Development trends in Mainland China 2023

The “In China for China” strategic approach holds paramount importance among foreign-invested enterprises, focussing on market relevance, customer satisfaction and competitive advantage by offering products and experiences specifically designed for the Chinese market. In addition to these factors, it is becoming increasingly crucial to emphasise cultural sensitivity, as it fosters trust, strengthens brand reputation, and plays a pivotal role in attracting and retaining the right talent. Organisations that demonstrate a strong commitment to the Chinese market and possess a deep understanding of the local context are more likely to appeal to top talent who value such dedication. In this article, Frank Redecker of REACH Talent Consulting outlines the results the inaugural 2023 Industry Compensation White Paper, a survey on industry compensation, examining compensation trends across multiple industries

The feedback from candidates collected for the report regarding the key factors influencing their decision-making can be summarised in five significant hiring and modern workplace trends that are reshaping the labour market:

- Remote work, including the concept of home office, will continue to experience substantial growth, even beyond the pandemic.

- The focus on diversity, equity and inclusion, along with work-life balance, will increasingly be of concern to job candidates.

- Corporate culture and market position will remain pivotal in attracting and retaining employees, serving as differentiators for employers.

- Inflation acceleration is influencing the changing needs of employees, including their expectations regarding compensation and benefits.

- Changing demographics and an ageing population will pose significant challenges in hiring qualified labour in the coming years.

