What impact will it have on European industry?

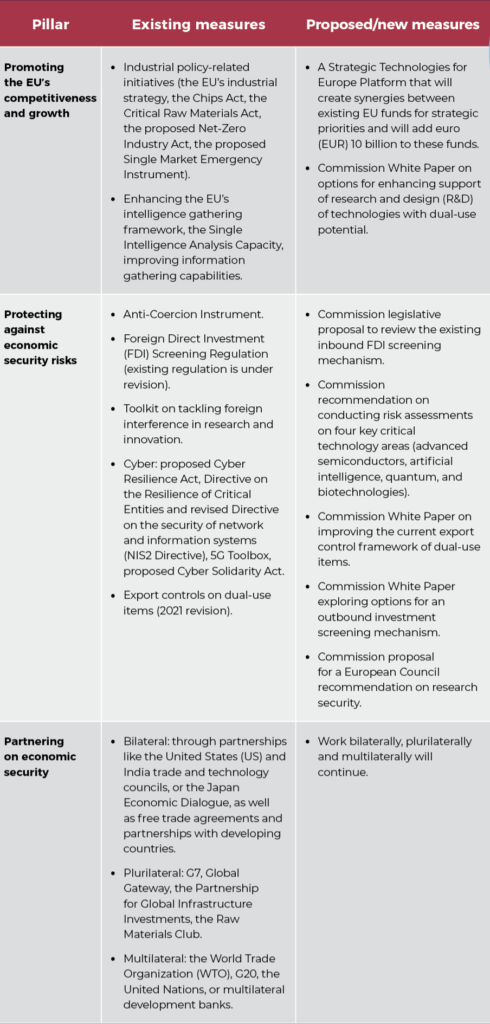

On 20th June 2023, the European Commission and the European External Action Service published a Communication on the European Economic Security Strategy (EESS).[1] This was followed by further announcements, most notably an October 2023 recommendation to carry out risk assessments on four critical areas, and a package announced on 24th January 2024 with five concrete initiatives under the EESS.[2]&[3] In this article, the European Chamber’s head of European government affairs, Ester Cañada Amela looks at the measures being taken and what impact they may have on European business.

The need for European Union (EU) policymakers to outline a clear approach towards economic security has become more apparent during the last few years as geopolitical developments and ‘black swan’ events, from COVID-19 to Russia’s invasion of Ukraine, revealed the security risks associated with certain economic flows. A document issued by the European Commission (EC) in June 2024 on the European Economic Security Strategy (EESS) identified four main risks:

- risks to the resilience of supply chains;

- risks to physical and cyber-security infrastructure;

- risks related to technology security and technology leakage; and

- risks linked to the weaponisation of economic dependencies or economic coercion.

What are the principles of the EESS?

The EESS framework is based on two main principles: proportionality (in terms of actions/responses taken) and precision (in terms of sectors/products targeted). The EESS is also not targeted at any particular country.

How are economic security risks addressed under the EESS?

Key takeaways

The proposals for an economic security strategy demonstrate the paradigm shift taking place in the EU’s thinking on how it views trade and investment relations, as well as what it considers to be both a security and strategic risk. This is an acknowledgement of both the changing global economic and geopolitical dynamics and the direction that the EU has been taking as a result, and it presents a framework on how to approach economic relations with third countries from a security viewpoint.

Similar to other defensive tools and mechanisms previously rolled out by the EU, the EESS and the new proposals under this framework are explicitly country-agnostic, a point that has been reiterated repeatedly by EU leaders like EC President Ursula von der Leyen. At the same time, China has been mentioned by name several times in press conferences (including in acknowledgements that this whole initiative was mentioned during a speech by von der Leyen on China on 30th March 2023).[4]

Both existing instruments and the various proposals under the strategy are likely to have an impact on the China operations and investment considerations of European businesses in the sectors affected by these regulations. Throughout the second half of 2023 and in the first months of 2024, EU leaders have clearly signalled their willingness to put the extensive toolbox that they have been developing to use in instances of distortions originating from China. For example, the EC has already launched an anti-subsidy investigation into electric cars from China and, under the Foreign Subsidies Regulation (FSR), three investigations have so far been announced on tenders submitted by Chinese companies in rail and solar.[5]&[6]&[7]&[8] It is expected that further investigations will be launched throughout 2024.

