Their role in pursuing carbon neutrality

China has deployed industrial parks across the country to facilitate and encourage business development in all sectors, demonstrating their ability to guide industry in particular directions. Given the considerable share industry contributes to China’s total carbon emissions, which in turn accounts for a large proportion of global carbon emissions, it is essential that China’s industrial sectors transition to ‘zero carbon’ operations. Guido D. Giacconi, vice president of the European Chamber, argues that the industrial parks are in a position to accelerate this transition and help China realise its carbon neutrality goals.

In recent years, China has stepped up to share global leadership in reducing pollution and combatting climate change. President Xi Jinping caught the world by surprise when, at the United Nations General Assembly in September 2020, he announced that China’s carbon emissions will peak by 2030 and carbon neutrality will be accomplished by 2060 (the 30/60 Goals), which delete confirmed China’s strong commitment to contribute to international efforts.

Global commitments and scattered actions are increasing, but they are far from what it will take to effectively confront climate change. ‘Carbon neutrality’ risks remaining a buzzword in China, and even the definition of ‘carbon emission’ is still not clear to many stakeholders (in this article, carbon emissions refers to all greenhouse gases emissions). Therefore, taking a coordinated, holistic, and pragmatic approach to carbon neutrality commitments is urgently needed: joint decarbonisation efforts will only succeed if there is full alignment on concepts and methodologies.

Domestically, China’s industrial parks will play a crucial role in realising the country’s carbon neutrality goals. In order to do so, they will need to develop modern economic models based on new energy, new infrastructure and green supply chains.

Over the past few years, China has been making great efforts to transform its energy structure. The growing need to counter the harmful effects of pollution, combined with a firm commitment to boost renewable power generation, and reduce dependency on coal as well as overall energy intensity, among other aspects, have turned China into a leading actor in the global energy transition. Nevertheless, it is still the world’s biggest source of carbon emissions, responsible for around 28 per cent of the total. As one of the biggest economies and manufacturing countries, China has the highest energy and carbon intensities. Recently, and despite commitments to the contrary, it also shown signs that its plan to reduce coal dependency has slowed down.

Roadmaps towards carbon neutrality have been already issued. The Chinese Government has established the ‘1+N’ policy framework to realise its 30/60 Goals, which encompasses several key sectors several key sectors and also outlines support initiatives. Despite the firm commitment and several policies already being in the implementation phase, China’s pathway to carbon neutrality still faces significant challenges, especially the critical conflict between energy security, near-term economic development, carbon peak/neutrality objectives and clearly defining intermediate steps.

According to the Energy Foundation’s Synthesis Report 2020 on China’s Carbon Neutrality,[1] to remain within the 2℃ temperature control range laid out in the Paris Agreement, China’s industrial sector needs to reduce its carbon emissions by 20–35 per cent by 2035 and 50–80 per cent by 2050, compared with 2015 levels.

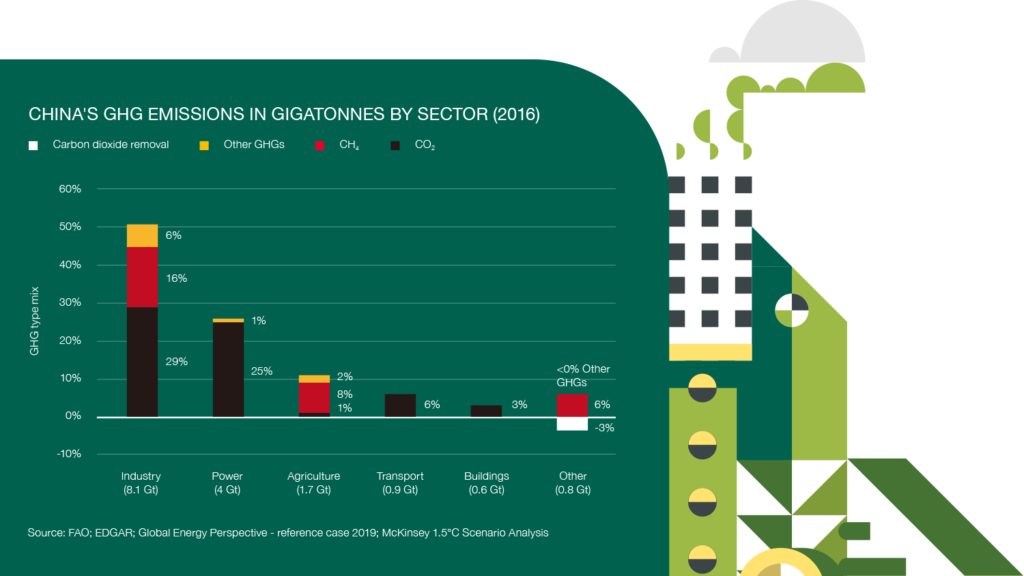

The industry sector accounts for more than 50 per cent of China’s total carbon emissions, followed by power (26 per cent), agriculture (11 per cent), transportation (6 per cent), and buildings (3 per cent) sectors. The high proportion of manufacturing value added in gross domestic product (GDP) (27.4 per cent in 2021) makes decarbonisation more difficult for China than the EU.