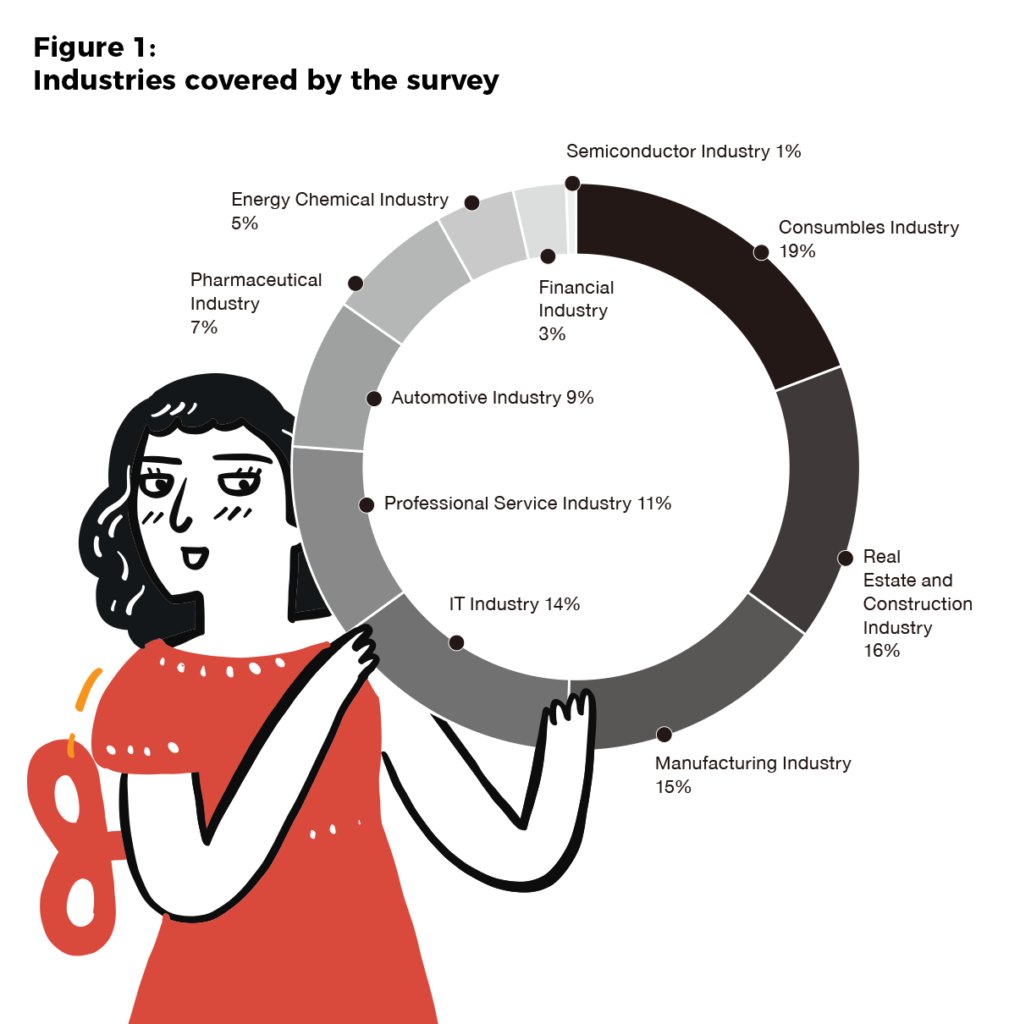

The findings of this research are based on feedback and data provided by over one million companies. The sample consists of 15.5 per cent from the manufacturing industry, 14.5 per cent from the information technology (IT) industry, approximately 11 per cent from the professional service industry, 9 per cent from the automotive industry, and 4.5 per cent from the energy chemical industry. These key industries collectively account for approximately 55 per cent of all recruitment activities analysed.

In regard to distribution across different regions, the majority of activities and feedback were focussed on first- and second-tier cities, representing about 78 per cent of the total market.

The majority of companies analysed were private Chinese enterprises (85 per cent), followed by foreign-owned companies (5 per cent) and joint ventures (1.5 per cent).

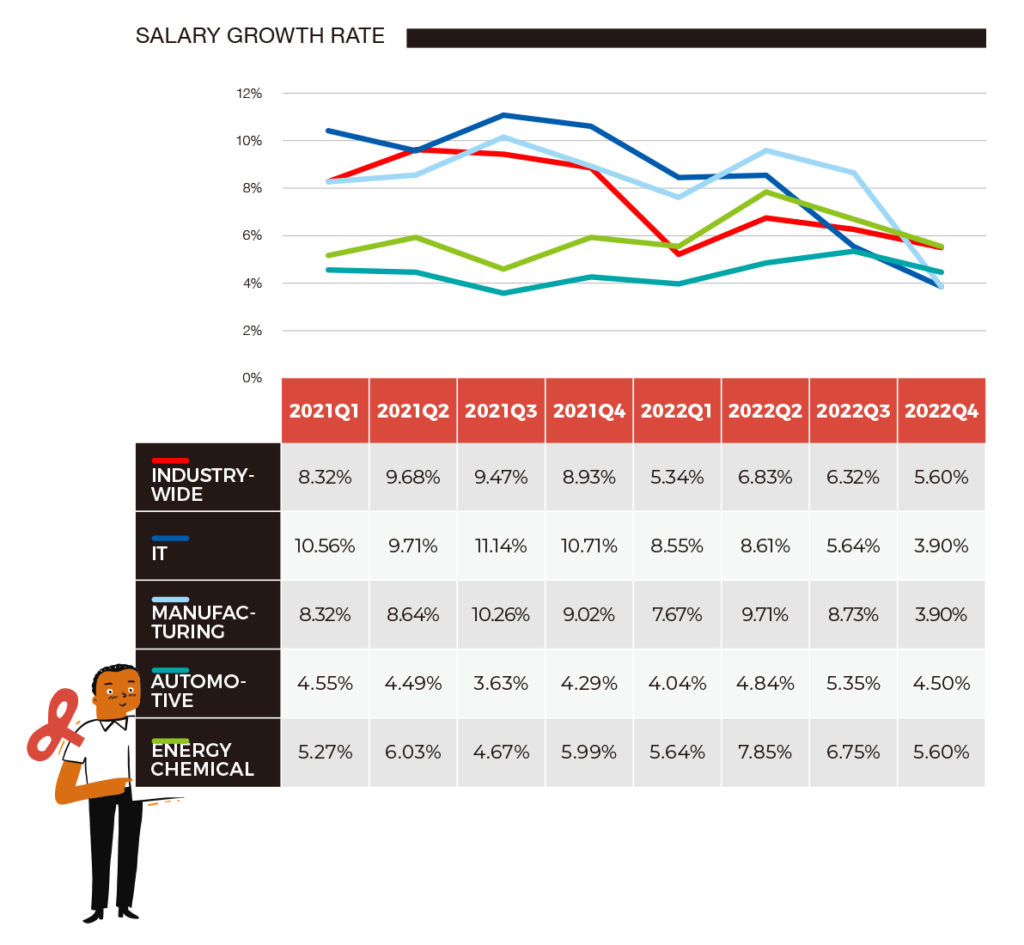

The data clearly reflects the economic impact of policy execution in the second quarter of 2022, showing a steady decline in salary increases compared to previous quarters. The average salary increase declined year-on-year (y-o-y) from 9.1 per cent in 2021 to approximately 6.02 per cent in 2022.

