The European Chamber’s annual Business Confidence Survey (BCS) was initiated in 2004 under President Serge Janssens de Varebeke.

The survey data was initially included with the Chamber’s Position Paper. President De Varebeke said in his foreword:

“As the reputation of the Chamber and the influence of the Position Paper have grown each year, it is necessary to make the papers a more comprehensive reference to doing business in China. Part in response to this, the Chamber conducted its first ever members Business Confidence Survey, the results of which have substantiated many of our members’ concerns. Therefore, along with the survey results, the Position Paper now also includes a summary section that brings together some of the key concerns of the members of the Chamber.”

President Serge Janssens de Varebeke, President’s Foreword, European Business in China Business Confidence Survey 2004

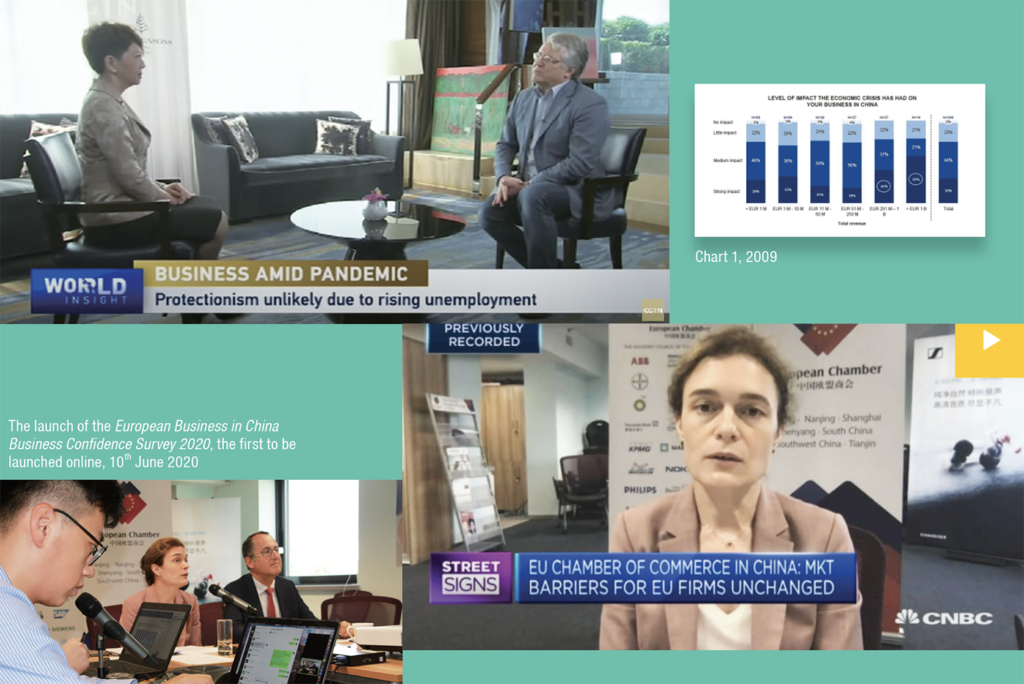

The BCS continued to be published as part of the Position Paper until 2007, when it was released as a publication in its own right. Some of the data from these early standalone BCS reports may be relevant again in the post-COVID-19 business environment – the 2008 and 2009 surveys framed the start of the economic crisis sparked by the collapse of the sub-prime mortgage market in the United States, much as the 2020 and 2021 reports will illustrate the impact of the pandemic.

One difference of note in 2009 compared to recent results was that it was larger companies rather than small and medium-sized enterprises (SMEs) that seemed to take the hit:

“Large companies have felt the impact particularly strongly. Those with more than 5,000 employees and euro (EUR) 1 billion in revenue in China, and that have been in China for more than 20 years, reported a significantly stronger impact than their smaller, less exposed, peers. This effect on larger companies is likely due to heavy contractions in demand in global markets.”

Many respondents to the 2009 survey had performed better than their headquarters or branches in other markets. However, as a result, many felt pressure to over-perform. And while the Chinese Government released a series of stimulus packages to boost the economy, respondents were evenly split on whether they would or would not benefit.