China has more than 15,000 industrial parks of various types—including 2,681 national and provincial industrial parks as of December 2019[2]—contributing more than half of the country’s industrial output by value. Among the national/provincial parks are 219 state-level economic and technological development zones, and 168 state-level high-technology industrial development zones. The GDP of the state-level economic and technological development zones reached Chinese yuan (CNY) 7.6 trillion in 2015, accounting for 11 per cent of the national GDP that year.[3] Data from 2019 shows that the combined GDP of the state-level high-tech industrial development zones reached CNY 12.1 trillion, accounting for 12.3 per cent of China’s total GDP.[4]

Nearly 70 per cent of China’s industrial energy use is concentrated in industrial parks, and accounts for about one third of the country’s carbon emissions. Therefore, it is of paramount importance for China to comprehensively involve industrial parks in addressing local carbon neutrality priorities by piloting holistic solutions and deploying international assessment and certification standards transparently and openly.

Unfortunately, just a few small-scale industrial parks are currently deploying targeted carbon neutrality programmes, with none known at the national level. A handful are demonstrating well-engineered and well-addressed deployment for example, the Goldwind Yizhuang Smart Park in Beijing, and the Shandong Dezhou Economic-Technological Development Area.

Industrial Parks in China could also play a crucial role in supporting companies as they face the forthcoming defense mechanisms by major economies, namely Europe, against so-called ‘carbon leakage’. For example, on 10th March 2021, the European Parliament approved a resolution proposing a Carbon Border Adjustment Mechanism (CBAM). From 2023, countries that trade with the EU would be requested to comply with EU carbon emissions regulations, implying that exports to the EU might face carbon tariffs to offset the extra costs for locally-based entities to be compliant with EU carbon regulations. The sectors covered so far include cement, electricity, fertilizer, steel and aluminium, with future extensions to other energy-intensive sectors being assessed.

As China continues to act as a manufacturing powerhouse, the EU CBAM would further challenge China’s competitive advantage, particularly with the COVID-19 pandemic making the Chinese economy even more dependent on exports. Policies such as the CBAM will put more pressure on China to reduce its carbon emissions and guarantee the sustainability of its exports to the EU.

The industrial park model is one of the main forms of industrial agglomeration development in China. Therefore, China’s 30/60 goals cannot be achieved without the crucial and proactive role of these industrial parks.

Allowing industrial parks to take a decisive role in shaping effective pathways towards carbon neutrality would also create favourable conditions for attracting investments from both European multinationals and small and medium-sized enterprises, seeking transparent business and industrial environments compliant with their global environmental and social governance (ESG) commitments. This is currently impossible in China due to the lack of reliable emissions data, the absence of direct access to renewable energy sources and inadequate green infrastructure, as well as the vague definitions of ‘carbon neutrality’ adopted by local governments. This means European companies are operating in industrial environments that do not allow assessment and certification by qualified independent third-party certification bodies, which prevents them from being compliant with their global ESG pledges.

A ‘carbon zero’ certified (through international standards) industrial park would also allow localised companies to deal with forthcoming carbon import tariffs like the CBAM. Such parks could become national benchmarks for accelerating China’s pace towards carbon neutrality. However, each Industrial Park has its own characteristics: there are no one-size-fits-all solutions, and technologies alone cannot achieve carbon neutrality.

European companies could play a crucial role in supporting Chinese industrial parks to accelerate their transformation towards carbon neutrality. If European companies’ energy transition experiences, as well as their rational and sustainable solutions, had been better utilised in China, the disruptions experienced in 2021 from inadequate management of energy shortages in many Chinese provinces could have been avoided.

Guido D. Giacconi is currently serves as vice president of the European Chamber. H e is co-founder and president of In3act Srl, an Italian business strategy consulting and advisory company with operations in China since 2006.He was also the former national chair of the Chamber’s Energy Working Group, former vice chair of the China-Italy Chamber of Commerce, and consultant to the Embassy of Italy in China and Italian Trade Agency, to name but a few.

[1] Synthesis Report 2020 on China’s Carbon Neutrality, Energy Foundation, 2020, <https://www.efchina.org/Attachments/Report/report-lceg-20201210/Synthesis-Report-2020-on-Chinas-Carbon-Neutrality.pdf/view>

[2] Report of Layout Plans and Operation Management on China Industrial Parks, Forward The Economist, 2021. https://bg.qianzhan.com/report/detail/0fe1d2c5c7414983.html

[3] Low-Carbon Development Pathways of Industrial Parks in China, Tsinghua University, 2021. http://zghjgl.ijournal.cn/ch/reader/view_abstract.aspx?file_no=20210107&flag=1

[4] “Statistical analysis of innovation and development of National High-tech Zones in 2019”, Ministry of Science and Technology of the PRC, 20http://www.most.gov.cn/xxgk/xinxifenlei/fdzdgknr/kjtjbg/kjtj2021/202106/P020210630532438708381.pdf

Recent Comments