A Closer Look at Industry 4.0 and CM2025

A Closer Look at Industry 4.0 and CM2025

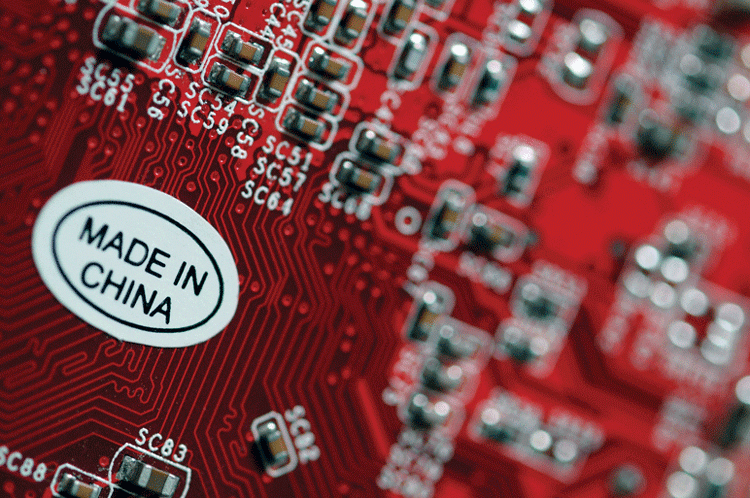

All over the world, businesses and governments are undertaking policies that take advantage of what is commonly referred to as the fourth industrial revolution. The German and Chinese governments believe this digital transformation will result in economic prosperity for both nations and have undertaken steps to capitalise on this change. In this article, Dr Tim Klatte, partner and head of Grant Thornton’s Forensic Advisory Services in Shanghai, takes a closer look at China Manufacturing 2025 (CM2025) and compares this strategic initiative with existing European practices like Germany’s Industry 4.0.

China and Germany have worked hard on establishing an ‘industrial internet’ (a network of communications between an entire supply chain), by using new computer technology for large data analytics, and artificial intelligence and machine learning techniques to optimise the manufacturing process. The reason for encouraging this shift is to make business more efficient, similar to the reasoning behind previous industrial revolutions. Outlining the importance of these changes, this article looks to compare the goals and challenges of Germany’s Industry 4.0 and CM2025 and lend insight into digital investment decision-making.

Industry 4.0

Germany has utilised a government-sponsored platform called Industry 4.0. The Federal Ministry for Economic Affairs leads the platform and looks for policy issues that might arise from enacting this new initiative. The ministry uses standardisation and legal necessity to ensure the ethical and secure progression of this program. They hope to create an environment that not only contains robust standards for development and intellectual property protection, but sound ethics as well. As of 2017, the ministry publicly invested euro (EUR) 200 million in a variety of companies through a verification program that ensures companies appropriately utilise funds for innovation and technology purposes. They have actively assisted in upgrading various logistics programs by digitising transportation production systems and sponsored the construction of technologically integrated research labs throughout Germany. The ministry is looking to facilitate investment in smart manufacturing by working with industry leaders, think tanks and trade organisations to see what changes could be made to encourage further investment.[i] The approach taken by Industry 4.0 is bottom up, pushing firms to take advantage of the incentives provided by the platform and grow Germany’s economy.[ii]

Industry 4.0 is not without its criticisms and concerns. Some experts are worried that the potential of the concept is overstated, or not as prominent as its proponents would like investors to believe.[iii] Critics suggest there are significant barriers to creating industrial networks and smart factories, and many firms are providing digitisation services at a very steep price which has caused companies to question whether now is the optimal time to digitise their factory. Additionally, with any advancement in network technology, security concerns become heightened. Firms are having a difficult time protecting their data and having more of their operations in the cloud, or on the Internet, will constitute a security risk. Thus, the incentives provided by Industry 4.0 may not be enough to attract investment.

CM2025

The CM2025 initiative operates on a similar principle to Industry 4.0 but differs in its implementation. Outlined in the CM2025 initiative, China is looking to enhance its manufacturing ability by utilising the internet of things, improved sensor and machine learning technology, and large data analytics. The Ministry of Industry and Information Technology (MIIT) announced its plans to invest an estimated Chinese yuan (CNY) 10 billion to support CM2025 from 2016–2020. According to the MIIT, China’s pilot projects have been successful thus far, seeing a 38 per cent increase in productivity for the 109 existing smart manufacturing projects.[iv] This initiative also looks to make Chinese goods more competitive and encourage innovation in Chinese businesses. The expansion of smart manufacturing is just one small part of the overall plan. They would also like Chinese manufactured goods to start being perceived as high end. This is part of a three-stage plan to move China beyond the middle-income trap to become the top producing economy in the world by 2049, the 100th anniversary of the founding of the People’s Republic of China. The MIIT hopes to have 15 innovation centres by 2020 and 40 by 2025 to fuel domestic innovation.[v] These centres are meant to research new manufacturing technologies domestically and to combat the idea that Chinese manufacturing is “large without being strong”.[vi] There are also 10 focus industries outlined in CM2025 that the MIIT has set goals for and hopes will expand with new investment.

