This photograph is reproduced with the permission of Rolls-Royce plc, copyright © Rolls-Royce plc 2012

Aerospace and aviation are both growing industries in China. European companies are long-term collaborators and have played a crucial role in helping China to reach its current capacity. With China’s plans to further open its airspace and the number of Chinese air passengers increasing the future is bright and European industry still has a key role to play.

The European Union (EU) is China’s largest trading partner in aeronautical products with an annual trade of around EUR 10 billion, but is facing increasingly strong competition from other foreign players. For example, the key role played by the United States (US) Government in promoting US aerospace companies through active dialogue with the Chinese Government has resulted in increasing penetration of US firms.

China is an integral part of European aerospace firms’ global strategies, the result of over 20 joint ventures (JVs) as well as extensive direct sourcing from Chinese companies. All major European aerospace companies are present in China providing more than 5,000 valuable jobs across their subsidiaries and JVs, working with the Chinese industry in areas such as design, engineering, development, manufacturing, maintenance and training.

It is noteworthy that out of China’s total air fleet roughly one in two aircraft is of European origin, and European engine manufacturers enjoy a leading position in the middle kingdom.

Rolls-Royce celebrate a milestone anniversary in 2013, 50 years after the first Vickers Viscount aircraft, powered by a Rolls-Royce engine, was delivered to China. Today they provide engines and parts to all the major airlines in Greater China. They are the leader in powering wide-body aircraft, and their Trent 700 engines power more than 90 per cent of China’s Airbus A330 fleet. Their Trent 900 engine powers the first A380 in Mainland China and Cathay Pacific has ordered 38 A350s which will be powered by the Rolls-Royce Trent XWB engines.

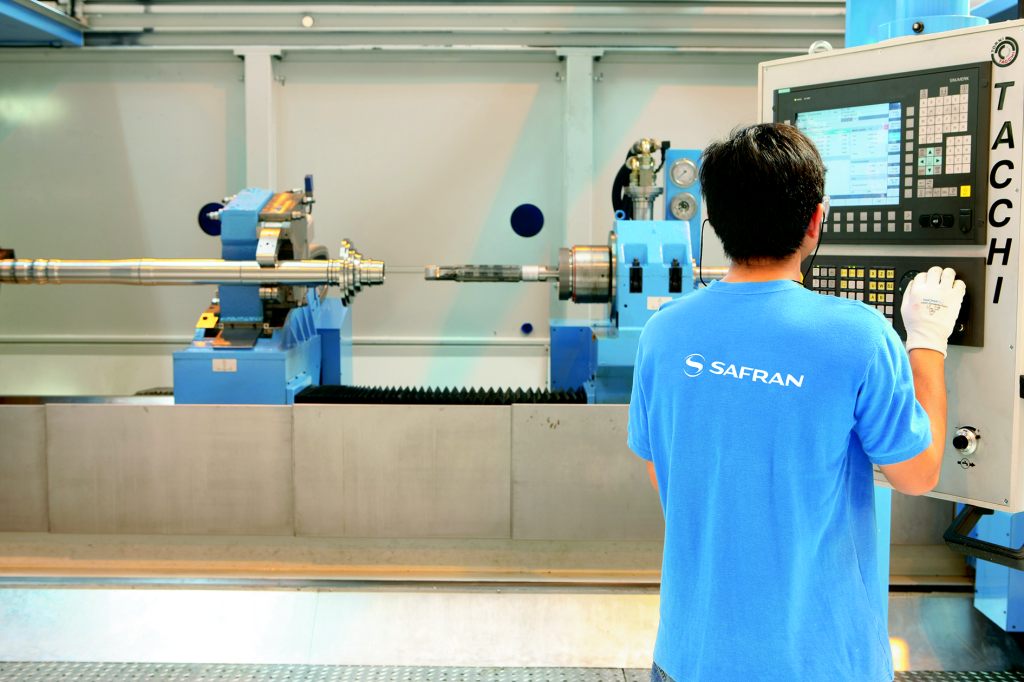

Also enjoying success in China’s aerospace industry is Safran. More the 3,000 of their CFM56 engines are in service or on order and all major Chinese airlines are operating equipment built by their group companies, including thrust reversers, landing gear and wiring.

