… European companies could benefit from decarbonising Chinese supply chains?

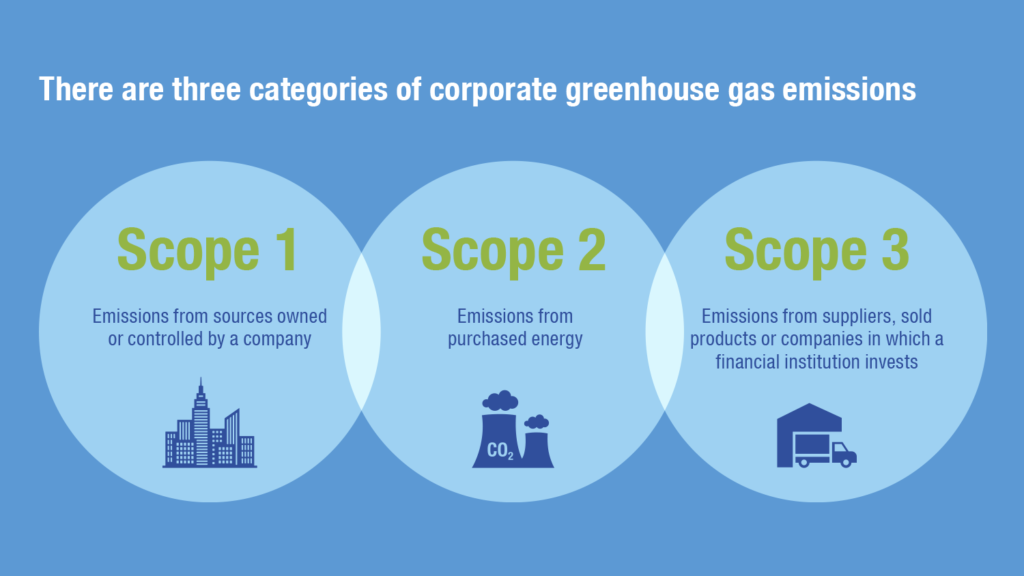

While many European companies have started measuring and managing their Scope 1 and 2 carbon emissions, most are still completely in the dark when it comes to Scope 3 – a company’s end-to-end supply chain emissions. New legislation is now requiring disclosure of these emissions also. Most supply chains still begin and end in China, regardless of where a company is located. As this article explains, China’s push to digitalise carbon disclosure means its supply chains may be the easiest to engage into decarbonisation programmes, and hence be an opportunity for European companies to achieve scope 3 decarbonisation.

Scope 3?

Indirect scope 3 emissions are on average 11 times higher than operational emissions, according to the Carbon Disclosure Project.[1]

Companies have little visibility over their Scope 3 emissions, due to low levels of data collection and digitalisation. According to the MSCI’s Net Zero Tracker 2022, only a quarter of companies currently make scope 3 emissions disclosures.[2] Demand for such data will increase, as investors need well-rounded emissions data to properly assess climate-related risks. Emissions quantification is the foundation for potential integration into the Chinese emission trading system (ETS).

Carbon disclosure in Europe

The Green Deal for Europe made clear the European Union’s (EU) objective of becoming climate neutral by 2050 and transitioning towards a circular economy. In April 2021, the European Commission adopted the Corporate Sustainability Reporting Directive (CSRD), which will cover all greenhouse gas (GHG) emissions of European companies and large EU-based subsidiaries of multinationals.[3]

Supply chain regulations in Europe

The European Commission proposal for a directive on corporate sustainability due diligence across global value chains aims to ensure all European companies comply with applicable human rights and environmental protection standards, including Scope 3 emissions. The law applies to European companies, as well as organisations from other regions operating in the EU, that have 500 employees and an annual turnover of euro (EUR) 150 million. High-risk industries such as leather, agriculture and mining have lower thresholds of 250 employees and EUR 40 million turnover. Once the text of the directive is finalised, EU Member States will have two years to integrate it into their respective national law. During that time, ‘first movers’ in the corporate sector can gain competitive advantages over their rivals.

Carbon disclosure in China via public digital platforms

In 2020, the People’s Bank of China issued trial guidelines for financial institutions’ environmental information disclosure. In 2021, the central government released an action plan to peak carbon emissions before 2030, [4] and China’s Securities Regulatory Commission (CSRC) revised the reporting standards of listed companies.

The Ministry of Ecology and Environment’s Measures for the Administration of Legal Disclosure of Enterprise Environmental Information took effect in February 2022 to standardise and mandate environmental reporting by companies with “a high environmental impact and that receive a high level of public attention”.[5] Major emitters with quotas will have to disclose information on quota settlement for the current and the previous year’s emission data, uploaded to public digital platforms set up by the local authorities.[6]

The new rules apply to five categories of companies: 1) key pollutant-discharging entities; 2) enterprises subject to mandatory clean production examination; 3) Shanghai and Shenzhen-listed companies and their subsidiaries; 4) bond issuing enterprises; and 5) entities that were subject to environmental penalties.