MIIT Focus Industries for CM2025[vii]

| 1. Next generation information technology | 2. Energy-saving vehicles and new energy vehicles |

| 3. High-end numerical control machinery and robotics | 4. Electrical equipment |

| 5. Aerospace and aviation equipment | 6. Agricultural machinery and equipment |

| 7. Maritime engineering equipment and high-tech maritime vessel manufacturing | 8. New materials |

| 9. Advanced rail equipment | 10. Biopharmaceuticals and high-performance medical devices |

The Chinese Government has several policy tools it can use to promote growth in these industries, including forced technology transfers, subsidies and standardisation. As Chinese companies become increasingly competitive and the Chinese market continues to evolve, technology transfers from foreign companies have been increasing. The MIIT also has plans to subsidise many Chinese companies, creating a price advantage for domestic businesses compared to foreign enterprises operating in the Chinese market. As for standardisation, the Chinese Government is striving for a more important seat at the negotiating table to reduce licensing costs incurred by Chinese companies when they utilise foreign technology.

Much like Industry 4.0, China increasing its domestic investment and rapidly shifting their manufacturing and economic infrastructure will be challenging. With this shift, foreign firms worry Chinese businesses will have an unfair advantage from government subsidies,[viii] creating tension that could hurt Chinese exports overall. Additionally, China’s diversity in the manufacturing market is also a concern, as the domestic labour force may not have the ability to transition into smart factories without causing significant unemployment.

A different economic approach

Industry 4.0 and CM2025 are fundamentally different in their approach. While China has specific, quantified goals for industry improvement, the German platform is focused more on research and development (R&D) to lower manufacturing costs. China is focused on rapidly improving their economy in a variety of ways, whereas Germany seems only concerned with increasing the efficiency of German manufacturing firms. The vast difference in public funding between the two countries underlines the fact that Germany is adopting more of a hands-off approach while China is very much state run.

The two countries also diverge on how to direct domestic research. Germany and other European countries are focusing their R&D on making technological breakthroughs, while China’s emphasis is on applied research. Governments in the European Union are only providing tax incentives for research, not direct subsidies like the MIIT.

Going forward, foreign businesses must be careful when determining the costs and benefits of entering or remaining in the Chinese market and be aware of the emerging global marketplace for smart technology.

Established in 1981, Grant Thornton is one of China’s first accounting firms with over 220 partners, 5,000 professionals and over 1,000 CPAs. An easy access to international resources, enables us to offer a full range of assurance, tax and advisory services to clients in every sector of the Chinese market. They serve a broad client base that encompasses more than 200 public companies and over 3,000 state-owned enterprises and privately-owned enterprises. More than 47,000 Grant Thornton professionals, in over 130 countries, are focused on making a difference to clients, colleagues and the communities in which we live and work.

[i] The background to Plattform Industrie 4.0, PLATTFORM INDUSTRIE 4.0, 2018,<https://www.plattform-i40.de/I40/Redaktion/EN/Standardartikel/plattform.html>

[ii] Digital Transformation Monitor: Key lessons from national industry 4.0 policy initiatives in Europe, European Commission, May 2017, <https://ec.europa.eu/growth/tools-databases/dem/monitor/sites/default/files/DTM_Policy%20initiative%20comparison%20v1.pdf>

[iii] Industry 4.0: Digitalisation for productivity and growth, European Parliament, September 2015, <http://www.europarl.europa.eu/RegData/etudes/BRIE/2015/568337/EPRS_BRI(2015)568337_EN.pdf>

[iv] China to invest big in ‘Made in China 2025’ strategy, Xinhua, 12th October 2017, <http://english.gov.cn/state_council/ministries/2017/10/12/content_281475904600274.htm>

[v] Hsu, Sara, Foreign Firms Wary of ‘Made in China 2025,’ But It May Be China’s Best Chance At Innovation, Forbes, 10th March 2017, <https://www.forbes.com/sites/sarahsu/2017/03/10/foreign-firms-wary-of-made-in-china-2025-but-it-may-be-chinas-best-chance-at-innovation/#26c9101524d2>

[vi] China Manufacturing 2025: Putting Industrial Policy Ahead of Market Forces, European Union Chamber of Commerce, 2017, <http://www.europeanchamber.com.cn/en/china-manufacturing-2025>

[vii] Ibid.

[viii] Ibid.

Recent Comments