Due to their wide-ranging downstream applications and impact on the overall market, industrial gases have been dubbed the ‘blood’ of industry. They are widely used in areas such as metallurgy, petroleum, petrochemicals, chemicals, electronics and aerospace. However, the current economic downturn in China has made it more challenging for companies and investors to determine where new opportunities are and growth prospects lie in China’s industrial gas market.

Due to their wide-ranging downstream applications and impact on the overall market, industrial gases have been dubbed the ‘blood’ of industry. They are widely used in areas such as metallurgy, petroleum, petrochemicals, chemicals, electronics and aerospace. However, the current economic downturn in China has made it more challenging for companies and investors to determine where new opportunities are and growth prospects lie in China’s industrial gas market.

Yong Teng, Yiru Lou and Webster Guo of L.E.K. Consulting shed some light on where they may be found.

The market: maintaining rapid growth

Industrial gases consist of three major types: air separation gases (i.e. nitrogen, oxygen, argon), synthetic gases (i.e. hydrogen, carbon dioxide, acetylene) and speciality gases (i.e. ultra-high purity gases, electronic gases), with 50 per cent, 35 per cent and eight to 10 per cent market share respectively.

The global industrial gas industry (outsourced only) grew steadily, at 7.6 per cent per year in the last two years, and was valued at USD 98 billion in 2015. As the industrial gas market typically grows at twice the rate of GDP growth, we forecast that the market will continue to grow at 7.3 per cent from 2015 to 2018—which would put its 2018 value at USD 122 billion—due to rapid industrialisation of developing countries.

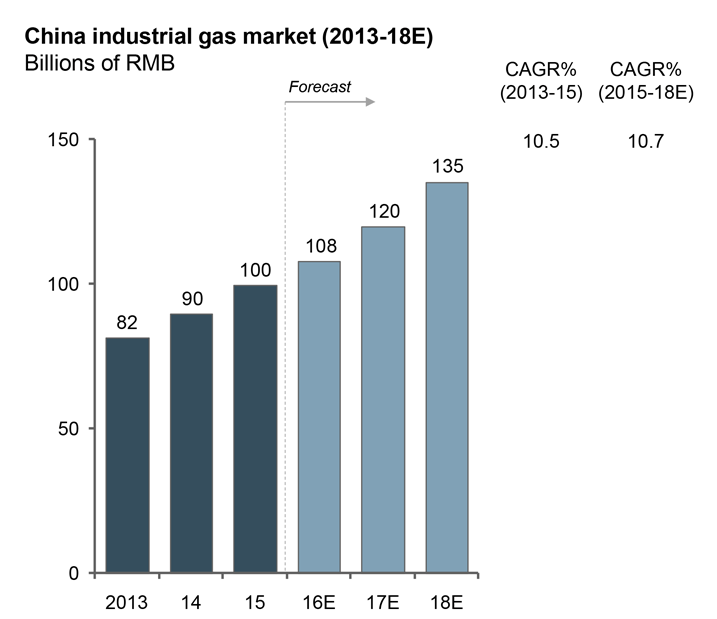

China’s industrial gas market (outsourced only) has grown at an even faster rate of more than 10 per cent per year, from CNY 82 billion in 2013, to CNY 100 billion in 2015. And with China’s per capita consumption of industrial gases still low compared to developed countries there is still considerable growth potential. We would expect China’s industrial gas industry to maintain double-digit growth over the next two to three years, to reach CNY 135 billion in 2018.

Additionally, Chinese customers are increasingly outsourcing their gas supply (currently 55 per cent of gas is outsourced, significantly lower than the 80 per cent seen in developed countries), a trend that will create additional opportunities for gas suppliers in China.

Figure 1: China’s Industrial Gas Market

Figure 1: China’s Industrial Gas Market

Competition: MNCs still hold the advantage, but locals are catching up

Four types of players exist within the industrial gas market:

- ‘Big 4’ multinational companies (MNCs) (Linde, Air Liquide, Air Products, Praxair): make up nearly half of the outsourcing gas market, each with revenues of over CNY 6 billion and over 50 factories in China.

- Tier-2 players, 5-7 large domestic (Yingde and Hangyang) and MNC (Taiyo Nippon Sanso, Messer) gas producers: own around 30% of the market with revenues of CNY 2-6 billion and 30-50 factories each.

- Tier-3, mid-sized companies, 20-30 domestic gas producers including Jinhong Gas, Shanghai Pujiang, Nantong Tianyuan, and Kaifeng Air Separation: own 10–15% market share with about 10 factories each in China.

