Asian private equity industry outlook favourable thanks to ongoing digitalisation trend

Cautious optimism prevails in the Asian private equity (PE) industry for 2021, with Asia Pacific regions leading the global recovery. The region even recorded a 29 per cent increase in merger and acquisition (M&A) deal value in the first three quarters of 2020 compared to the same period in 2019. While mounting geopolitical tensions and the evolving pandemic remain the key concerns of PE investors, Asian countries—namely, China, Japan and India—are considered the most appealing investment destinations given their robust opportunities. Barry Tong of Grant Thornton outlines some of the trends in the PE industry that emerged from a recent survey carried out by the company.

_____________________________________

The unprecedented pandemic has brought both challenges and opportunities to the PE industry. Despite travel restrictions posing challenges for on-site due diligence and hindering cross-border deals, the crisis has led to faster adoption of new technologies and sparked tremendous demand for healthcare services, thus expediting the development of the technology and healthcare sectors. The pandemic also sped up industry consolidation and restructuring deals in hard-hit sectors such as energy, mining and utilities. Thanks to ongoing digitalisation, PE firms have changed their normal working routines and investment approval procedures drastically to incorporate remote meeting technologies and virtual due diligence. This has had the added benefits of greatly enhancing work efficiency and deal-closing speeds.

COVID-19 pandemic bodes well for healthcare industry and new economy companies

Throughout the pandemic, technology has been a lifeline for businesses, and it is now also considered as the key to recovery. PE firms are increasingly looking to join the fast-emerging sector, chasing technology ventures related to healthcare, e-commerce, online education and other ‘new economy’ companies as innovative technologies transform business models and spur rapid growth in the post-outbreak era.

COVID-19 has also pushed the healthcare industry to devote more resources to quality control procedures, and to boost operational efficiency through technological solutions when demand for products and services is high. Telehealth has likewise become a new trend, given the restrictions on public mobility in many countries.

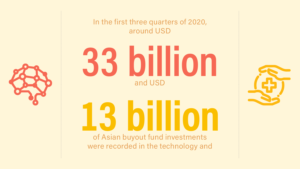

The swift recovery of the PE industry should generate cautious optimism going forward, with significant levels of capital waiting to be deployed. The technology and healthcare sectors are two of the few industries that experienced growth in investments in the last year. In the first three quarters of 2020, around United States dollars (USD) 33 billion and USD 13 billion of Asian buyout fund investments were recorded in the technology and healthcare sectors respectively. Online healthcare service providers saw a spike in demand while artificial intelligence companies showed their ability to repurpose solutions to tackle the pandemic. The two sectors are at the forefront of keeping the global community in order, providing investors with both short-term and long-term counter-cyclical investment opportunities.

Distressed asset opportunities rise amid economic downturn

The lingering pandemic and the subsequent economic fallouts have spurred a surge in distressed assets, with the sectors hit hardest being retail, hospitality, leisure and commercial real estate. China’s deleveraging policy and the resultant credit tightening have also made the debt-laden small to medium-sized property developers more vulnerable to distress selling, as they are left struggling to meet debt obligations and fund new land acquisitions.

Distressed assets driven by lowered valuations are in growing demand, fuelled by bank capital constraints. As many companies are just hanging on, with limited support from banks and short-term government assistances, there could be an influx of PE capital searching for distressed opportunities when that support runs out.

By taking advantage of the persistent low-interest environment, distressed asset investors could achieve enhanced returns through leveraged acquisitions. However, success in distressed asset investing requires significant expertise in order to assess risk and opportunity wisely, as well as sound strategies for realising value and conducting management in turbulent times.

The rise of continuation funds and restructuring deals

With the severe economic disruptions caused by the unprecedented pandemic, scheduled exit windows for portfolio assets may no longer be viable. Continuation funds, which allow general partners to extend hold periods for assets, have grown rapidly in the wake of tremendous uncertainties related to the prolonged pandemic and geopolitical tensions.

A continuation fund allows general partners to transfer assets from an existing fund to a newly created vehicle, with limited partners given the choice to exit or to rollover into the new funds alongside new investors. It provides investors the option of liquidity as well as a new exit window in the existing fund for those that want to cash out. It also gives investors the opportunity to benefit from the up-side of a second phase of value creation.

In view of the COVID-induced uncertainties, the current diversified exit trend is expected to continue, with restructuring deals forecast to rise in the short- to medium-term. It is crucial to conduct rigorous financial and other important due diligence to reveal the fair market valuation and minimise the risks of a restructuring deal. Meanwhile, investors looking at this option should seek professional advice also on the legal contractual terms, tax issues and political environment.

Lofty valuations remain the major challenge

In 2021, extreme market valuations remain a major concern for investors. The elevated levels of dry powder over the last few years are likely to hold buyout price multiples at a fairly high level.

The key challenge for PE investors in 2021 will be how to sensibly deploy equity amid intensifying competition and manage troubled portfolios in a volatile and unpredictable market.

Note: This article is a synopsis of Grant Thornton’s Asia Equity 2021 survey, which you can access here:

Barry Tong has over 20 years of financial advisory experience and is an advisory partner at Grant Thornton Hong Kong, as well as the national leader of Forensic & Investigation Services at Grant Thornton China. Barry is also the president of the Hong Kong Chapter of the Association of Certified Fraud Examiner, the world’s largest anti-fraud organisation with 85,000 members around the globe. He is also senior fellow of the Hong Kong Securities and Investment Institute.

Grant Thornton Hong Kong Limited is a member firm of Grant Thornton International Ltd, one of the world’s leading independent assurance, tax and advisory advisers with 58,000+ people in 136 countries. Under the unique ‘one firm, one China’ ethos, Grant Thornton Hong Kong is fully integrated with Grant Thornton China with a comprehensive network of 28 offices, 270+ partners and 6,000+ professionals across China.

Recent Comments