The future of new energy vehicles

After more than a decade of development, China’s electric vehicle (EV) industry is now at the forefront of the world’s ‘EV revolution’, experiencing exponential growth since 2020. But a recent slump in car sales, largely due to the expiration of a government subsidy programme at the end of 2022, has led to a full-blown price war in the world’s largest vehicle market to clear out inventories before stricter national emissions standards take effect in July 2023.[1] As strong Chinese contenders emerge on the global EV market, what speedbumps can be foreseen for the growth of the new electric vehicle (NEV) industry? How do Chinese NEVs compare to the Teslas and BMWs of the world, and most importantly, how will traditional European automotive powerhouses remain competitive in the global supply chain while China remains the largest global market? Stephanie Sam, communications and business manager with the European Chamber, looks into these issues and more.

Climate policy in the driver’s seat

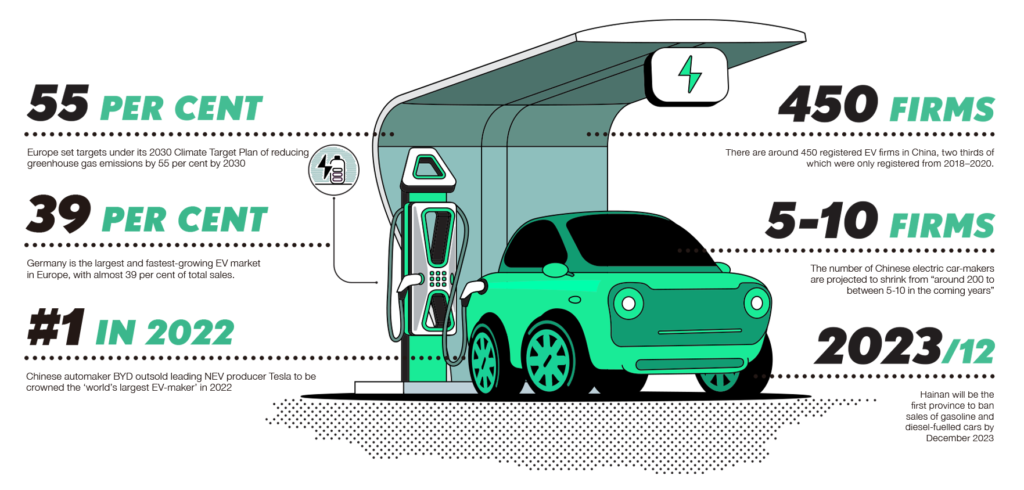

Driven by ambitious targets set under its 2030 Climate Target Plan for reducing greenhouse gas emissions by 55 per cent by 2030, and subsequent ‘Fit for 55’ legislation requiring all new vehicles in Europe to be zero-emission by 2035,[2] the European Union (EU) has made a strong push for the transition to cleaner modes of transportation, including NEVs.

Such government incentives and environmental regulations, alongside consumer demand, are driving the NEV market in Europe. Generous schemes, including tax credits and subsidies, have been offered by many European governments for the purchase of NEVs. In terms of preferential taxation, Norway in particular is miles ahead of other nations, waiving import duties and car registration taxes for EVs in addition to imposing heavy taxes on purchases of conventional cars that rely on fossil fuels. Some EU Member States—such as The Netherlands and Sweden—have implemented zero or low-emission zones that regulate access to urban areas based on emissions of motorised vehicles, and other pioneering efforts to incentivise NEV adoption.[3]

Meanwhile, European consumers are increasingly aware of the environmental impact of their transportation choices, leading to a surge in demand for cleaner vehicles that has prompted automotive manufacturers to invest in NEV development to meet Europeans’ needs and preferences. Germany is the largest and fastest-growing EV market in Europe, with almost 39 per cent of total sales, while the Scandinavian nations of Norway and Sweden have the highest EV share of overall passenger vehicle sales.[4] With advancements in technologies such as batteries improving performance, efficiency and safety, and a well-developed network of charging infrastructure, European automotive manufacturers have set standards that helped establish the region as the global leader in the NEV industry.

The race to stay relevant

The traditional dominance of the automotive sector by European powerhouses like Volkswagen and Audi makes China’s recent prominence in the NEV industry a little surprising. There are around 450 registered EV firms in China, [5] two thirds of which were only registered from 2018–2020.[6] Chinese automotive manufacturer BYD outsold leading NEV producer Tesla to be crowned the ‘world’s largest EV-maker’ in 2022. Although the title may be contested, once both fully electric vehicles as well as plug-in hybrids (PHEVs) are counted, BYD’s growth trajectory cannot be trivialised given its combined sales figures of 1.86 million, selling 911,000 EVs and 946,000 PHEVs globally.[7]

For Chinese consumers, pandemic-induced economic woes have made the cheaper, locally produced EVs more attractive than imported or foreign models like Tesla. However, that’s only one side of the story. Strong electric car sales in China have also been underpinned by significant financial support from the Chinese Government for both manufacturers and buyers, with major investment in research and development (R&D) and strict regulations on carbon emissions, as well as a quota system for NEV production.

Despite the end of subsidies by January 2023, China’s EV market is expected to continue growing due to the increase in consumer interest. Other incentives remain, including the extension of the 10 per cent sales tax exemption until the end of 2023 as part of China’s efforts to boost post-zero-COVID consumption.[8] Another boost to consumer confidence is China’s focus on improving charging station accessibility, with the number of infrastructure facilities nearly doubling in 2022.[9] The country’s large middle-class consumer base, strong local supply chains and industrial clusters for components like batteries and electric motors, and large manufacturing capacity has given it a competitive advantage. Coupled with prioritisation of R&D, this has allowed Chinese automotive manufacturers to improve the performance, range and affordability of their NEVs to make them comparable with premium foreign competitor’s products.

