then submitted for approval by the EU Council and the European Parliament.

At this juncture, it is worth remembering that the EU Parliament has the power to decline or withhold consent to an international agreement. Thus, if the EU Parliament refuses to give its consent, the agreement the parties will have signed onto will be considered legally void.

In other words, the next steps are crucial for the CAI’s implementation. European business in China will be watching developments closely.

Note: The content for this article was amalgamated from two articles previously published on China Briefing:

a) EU, China Give Political Approval to Market Access Agreement (china-briefing.com)

b) https://www.china-briefing.com/news/eu-china-reach-agreement-on-investments-in-principle-what-does-it-mean-for-businesses/

—————–

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. With more than 28 years of on-the-ground experience and a large team of lawyers, tax experts and auditors, in addition to researchers and business analysts, we are your partner for growth in Asia.

For further information, please visit www.dezshira.com

Recent Comments