While this is a big step towards more transparency, the current standards do not cover scope 3 emissions. The main challenges for boosting emissions reporting lie in data availability and quality, and disclosure standards – challenges the Chinese Government is taking steps to address. In June 2022, a new set of voluntary guidelines called for reporting of ESG-related metrics published in the Guidance for Enterprise ESG Disclosure, the country’s first disclosure standards. These seek to fill gaps in corporate reporting through guidelines, including a comprehensive indicator system of 118 metrics. [7] The standards are intended for self and third-party evaluation, and cover enterprises of different types, industries and sizes. However, no metric for Scope 3 GHG emissions disclosure has been included. Investors hope such a framework will incorporate scope 3 emissions and eventually become mandatory.

Chinese companies have been making ESG disclosures over the past decade with continuous improvements, which indicates the market is ready for stricter requirements. Furthermore, Chinese business leaders are increasingly conscious that broad and sophisticated ESG reporting is a key element in transitioning to a low-carbon business model.

Supply chain transparency in China

The Institute of Public and Environmental Affairs (IPE), a non-profit environmental research organisation, designed a Corporate Climate Action Transparency Index (CATI) in 2021, upgraded in 2022, to assess both manufacturers that outsource production to suppliers and manufacturers that consume a lot of energy during production. The CATI uses five dimensions: 1) corporate climate policies and mechanisms; 2) GHG measurement and disclosure; 3) carbon target settings; 4) carbon emissions reduction performance tracking; and 5) climate actions in owned operations and supply chains.

The CATI is distinguished by its ability to motivate entities to push their affiliates and suppliers to measure and disclose carbon data at the facilities level. In the first six months of 2022, nearly 30 brands have encouraged more than 1,050 facilities in China to publicly disclose their carbon data. These facilities primarily deal with textile and apparel, and information technology (IT), with a growing carbon-intensive industry presence, such as chemical, fibre, and iron and steel.

An online digital platform for measurement, reporting and verification (MRV) is enabling more cost-effective GHG management, and encouraging certification of operations and supply chain decarbonisation. Meanwhile, advanced technology is facilitating collaboration for better MRV efficiency and accuracy.

In 2021, carbon trading started on China’s national ETS, covering the power generation sector and with plans to expand to sectors like cement and non-ferrous metals. The overarching regulation for the ETS, and rules for registry, trading and clearing of allowance put in place the building blocks for trading in carbon allowances between large emitters. There is also potential to create a broader and deeper emissions disclosure system, as companies realise the financial value in participation and decarbonisation.

Europe’s experience with building collaborative ecosystems

Companies are joining forces to tackle regulatory and sustainability issues collaboratively in various consortia, networks and associations, such as the International Material Data System (IMDS). This data-reporting tool was initially designed for the EU’s 2000 End of Life Vehicles Directive on the safe dismantling and recycling of vehicles. The IMDS today is not only the leading automotive industry data collection/management tool, but also became recognised by many other industries and used by over 100,000 suppliers worldwide.

Getting to a carbon ecosystem

The World Business Council for Sustainable Development’s Pathfinder Initiative, launched in March 2021—also labelled ‘Partnership for Carbon Transparency’ or PACT—brings together stakeholders from across value chains and industries, industry-focussed initiatives, standard-setting organisations, leading technology companies and regulators to accelerate decarbonisation by standardising carbon emissions data exchange. PACT creates interoperability to ensure all organisations and value chains can connect and access primary emissions data associated with their products.

An ecosystem for decarbonising Chinese supply chains

Scope 3 regulations are paving the road to decarbonisation of global supply chains. Carbon technology and solution providers (carbon reducers) can facilitate carbon reduction by engaging companies to decarbonise their operations and supply chains. Carbon markets turn the challenges involved into opportunities, while fintech enable working together across regions and industries as an ecosystem, facilitated via digitised platforms such as in China.