Industry highlights

The field of IT has evolved from what was referred to as the ‘information society’ to its current state, often described as the beginning of the ‘intelligent society’. Talent specialising in IT innovation are shaping the future of this ‘intelligent society’. However, due to the pandemic and geopolitical scenarios, there has been a noticeable decline in the demand for overall IT talent, with companies focussing more on cost control and increased efficiency. Nevertheless, the data indicates a surge in the recruitment of high-performing skilled workers and a stronger emphasis on talent retention to initiate new IT innovation processes. In this industry during the same timeframe, the average salary increase declined from 10.5 per cent in 2021 to approximately 6.7 per cent in 2022.

The manufacturing Industry, with its technology-intensive and labour-intensive classifications, is currently facing a significant ‘labour shortage’ or ‘talent shortage’ to meet its business needs. Recruiting skilled operators has become increasingly challenging due to demographic shifts in China’s society and changes in candidates’ career aspirations. Moreover, the lack of high-end intelligent manufacturing and technical talent reserves has compelled many companies within the manufacturing industry to seek individuals from various other industries, particularly those focussed on digital transformation. As a result, there has been the average salary increase during 2022 in this field is at approximately 7.5 per cent, though this is down from just over 9 per cent in 2021.

In the automotive industry, overall recruitment demand is on the rise, primarily driven by the transformation requirements faced by domestic traditional original equipment manufacturers (OEMs). These companies need to invest more in domestic research and development for new energy vehicles while also reducing the time to market for new products. Consequently, there is an urgent need to attract exceptional talent in fields such as software development, energy storage and design, leading to an average salary increase in 2022 of 4.7 per cent, up from 4.2 per cent in 2021.

The global energy situation, marked by turbulence in recent years and the development of carbon peak and carbon neutrality strategies, is significantly changing transformation process requirements in the energy chemical industry. The pace of transformation has become a key determinant of future sustainability and success in this industry, similar to other sectors but driven by different factors. As a result, the continuous development and utilisation of new energy sources are expected to lead to increased investments in human capital, materials and financial resources within this industry. Report findings demonstrate a clear increase in overall recruitment within the energy chemical industry, with an average salary increase of 6.5 per cent, a jump up from 5.5 per cent in 2021.

Conclusions

In summary, the talent market in China is characterised by its size; high demand for skilled professionals; talent shortages in specific fields; an emphasis on education and skill development; the rise of entrepreneurship and startups; government initiatives to attract and retain talent; and the growing importance of digital skills. It is essential for organisations operating in China to understand the dynamics of this talent market in order to effectively attract, retain and leverage the right talent for their success.

For organisations that recognise the significance of attracting and retaining the right talent, they can drive their overall success by leveraging specialised skills and expertise. Additionally, a focus on talent retention and attraction enhances organisational culture, fosters positive team dynamics, increases employee engagement and satisfaction, minimises turnover costs, retains valuable knowledge, and helps build a positive employer brand that attracts high-quality candidates.

Considering the talent market’s current development and the changes brought about by the post-pandemic business environment, it is evident that the “In China for China” strategy approach holds even greater importance. It not only ensures market relevance, customer satisfaction, competitive advantage and cultural sensitivity, but also plays a vital role in attracting and retaining top talent in China.

NOTE: The results in this article are extracted from the 2023 Industry Compensation White Paper, the full version of which is available to download at https://www.wjx.cn/vm/wFN6LHP.aspx#

Frank Redecker, with more than 35 years’ worldwide experience in senior management positions, is the founding partner and CEO of REACH Talent Consulting Co Ltd and elected board member of the European Union Chamber of Commerce in China, Nanjing Chapter.

REACH is an independent partner company of X-GIANTS Group, a leading technology-driven HR solution service provider offering executive search, recruitment process outsourcing, flexible staffing, HR-SaaS, expert network and consulting solutions to support customers’ success and sustainable growth. As the European business bridge, REACH aims to strengthen the services to European customers in China and oversea.

To support the development of effective talent attraction and retention strategies in China’s post-pandemic business environment, we have undertaken the task of creating the inaugural edition of X-GIANTS’ 2023 Industry Compensation White Paper in order to enable companies to better plan their talent management processes, align talent expectations, and make informed HR decisions that enhance overall effectiveness. The data presented in the white paper serves as a valuable resource for agile personnel planning, including selection, recruitment, training, retention, and compensation management.

Recent Comments