Safran have two production sites in China – both in Suzhou – that manufacture parts for the aerospace industry. They also operate four JVs with China Aviation Industry Corporation (AVIC) and one with the Commercial Aircraft Corporation of China (COMAC).

These are just two of the major European success stories in this industry, but it is notable that European firms are also important clients of the Chinese industry, with a cumulative sourcing of close to EUR 1 billion annually, which is likely to increase significantly throughout the present decade.

Despite these industrial achievements there are still notes of caution, for example, in the area of air-traffic control (ATC) equipment. European ATC equipment manufacturers currently have a predominant position, and the Civil Aviation Administration of China (CAAC) has expressed interest in the EU SESAR (Single European Sky ATM (air traffic management) Research) programme. Lack of follow‐up, however, is leading the CAAC to consider the US NextGen as a feasible alternative, jeopardising the future position of European companies in the domain.

China’s civil aviation industry remains profitable and looks set to be one of the largest in the world for the next 20 years. It is expected to expand at an annual rate of 7.9 per cent. This will translate into 5,000 new commercial aircraft, over 2,000 helicopters and the need for 70,600 new pilots and 96,400 aircrew members.

The CAAC has stated that the nation’s aviation industry reported a full year profit of CNY 29.6 billion in 2012. It is, however, notably less than the profit made in 2010 (CNY 43.7 billion). In 2012 the number of passengers reached 319 million people[1], a nine per cent increase from 2011, which reflects the booming local economy and increased propensity to travel as domestic consumption expands and government-led investments in the aviation industry increases.

According to the CAAC, it is predicted that air passenger numbers will increase 9.4 per cent year-on-year to 350 million passengers in 2013[2] and cargo volume will increase 4.3 per cent to 5.7 million tons in 2013[3]. Chinese carriers are expected to handle 450 million passengers per annum by 2015[4] and 1.5 billion by 2030[5].

This photograph is reproduced with the permission of Rolls-Royce plc, copyright © Rolls-Royce plc 2012.

Today there are over 180 commercial airports in China and under the 12th Five-Year Plan 82 new commercial airports will open over the next five years.

Despite this growth, domestic and foreign players in China’s aviation industry — including airlines, OEMS, and suppliers of repair services — face operational constraints such as a lack of qualified pilots and technicians.

The development of foreign players is further hampered by restrictive legislation which is difficult to navigate in a regulatory landscape that is often vague and sometimes opaque.

Also, although the concern of emissions trading schemes (ETS) hampering bilateral exchanges has sometimes been overstated it is still an area that requires constant attention. A clear resolution to this issue is needed.

What these issues highlight is a need to deepen the dialogue between Chinese and European authorities and industry leaders in aerospace- and aviation-related fields that accurately reflects the level of trade between both sides. A feasible way of building trust and mutual understanding, and opening up the channels for meaningful dialogue is through non-industrial cooperation, an area in which the EU has already made great progress.

More than 10,000 Chinese professionals have been trained by European firms through funding Chinese Universities and through direct training programmes provided to the CAAC and other institutions. The EU has also been an active contributor through its EU‐China Civil Aviation Program (EUCCAP).

In 2005 the European Commission and the CAAC successfully held the EU‐China Aviation Summit, which gathered more than 250 representatives from both sides. If replicated it could provide the impetus needed to push forward and deal with outstanding issues, leading to further, mutually beneficial cooperation between China and the EU in aerospace and aviation.

[1] China Civil Aviation Development and planning department, 2012 Civil Aviation Industry Development Statistics Bulletin, viewed 24th May, 2013. http://sqgk.caac.gov.cn/pub/root24/000014170/201305/P020130520565539829713.pdf

[2] National Civil Aviation Conference and aviation security conference held in Beijing, 21st December, 2012, viewed 3rd April, 2013.

[3] National Civil Aviation Conference and aviation security conference held in Beijing, 21st December, 2012, viewed 3rd April, 2013.

[4] China Civil Aviation Development 12th Five-Year Plan (2011-2015), May 2011, viewed 28th May, 2013. http://www.caac.gov.cn/I1/I2/201105/t20110509_39615.html

[5] China’s civil aviation passenger traffic will reach 700 million passengers in 2020, Xinhua, 13th January, 2010, viewed 28th May, 2013. http://news.xinhuanet.com/fortune/2010-01/13/content_12804554.htm

Recent Comments