Speed bumps ahead

Projections that the number of Chinese electric-carmakers shrinking from “around 200 to between 5-10 in the coming years”[10] indicate the approach of domestic market saturation, after which only the cream of the crop will remain. This clear-out will coincide with increased competition from foreign car-makers, such as BMW and Volkswagen, who plan to launch electric models for the China market. Meanwhile, Chinese manufacturer Nio is planning European expansion with new sedan models in a bid to diversify and minimise risk.

For European players aiming to get a slice of the China pie, mandatory data localisation and cybersecurity concerns are causing dilemmas for R&D, making foreign companies reluctant to bring their core technologies to China. At the same time, the size of the market, strong demand and fast pace of commercialization, which characterizes China’s R&D ecosystem, means that if European automotive manufacturers do not get involved, they risk falling behind.

Meanwhile, the United States-China ‘chip war’ has raised concerns about supply chain security, future development and production costs in the automotive industry. A potential semiconductor shortage poses a significant threat for the NEV industry overall, as many vehicles rely heavily on advanced chips for functions such as battery management, power control and connectivity.

An electric future

While it is clear we are heading in the right direction, the road

towards complete electrification of the automotive industry is long and paved

with fierce competition. The Shanghai International Automotive Industry

Exhibition in April 2023 showcased how rapidly China is adopting the necessary transformative

technology – not only to satisfy local demand for more affordable yet high-tech

models, but also to compete globally. However, the rush to slash prices in the

largest car market indicates an imminent slowdown, and decreased certainty of

profitability along the global automotive value chain for 2023. Meanwhile, although

China has not gone to the EU’s policy extremes of banning combustion engine

sales (yet), Hainan will become the first province to ban sales of gasoline and

diesel-fueled cars by 2030 [11]

– a clear indicator that the authorities are contemplating doing the same in

other jurisdictions. On the EU side, while there is a sustained momentum for EVs

among consumers, European carmakers will need to adopt a more aggressive

R&D strategy if the bloc wants to continue to have a seat at the global NEV

table.

[1] China to implement stricter vehicle emissions standards from July 1, Reuters, 9th May 2023, viewed 14th May 2023, <https://www.reuters.com/world/china/china-implement-stricter-vehicle-emissions-standards-july-1-2023-05-09/>

[2] Zero emission vehicles: first ‘Fit for 55’deal will end the sale of new CO2 emitting cars in Europe by 2034, European Commission, 28th October 2022, viewed 14th May 2023, <https://ec.europa.eu/commission/presscorner/detail/en/ip_22_6462>

[3] Global EV Outlook 2021: Policies to promote electric vehicle deployment, International Energy Agency, viewed 12th May 2023, <https://www.iea.org/reports/global-ev-outlook-2021/policies-to-promote-electric-vehicle-deployment>

[4] Mukherjee, Abhik, Berlin Factory Takes Tesla to Top Spot in Europe EV Sales as Chinese Brands Gain Ground, Counterpoint, 14th March 2023, viewed 14th May 2023, <https://www.counterpointresearch.com/zh-hans/europe-ev-sales-q4-2022/>

[5] Sales of New Energy Vehicles in December 2020 , China Association of Automobile Manufacturers, 14th January 2021, viewed 15th May 2023,<http://en.caam.org.cn/Index/show/catid/34/id/140.html>

[6] CK Tan, China’s EV industry braced for shakeout as prices plunge, Nikkei Asia, 5th May 2023, viewed 13th May 2023, <https://asia.nikkei.com/Business/Business-Spotlight/China-s-EV-industry-braces-for-a-shakeout-as-prices-plunge>

[7] Ren, Daniel, BYD beats Tesla in 2022 EV sales, as the world’s No 1 electric car seller vindicated Warren Buffett’s bet, South China Morning Post, 3rd January 2023, viewed 12th May 2023, <https://www.scmp.com/business/china-business/article/3205388/byd-beats-tesla-2022-ev-sales-worlds-no-1-electric-car-seller-vindicated-warren-buffetts-bet>

[8] Jiang, Mengnan, China ends electric vehicle subsidies, China Dialogue, 12th January 2023, viewed 13th May 2023, <https://chinadialogue.net/en/digest/china-ends-electric-vehicle-subsidies/>

[9] China’s NEV charging infrastructure facilities nearly double in number in 2022 , Xinhua, 14th February 2023, viewed 15th May 2023, <https://english.www.gov.cn/archive/statistics/202302/14/content_WS63eadb09c6d0a757729e6b8d.html>

[10] CK Tan, China’s EV industry braced for shakeout as prices plunge, Nikkei Asia, 5th May 2023, viewed 13th May 2023, <https://asia.nikkei.com/Business/Business-Spotlight/China-s-EV-industry-braces-for-a-shakeout-as-prices-plunge>

[11] Yeung, Jessie & Deng, Shaun, Chinese island plans to ban sales of fossil fuel-powered vehicles by 2030, CNN, 16TH May 2023, <https://edition.cnn.com/2022/08/25/energy/hainan-fossil-fuel-vehicles-ban-intl-hnk/index.html>

Recent Comments