Market, technical requirements and opportunities for EU producers

China is one of the world’s largest dairy markets – and certainly the largest importer of dairy products. Although the sector was affected by a series of demand and price disruptions in 2022, it is expected to stabilise in 2023 before returning to growth in the following years. A key driver is the increased health awareness of Chinese people – one of the few positive outcomes of the COVID-19 pandemic. In a recent report on China’s dairy sector, the EU SME Centre explains what opportunities, as well as persisting and new challenges, are facing European Union (EU) dairy producers in the Chinese market. This article outlines some of the insights included in that report.

Market overview

The average dairy consumption per capita in China is significantly lower than in the EU or other markets, but it has been growing significantly compared to previous years, driven by two main factors:

- Government policies and initiatives: Since the early 2000s, the Chinese Government has actively encouraged milk consumption, starting with the flagship ‘School Milk Programme’. In particular milk and yoghurt are also key elements of the Healthy China Initiative (2019–2030). Government regulation and supervision of dairy products has been significantly enhanced, contributing to trust and confidence of Chinese consumers.

- Growing awareness of the health benefits of dairy products: Dairy products have positive effects on the immune system. Consumption of dairy products has been encouraged since the outset of the pandemic in early 2020 as a way to increase prevention, especially for vulnerable groups such as the elderly.

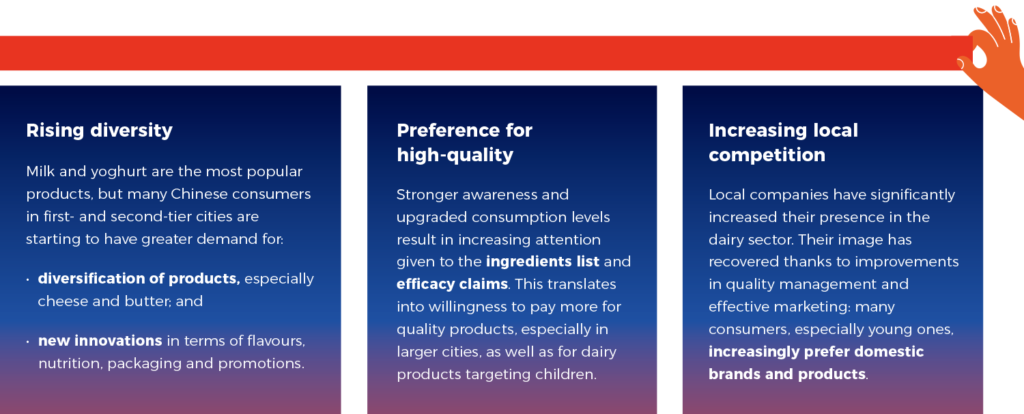

The Chinese dairy market is extremely competitive; market players are constantly changing while bigger brands are solidifying their positions in many segments. Three main trends can now be identified in China’s dairy market (See Box 1).

Imported dairy products are generally still viewed as representing higher quality – particularly those from traditional exporting countries. In fact, China’s dairy sector is characterised by strong country-related associations by Chinese consumers. The EU has a solid market share in China’s dairy market: 36 per cent overall – with variations from 85 per cent for yoghurt and 65 per cent for infant formula, to 10 per cent for milk powder and butter (dominated by New Zealand, and to a lesser extent Australia).

Regulatory and technical requirements:

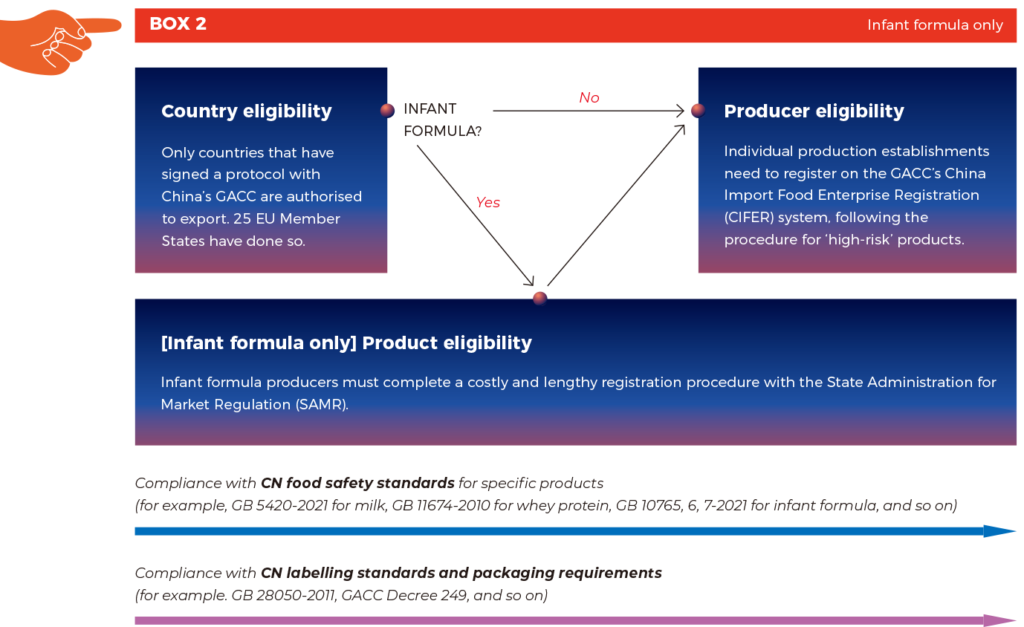

There are two main pathways to enter the Chinese market: through general trade or cross-border e-commerce (CBEC). The former is the traditional way to export products to China – but also the most difficult and time-consuming as it requires several approval procedures; the latter is less expensive and faster, though highly competitive and with some limitations.[1] The process for general trade is summarised in Box 2.

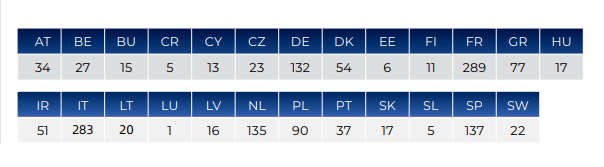

The most challenging aspect is the registration of the production establishment on the GACC’s CIFER system. The process is extremely complicated, takes several months and requires cooperation with the food safety authority in the country where the producer is based. A large amount of documentation must be provided, including on sensitive business information.[2] As of June 2023, EU Member States only had a limited number of dairy production establishments successfully approved.

An additional regulatory layer—and challenge—exists for infant formula producers. Before initiating registration on the CIFER system, producers must first register their products with the SAMR. This process is extremely lengthy and costly, involves the appointment of a domestic responsible agency in China and several rounds of testing and technical review, combined potentially with onsite inspections of the production establishment. This requirement is stipulated in the Administrative Measures of Product Formulation Registration of Infant Formula Milk Powder, which were revised by the SAMR on 10th July 2023 (entering into force in October 2023). The revised measures were released after the publication of the EU SME Centre report and therefore are not included there; but overall, compared with the previous version in force, the revised measures:

- expand the legal basis for rejecting the registration of infant formula products, for example, when the application materials submitted are untrue or fraudulent, when the scientific and safety basis of the product formula is deemed as insufficient, or when the applicant is considered not to have the research and development, production or supervision capabilities necessary for ensuring the product quality and safety;

- expand, from six to nine, the elements that cannot be specified on product labels and instructions, such as the use of vague and fuzzy statements such as “imported milk source”, “derived from foreign pastures”, “ecological pasture”, “imported raw materials”, “original ecological milk source”, “pollution-free milk source”, and so on; the image of babies and women cannot be used, together with wording such as “human emulsification” or “mother emulsification”; and

- may require onsite inspection of production establishments, including in cases involving major changes in the product formula, in the address of the production facility, or in any case further verification is required by the technical evaluators.

Opportunities, challenges and recommendations for EU exporters

European dairy exporters are strongly recommended to get involved in marketing and promotional activities in China, and actively support their local importer/distributor. What can be done largely depends on the stage of the company’s development within the Chinese market, as well as its resources and commitment. But in general, localisation of product design and communication is required, together with efforts to educate consumers.

The EU-China Geographical Indication Agreement also provides leveraging opportunities for EU producers during promotional activities. Among the 96 EU GI products included in the agreement and thus effectively protected in China, 11 are dairy products and 19 more will become protected by 2025.

Finally, EU producers should remember that the European Commission, through the Research Executive Agency, co-finances campaigns and events to promote EU farm products worldwide – including dairy products in China, under the slogan “Enjoy, it’s from Europe”.

[1] A detailed illustration of how CBEC works, featuring four case studies, is provided in a recent EU SME Centre report: <https://www.eusmecentre.org.cn/publications/selling-to-china-via-cross-border-e-commerce/>

[2] An overview of the main challenges on CIFER registration is provided in a recent survey conducted by the EU SME Centre: <https://www.eusmecentre.org.cn/publications/fb-survey-results-customs-processes-and-the-cifer-system-2/>

Note: This article is based on the report China’s dairy sector: market, technical requirements and opportunities for EU producers by the EU SME Centre, available to download from their website, www.eusmecentre.org.cn.

The EU SME Centre is a non-profit initiative funded under the European Union’s Single Market Programme (SMP). The EU SME Centre provides a comprehensive range of hands-on support services to European small and medium-sized enterprises (SMEs), assisting them to establish, develop and maintain commercial activities in the Chinese market. By offering support through the provision of information, confidential advice, networking events and training, the Centre focusses on the crucial early stages of SMEs’ market penetration strategy. The Centre also acts as a platform facilitating coordination amongst EU Member State and public and private sector service providers to EU SMEs.

Recent Comments