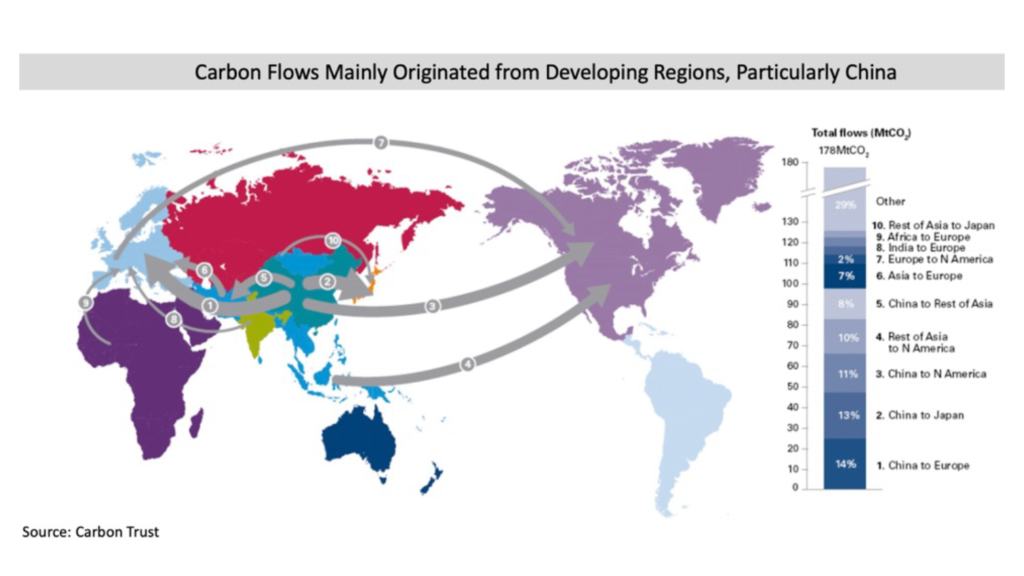

The map of global carbon flows shows the size of the opportunity.

Source:International Carbon Flows-Global Flows, The Carbon Trust, May 2011.

Companies should bear initiatives like the EU’s CBAM in mind which will impact the competitiveness of Chinese products. “We all should also bear in mind the term ‘coopetition’—a portmanteau of cooperation and competition—we need to ensure the planet survives so we all have the chance to compete in whatever way we want.”[8]

Carbon emissions could well become the first common denominator for collaboration across regions and industries.

In summary

How can companies achieve scope 3 decarbonisation of China supply chains?

- Access your suppliers via China’s public digital platform

- Run scope 3 decarbonisation programmes

- Share value from decarbonisation

How can organisations facilitate this collaborative ecosystem to grow naturally?

- Align standards

- Enable trading via collaborative market mechanisms

- Leverage China’s public digital platforms

The authors of this article will release a White Paper which explains in more detail:

- how to get ‘coopetitive’ supply-chain-wide exchange of sustainability-related data?

- how to determine the business value of decarbonising?

- how to reduce cost, time, and effort to decarbonize product and supply chain?

The White Paper will be accessible on the LinkedIn company page of Decarbsupplychains.

Authors

Johnny Browaeys, vice chair of the European Chamber’s

Carbon Working Group; Rob Gierke, CEO of Purenessity; Soraya Kadra,

Renewable Energy Innovative Solutions at Seeder Clean Energy; Gunther Walden,

CEO of Circular Tree; and Joerg Walden, Board Member at INATBA.

[1] Hollinger, P (2021) COP26: Why companies must broaden the emissions fight through supply chains. Financial Times. <https://www.ft.com/content/116af7f0-944f-4096-81b3-87717f3e4a99>

[2] The MSCI Net-Zero Tracker, MSCI, March 2021, viewed 2nd August 2022, <https://www.msci.com/documents/1296102/26195050/MSCI-Net-Zero-Tracker-Mar2022.pdf>

[3] Latham & Watkins (2022) What the CSRD Could Mean for Companies in the EU. Laham & Watkins Environmental, Social & Governance Practice. <https://www.lw.com/thoughtLeadership/What-the-CSRD-Could-Mean-for-Companies-in-the-EU>

[4] Zhang, Z. (2022) What is ESG Reporting and Why is it Gaining Traction in China? China Briefing. <https://www.china-briefing.com/news/what-is-esg-reporting-and-why-is-it-gaining-traction-in-china/>

[5] Huld, A. (2022) China ESG Reporting – New Measures on Disclosure of Enterprise Environmental Information. China Briefing. <https://www.china-briefing.com/news/china-esg-reporting-disclosing-enterprise-environmental-information/>

[6] Ziying, S. (2022) How should businesses in China react to new environmental disclosure requirements? China Dialogue. <https://chinadialogue.net/en/business/how-should-businesses-in-china-react-to-new-environmental-disclosure-requirements/>

[7] Roberts, A.; Hutchinson, G.; Ding, A. (2022) China’s new ESG Disclosure Standards. Sustainablefutures. <https://sustainablefutures.linklaters.com/post/102hpkx/chinas-new-esg-disclosure-standards>

[8] Blockchain, Coopetition and Aligning Incentives in the Emerging Economy, Unshrugging Atlas, episode 2, SingularDTV, 21st June 2018, viewed 7th July 2022, <https://medium.com/singulardtv/blockchain-coopetition-and-aligning-incentives-in-the-emerging-economy-86c7ab25abe6>

Recent Comments