New Guangzhou Nansha preferential tax incentive

Plans to create a city/regional cluster of key cities in Guangdong, along with Hong Kong and Macao—dubbed the ‘Greater Bay Area’ or GBA—were widely welcomed when they were first formally introduced in 2017. The first major piece of infrastructure to be set up was the sea bridge connecting Shenzhen and Hong Kong to Zhuhai and Macao by road. Then COVID-19 arrived and further infrastructure development stalled out. In 2022, the Chinese Government began to renew its drive to incentivize investment in the GBA through initiatives like special business zones and preferential treatment for enterprises from the industries most in demand. Aaron Finley, chair of the South China Finance and Taxation Working Group, looks at one of these newly proposed initiatives.

On 14th June 2022, the State Council officially issued the Overall Plan for Deepening the Guangdong-Hong Kong-Macao Comprehensive Cooperation (GBA) in Guangzhou Nansha Facing the World (Guo Fa [2022] No. 13) (Overall Plan).1 The aim of the Overall Plan is to promote GBA comprehensive cooperation in Guangzhou Nansha, and to support Nansha in becoming a major strategic platform within the GBA.

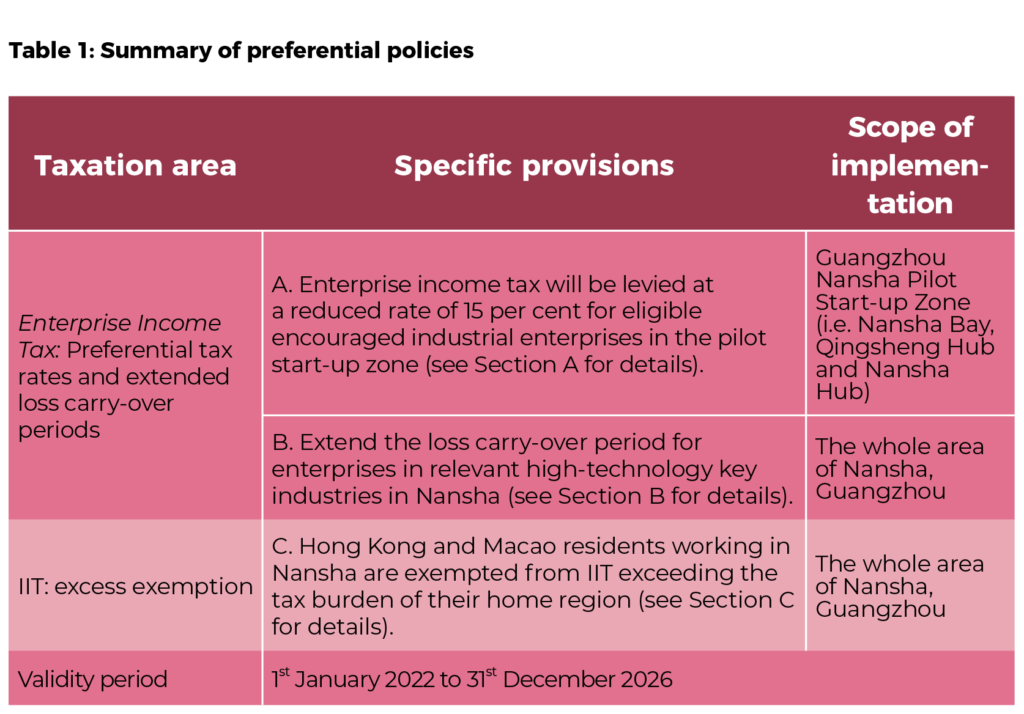

On 21st July 2022, China’s Ministry of Finance (MOF) promulgated the Notice on the Preferential Policies for Individual Income Tax (IIT) in Nansha, Guangzhou (Cai Shui [2022] No. 29), (Circular No. 29),2 and on 25th September 2022, the State Administration of Taxation (STA) released the Notice on Guangzhou Nansha Enterprise Income Tax Preferential Policies (Cai Shui [2022] No. 40) (Circular No. 40).3 These two documents clarified the tax incentive policies in the Overall Plan and put forward opinions on how these should be implemented. Table 1 briefly introduces the new preferential policies.

A. Enterprise income tax – A reduced rate of 15 per cent will be made available for eligible encouraged industrial enterprises located in the Nansha Pilot Start-up Zone.

- Applicable conditions (subject to both):

- If a company’s main business is the industrial project specified in the Guangzhou Nansha Enterprise Income Tax Preferential Catalogue (2022 Edition) (Preferential Catalogue), and the main business income accounts for more than 60 per cent of the total enterprise revenue. Total income shall be determined in accordance with Article 6 of the Enterprise Income Tax Law.

- Enterprises must have substantive operations in order to be eligible for consideration.

- Application to head office and branches

- For enterprises with their China head office located in the Nansha Pilot Zone, the 15 per cent tax rate will only apply to the income derived by that office, as well as branches located in the Nansha Pilot Zone that meet the prescribed conditions;

- For enterprises with their head office located outside the Nansha Pilot Start-up Zone, the 15 per cent tax rate will only apply to income derived by their branches located in the pilot zone that meet the prescribed conditions.

B. Enterprise income tax: Starting from 1st January 2022, high-technology companies established in Nansha and technology-based small and medium-sized enterprises (SMEs) will be allowed to carry forward any losses incurred in the eight years before the initial qualification year, with the maximum carry-over period extended to 13 years.

- Applicable conditions (subject to both):

- Enterprises in key high-technology industries that engage in the business specified in the Preferential Catalogue, and their main business income accounts for more than 60 per cent of the total revenue of the enterprise;

- Qualified as a high-technology enterprise or a technology-based SME, including:

a) High-technology enterprises: identified in accordance with the Notice on Revising and Issuing the Administrative Measures for the Identification of ‘High-technology Enterprises’ (Guoke Fa Huo [2016] No. 32);

b) Technology-based SMEs: In accordance with the Notice on Printing and Distributing the Evaluation Measures for ‘Science and Technology-based SMEs’ (Guo Kefa Zheng [2017] No. 115), the registration of S&T-based SMEs shall be obtained.

C. IIT – Hong Kong and Macao residents working in Nansha are exempted from the portion of their personal income tax burden exceeding the equivalent amount of tax in Hong Kong or Macao.

- Scope

of benefits: Comprehensive income from Nansha, Guangzhou.

- Preferential application method: The subsidy can be claimed when filing the annual settlement of IIT in Nansha, Guangzhou.

Note: This article has been prepared by Deloitte China for general reference only. We recommend that readers consult a tax advisor before taking action on the relevant information.

Aaron Finley is national vice chair and South China Chapter Chair of the Finance and Taxation Working Group. He is also the director for South China Business Development with Deloitte China.

Deloitte China provides integrated professional services, with our long-term commitment to be a leading contributor to China’s reform, opening-up and economic development. We are a globally connected firm with deep roots locally, owned by our partners in China. With over 20,000 professionals across 30 Chinese cities, we provide our clients with a one-stop shop offering world-leading audit and assurance, consulting, financial advisory, risk advisory, tax and business advisory services.

Recent Comments