We’ve all heard that a butterfly flapping its wings in one part of the world can cause a tornado many miles away. In recent times, many businesses and industries have seen this trope become a reality, as turbulence sends ripples along global supply chains and communications networks. Frank Mei, an advisory partner with KPMG China, outlines the best approach to decision-making for managers amid all this unpredictability.

The age of unpredictable change

We are in an era of unprecedented uncertainties. Regulatory changes, geopolitical development, shifts in customer behaviour, technological advancements, emerging players and market segments and new stakeholder dynamics, to name just a few, are creating complex layers of perplexity for future business. A recent global CEO survey showed Chinese CEOs are more concerned about geopolitical, environmental and technological uncertainties than their global peers.[1] Recent developments in China-US trade negotiations have certainly exacerbated the complexities.

While there is no doubt that uncertainties create significant challenges, they are also often the source of profit in a competitive market. Hence the challenge is not changes per se, but rather how companies cope with them.

How should companies develop strategies to succeed in the future? Can the recipe that worked for past successes guarantee similar future results or even survival? In this fast-changing world, the status quo is constantly being questioned. Decision-making based on past experience and, in many cases, a qualitative approach may not necessarily be the optimal approach to addressing complex uncertainties.

Decision-making more challenging, calls for innovation and change of mindset

Daniel Kahneman, the winner of the 2002 Nobel Prize for Economic Sciences for his work on decision-making and behaviour economics and author of Thinking Fast and Slow, said that “whatever else it produces, an organisation is a factory that produces judgements and decisions.”[2]

Decision-making in this complex world is becoming more difficult. For companies to survive and succeed in the future, a shift of mindset is necessary; our view of uncertainties and corresponding strategies needs to be flexible, dynamic, forward-thinking, adaptive and robust.

Developments in decision-making theories and practices

Companies face difficult business decisions all the time: How to quantify the risk value and strategic value of an acquisition? How to assess the value of each asset in a portfolio, considering future uncertainty, fluctuation and strategic options? How to quantify the impact of potential regulatory changes and determine the optimal strategy?

There have been significant developments in theories and innovative practices across industries and sectors in decision-making under uncertainty, which offer deep insights and innovative tools that provide better support for companies.

Behaviour economics challenges the assumption that the human mind is rational and explains how we make decisions when facing uncertainties. Game theory shows how we behave in competitive settings. Finance theories such as real option theory and financial modelling are often applied beyond the industry. Scenario planning and simulation are being used by leading organisations. By combining those approaches with developments in artificial intelligence (AI) and computing power, companies are increasingly moving rapidly beyond heuristic-based decision-making—strategies based on little information that often still turn out to be accurate—to an analytic-driven, AI-led and algorithm-augmented style.

Improve decision-making – a quantitative analytical approach

When re-evaluating a decision-making approach, the following six guiding principles may be helpful:

- Future Scenarios: Consider not only the assumed future, but also all plausible future scenarios to make strategies adaptive.

- Strategic Flexibility: Consider how uncertainties evolve and management’s flexibility (and the value of such).

- Multiple External Players: Multiple stakeholders and players add extra complexities. Game theory would help better understand the dynamics and the most suitable strategies.

- Understanding of Behaviour: Behaviour economics have been proven to be effective in helping to understand, predict and influence people.

- Deep Uncertainty: With complex and sometimes deep uncertainties, we need to evaluate not only the optimal strategy but also a robust one to address them.

- Internal Stakeholders Alignment: Engaging stakeholders in a deliberation over the analytical process is crucial to determining an optimal/robust strategy.

In a nutshell, companies need a more accurate representation of the complex and ever-changing future to maximise the probabilities of success. This is where forward thinking, models and algorithms hold the advantage over heuristic approaches.