“Companies with more than 250 employees in China reported more optimism about their ability to benefit from the stimulus package than SMEs reported. Financial services firms and companies in the industrial goods and services sector answered that they expect to benefit more often than those in professional services and consumer goods and services did. This result can be explained by the fact that the Chinese stimulus package focusses on infrastructure and capital goods sectors in which the primary European actors are larger companies in the industrial goods and service sector.”

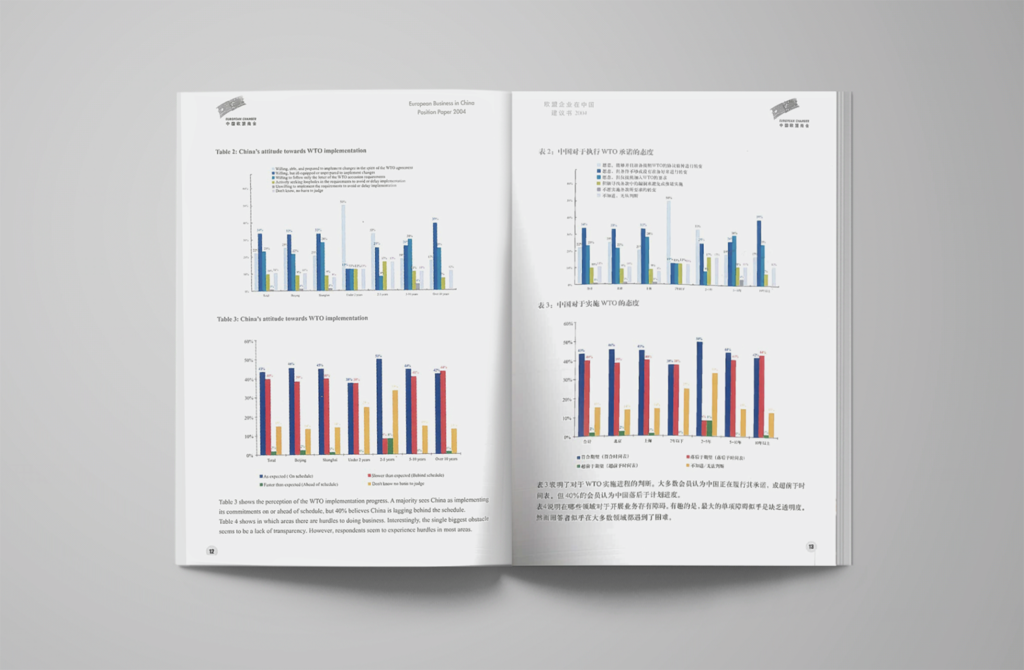

The first BCS in 2004 had a grand total of six charts, which looked at:

- Opinion on overall business in China

- China’s attitude towards WTO implementation

- China’s attitude towards WTO implementation (perception of progress)

- Obstacles in operating business in China

- Evaluation of counterfeiting and copyright violations; and

- Evaluation of intellectual property rights enforcement

By contrast, the most recent BCS had 86 charts, 14 times the amount of data included in the first survey.

The BCS survey now takes place over a month, with staff in all chapters and offices of the Chamber pulling out all the stops to encourage members to take part, so that the data gleaned from the answers provides as broad and balanced a picture as possible.

While the 2020 survey was conducted in February before the full impact of the COVID-19 pandemic was felt—or even imagined—the data:

“still shows significant downward trends. This is seen especially in logistics, chemicals and petroleum, construction and the automotive industry; sectors that have the highest share of r”espondents reporting negative growth. Year-on-year (y-o-y) revenue growth dropped to the lowest levels seen since the 2010 BCS, and earnings before interest and tax (EBIT) growth, which was reported by 62% of respondents two years ago, is now only indicated by 43% of those surveyed. These downward trends are reported disproportionately by SMEs, with only 46% seeing increased revenue and 40% experiencing higher EBIT, compared to 56% and 47% of multinational companies (MNCs), respectively.”

The launch of the European Chamber’s annual BCS is now a major draw for media, both international and domestic. Respected business TV networks such as Bloomberg and CNBC, as well as publications such as Deutsche Welle, The New York Times, The Wall Street Journal, Le Monde, The Economist, to name but a few, line up for interviews with members of our executive committee.

While business confidence may waver from year to year, confidence in the European Chamber’s ability to continue producing valuable analysis of the business environment for European companies on the ground in China can remain strong.

Recent Comments