At the same time, there are a number of challenges to the ability of EU stakeholders to push forward on new measures. This is because a number of aspects of this strategy fall under member state purview in terms of competencies, due to the potential for unintended impacts resulting from the development and deployment of these tools. This is reflected in the cautious approach to the proposals themselves: three out of the five take the shape of white papers rather than legislative proposals and have extensive timelines for information gathering, reviews and assessments. This cautious approach is generally supported by leading European industry associations such as BUSINESSEUROPE and the Federation of German Industries, which have warned of unintended negative effects on general European competitiveness.[9]&[10] Industry players in particularly threatened sectors, such as wind and solar, have been calling for more support through industrial policy for European manufacturers and protective measures to address distortions in the Internal Market, as well as for a measured approach to the deployment of trade defence tools.[11]&[12]&[13]

From the Chinese side, the China Chamber of Commerce to the EU has shared its concerns over the five measures announced in January 2024, as well as on the electric vehicles and FSR probes.[14]&[15]&[16]&[17] Chinese Government spokespeople have expressed similar views on these investigations, with the Ministry of Commerce (MOFCOM) alleging potential non-compliance with WTO rules.[18] In the meantime, the MOFCOM has launched an anti-dumping probe on imported brandy from the EU.[19]

Next steps

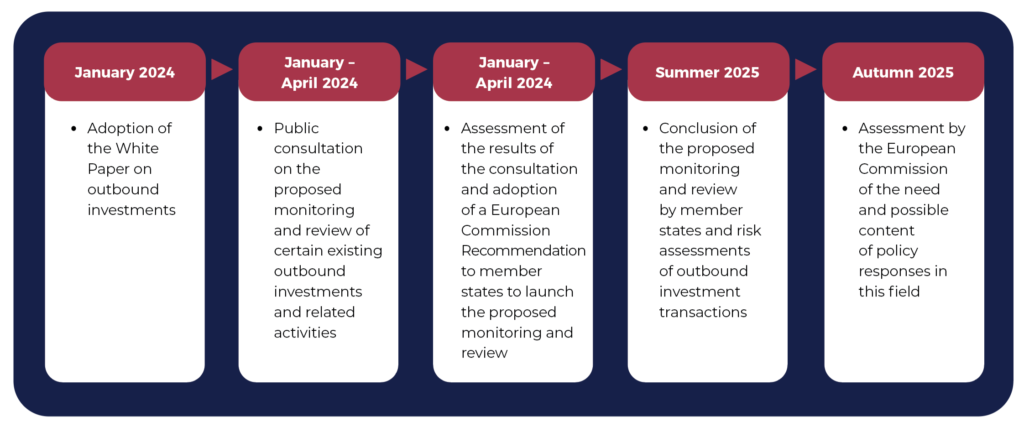

In terms of the five new EC initiatives announced in January 2024, the timelines are as follows:

- Proposal to review the existing inbound FDI screening mechanism: the Council of the EU and European Parliament will each begin work to develop a negotiating position on the proposal, after which inter-institutional negotiations commence.

- White paper on outbound investment screening: the deadline for the public targeted consultation is 17th April 2024.[20]

- White paperon export controls: an EC recommendation on a coordination mechanism among member states on new National Control Lists will be issued before the end of the current term in June. An early evaluation of the Dual Use Regulation based on the outcomes of a forthcoming in-depth study, together with the results of the evaluation of the list of critical technologies announced by the EC in October 2023, will be finalised in the first quarter of 2025.

- White paper on options for enhancing support of R&D of technologies with dual-use potential: a public consultation will be open until 30th April 2024.[21]

- Proposal for a Council Recommendation on enhancing research security: the Council of the EU will assess the proposal.

Given the potential impact on industry of both these new measures and of further EU actions under the umbrella of the existing defensive toolbox, it will be important for European industry to continue to monitor further developments and to provide feedback to EU policymakers.

Author’s note:

Ester Cañada Amela manages the European Chamber’s overall

engagement with European institutional stakeholders and monitors relevant

policy developments in the EU. She is also in charge of the Advocacy Platform

at the EU SME Centre, an EU-funded project implemented by the European Chamber

and three other partners, as well as the Chamber’s Standards and Conformity

Assessment Working Group.