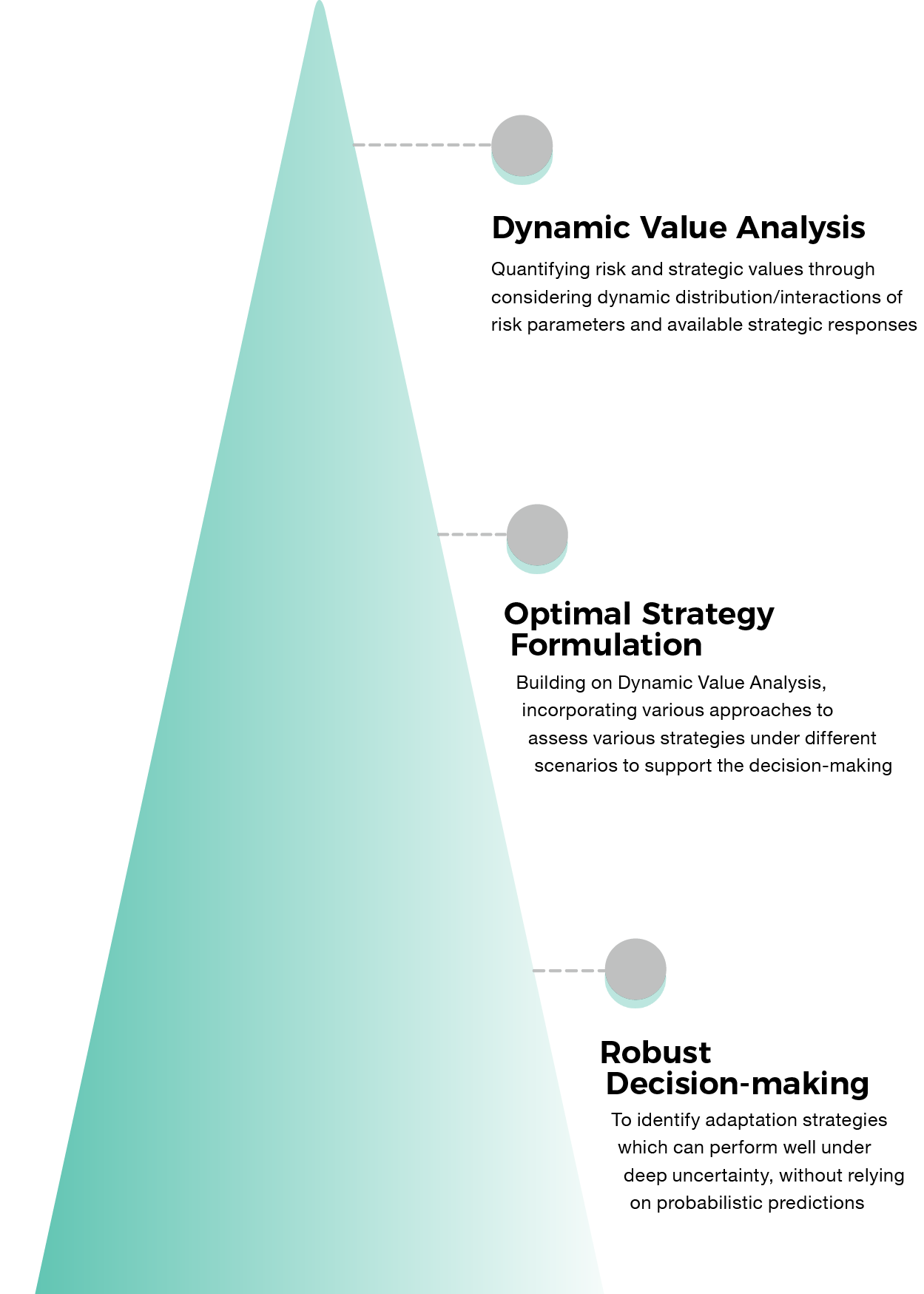

The diagram above demonstrates a sample layered, iterative three-step quantitative approach to sophisticated decision-making. The goal is to address the limitations of traditional processes and significantly improve the quality of decisions by clarifying strategic visions and developing more precise roadmaps.

The steps are as follows:

- Have a dynamic view of value: Quantifying risk value and strategic values through considering dynamic distribution/interactions of risk parameters and available strategic responses to clarify tactical vision.

- Formulate optimal strategies: Based on the quantitative risk value and strategic value, incorporating various scenarios to assess various strategies under different approaches to support the decision-making. Competitive games should be incorporated into the model when appropriate.

- Robust decision-making under deep uncertainty: This is based on the concept of ‘robustness’ rather than ‘optimality’. It emphasises the ability to be effective over a range of possible future conditions where uncertainties are difficult to quantify or be agreed upon.

Building AI-enabled decision-making capabilities

Companies globally are now pivoting to an algorithm and AI style of decision-making, and the paradigm shift is obvious. In his book Principles, Ray Dalio, the founder and co-chair of Bridgewater Associates—the largest and one of the best-performing hedge funds in the world—said that the company’s investment decisions are mainly made by computers, and management override the system “less than 2 per cent of the time”. The new paradigm will require organisations to transform their current business, cultural and technical set-up. In order to do this, companies will have to work on these six aspects in particular:

- Understand current strategic decision-making processes: How are strategic decisions made, based on data, evidence or intuition? How much confidence does management have in these decisions?

- Assess existing organisational capabilities as ‘math houses’: Data in isolation is not useful. It is the ability to process data using math house capabilities of mathematics, algorithms and modelling rather than the traditional business and management capabilities that makes all the difference.

- Conduct any pilot project with an engineering mindset: Developing AI decision-making requires a combination of data/computer scientists and business insight. An engineering mindset will help standardise the use of these applications while ensuring that they are scalable and extensible.

- Develop models, algorithms and data structure: Each business decision is unique and may require different models, algorithms and datasets. The process is also an iterative one, where knowledge and experience can be accumulated and captured.

- Transparent, consistent and relevant: For management to accept and be comfortable with analytics-based and AI-enabled decision-making, the logic, model and algorithms need to be explainable and consistent, with addressing business issues as their main goal.

- From ‘what happened?’ to ‘what will happen?’ to ‘what should we do?’: AI-assisted decision-making support will move from description (past event) to predictive and prescriptive (see and shape the future).

Company Introduction

KPMG is a global network of independent member firms offering audit, tax and advisory services. The firms work closely with clients, helping them to mitigate risks and grasp opportunities. Clients include business corporations, governments and public sector agencies and not-for-profit organisations. They look to KPMG for a consistent standard of service based on high order professional capabilities, industry insight and local knowledge. KPMG member firms can be found in 152 countries. Collectively they employ more than 189,000 people across a range of disciplines. Sustaining and enhancing the quality of this professional workforce is KPMG’s primary objective. Wherever our firms operate, we want them to be no less than the professional employers of choice.

[1] Collaborating and Innovating for Growth: 2018 China CEO Survey, KPMG, 2018, viewed 23rd May 2019, p. 8 < https://home.kpmg/cn/en/home/insights/2018/05/china-ceo-outlook.html>

[2] Kahneman, D., Thinking, Fast and Slow. Farrar, Straus and Giroux, New York, 2011, p. 408.

Recent Comments