- Lastly, there are over 1,000 smaller manufacturers making up the restSome local companies are investing heavily in R&D and M&A to catch up. For example, Jinhong Gas developed the capability of mass production of 99.9999% purity ammonia in 2012, and quickly captured over 50 per cent market share in the electronics industry.

- Local players are still unable to compete with major MNCs in terms of both scale and technology. For example, Hangyang is the first domestic company that is able to offer medium-to-large-scale air separation units. However, Hangyang requires roughly 50 operators for its 80km3/h (cubic kilometres per hour) unit, while Air Products only needs 16.

Downstream applications: attractive opportunities in the electronics industry

Among the major downstream application industries, we believe electronics is more attractive because of: 1) rapid growth in demand; 2) heavy reliance on specialty gas and advanced technologies; and 3) relatively limited competition.

Rapid growth in demand

Industrial gases are indispensable raw materials used in electronics manufacturing, from semi-conductors, flat panel displays, solar cells, to LED lighting. With increasing demand for data processing, automotive electronics and internet-related services, the semiconductor industry is expected to grow at 5.1 per cent per year in the next five years globally, of which China makes up roughly 30 per cent of the market and is the largest growth driver.

We therefore expect the speciality gas industry for the electronics market to grow up to 15 per cent per year in the next five years, to a value of CNY 13 billion.

Figure 2: China’s Electronics Industry

Figure 2: China’s Electronics Industry

Heavy reliance on speciality gas and technology advancement

The electronics end-market relies heavily on the use of speciality gases in various processes including etching, film forming, doping and ion injection, and crystalline production.

Unlike the metallurgy and chemical industries, the electronics industry holds industrial gas suppliers to higher standards:

- Medium-to-large-scale air separation unit expertise: deep know-how in site and pipeline design, strict safety compliance and strong operational support.

- Adequate portfolio in specialty gases: certain VLSI (very large scale integration systems) require over 50 kinds of specialty gases in 400+ manufacturing processes.

- High purity level: key processes require 6N purity (99.9999%), or even higher.

Relatively Limited Competition

Because electronic speciality gas has such high technical requirements, the market is mostly dominated by leading MNCs. Air Products, Praxair, Showa Denko, Linde and six other foreign manufacturers account for 85 per cent of the market share in China.

Local players are able to produce and supply high purity silane, ammonia, nitrous oxide and neon gas, and are expected to be able to provide chlorine (CL2) and arsenic in near future. Local speciality gas has a 30 per cent share in 8+ inch semiconductors. However, the majority of local gas suppliers only have small-scale operations and can’t provide customers with a full range of services.

Figure 3: Market dynamics of China’s industrial gas market for the electronics industry

Figure 3: Market dynamics of China’s industrial gas market for the electronics industry

Growth options of local players

In a market where MNCs enjoy dominant positions, local gas companies may start looking into the following options:

- Identifying the right segment: local gas companies can enter the electronics gas market through segments which require lower technical capabilities and purity requirements (e.g., Jinhong gas now makes up 50% of the high purity ammonia market).

- Cooperating with research institutes: collaboration with institutes with deep expertise in specialty gases, such as Guangming Chemical Research and Design Institute (China’s only specialty gas research institute) and the Liming Research Institute of Chemical Industry (Chinese leading fluoride research institute).

- Look into M&A: major MNC and local gas suppliers have continually strengthened their business through M&As. Local companies may begin to look to overseas targets with advanced know-how in specialty gases.

Investment considerations

There are still attractive opportunities for PE investment, especially in speciality gases. However, it is worth considering what the underlying market drivers are. What will be the future trends? What are customers’ purchasing requirements and specifications? How competitive is the target’s offering compared to market competitors? What investments are required to fulfil capability/resource gaps? Investors should scrutinise potential risks in order to develop mitigation plans accordingly.

L.E.K. Consulting is a global management consulting firm that uses deep industry expertise and rigorous analysis to help business leaders achieve practical results with real impact. We have a wealth of experience and insight in China’s industrials sector and help business leaders make informed decisions and achieve tangible results through our professional expertise and rigorous analysis. Founded more than 30 years ago, L.E.K. employs more than 1,200 professionals across the Americas, Asia-Pacific and Europe. For more information, go to www.lek.com. The authors of Investment Opportunities in China’s Industrial Gas Market, Yong Teng, Yiru Lou and Webster Guo, are all from L.E.K. Consulting’s Shanghai Office.

Recent Comments