[1] European Economic Security Strategy, European Commission, 20th June 2023, viewed 21st March 2024, <https://ec.europa.eu/commission/presscorner/api/files/attachment/875428/Factsheet%20Economic%20Security%20Strategy_EN.pdf>

[2] Commission recommends carrying out risk assessments on four critical technology areas: advanced semiconductors, artificial intelligence, quantum, biotechnologies, European Commission, 3rd October 2023, viewed 21st March 2024, <https://ec.europa.eu/commission/presscorner/api/files/document/print/en/ip_23_4735/IP_23_4735_EN.pdf>

[3] Commission proposes new initiatives to strengthen economic security, European Commission, 24th January 2024, viewed 21st March 2024, <https://ec.europa.eu/commission/presscorner/api/files/document/print/en/ip_24_363/IP_24_363_EN.pdf>

[4] Speech by President von der Leyen on EU-China relations to the Mercator Institute for China Studies and the European Policy Centre, Delegation of the European Union to Japan, 30th March 2023, viewed 21st March 2024, <https://www.eeas.europa.eu/delegations/japan/speech-president-von-der-leyen-eu-china-relations-mercator-institute-china-studies-and-european_en?s=169>

[5] Commission launches investigation on subsidised electric cars from China, European Commission, 4th October 2023, viewed 21st March 2024, <https://ec.europa.eu/newsroom/trade/redirection/document/99093>

[6] Commission opens first in-depth investigation under the Foreign Subsidies Regulation, European Commission, 16th February 2024, viewed 21st March 2024, <https://ec.europa.eu/commission/presscorner/api/files/document/print/en/ip_24_887/IP_24_887_EN.pdf>

[7] Commission opens two in-depth investigations under the Foreign Subsidies Regulation in the solar photovoltaic sector, European Commission, 3rd April 2024, viewed 5th April 2024 <https://ec.europa.eu/commission/presscorner/detail/en/ip_24_1803>

[8] At the time of writing, China Railway Rolling Stock Corporation, the Chinese company involved in the first investigation under the FSR, had already withdrawn its bid.

[9] Economic security – Business welcomes clarity and further debate, BUSINESSEUROPE, 24th January 2024, viewed 21st March 2024, <https://www.businesseurope.eu/publications/economic-security-business-welcomes-clarity-and-further-debate>

[10] European Security Strategy, BDI, 10th November 2023, viewed 21st March 2024, <https://english.bdi.eu/publication/news?tx_news_pi1%5Bnews%5D=10331&cHash=212f71dbd91a2a15a906364d989e3fb6>

[11] Bermingham, F, Siemens boss demands EU action to fend off ‘cheap’ Chinese wind power imports, SCMP, 21st February 2024, viewed 21st March 2024, <https://www.scmp.com/news/china/diplomacy/article/3252627/siemens-boss-demands-eu-action-fend-cheap-chinese-wind-power-imports>

[12] EU Commission remarks on solar manufacturing crisis, SolarPower Europe, 5th February 2024, viewed 21st March 2024, <https://www.solarpowereurope.org/press-releases/statement-eu-commission-remarks-on-solar-manufacturing>

[13] Press Release: Race against time: safeguarding the European solar industry is still possible, European Solar Manufacturing Council, 2nd February 2024, viewed 5th April 2024, <https://esmc.solar/press-release-race-against-time-safeguarding-the-european-solar-industry-is-still-possible/>

[14] CCCEU Statement of EC unveiling “European Economic Security Package”, China Chamber of Commerce to the EU, 24th January 2024, viewed 21st March 2024, <http://en.ccceu.eu/2024-01/24/c_4020.htm>

[15] CCCEU Statement on the EU’s Anti-Subsidy Probe into Chinese EVs, China Chamber of Commerce to the EU, 4th October 2023, viewed 21st March 2024, <http://en.ccceu.eu/2023-10/04/c_3481.htm>

[16] CCCEU Statement on the European Commission’s First In-depth Investigation under the Foreign Subsidies Regulation Targeting CRRC Qingdao Sifang Locomotive, China Chamber of Commerce to the EU, 16th February 2024, viewed 21st March 2024, <http://en.ccceu.eu/2024-02/16/c_4058.htm>

[17] CCCEU Statement on EC opens two in-depth investigations into Chinese companies under FSR in solar photovoltaic sector, China Chamber of Commerce to the EU, 4th April 2024, viewed 5th April 2024, <http://en.ccceu.eu/2024-04/04/c_4138.htm>

[18] China expresses strong dissatisfaction with EU probe into Chinese EVs, vows to protect interests of Chinese companies, Global Times, 4th October 2023, viewed 21st March 2024, <https://www.globaltimes.cn/page/202310/1299228.shtml>

[19] China launches anti-dumping probe into EU brandy, Xinhua, 5th January 2024, viewed 21st March 2024, <https://english.news.cn/20240105/42a3126849d544b59bee7afb12e6a7de/c.html >

[20] Feedback can be submitted at: <https://ec.europa.eu/eusurvey/runner/TC_Monitoring_Outbound_Investments_in_Technology>

[21] Feedback can be submitted at: <https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/14060-RD-on-dual-use-technologies-options-for-support_en>

Recent Comments