Majority expect national carbon market to include all key emitting sectors by 2025

The United Nations (UN) entity responsible for supporting the global response to climate change states that “Carbon pricing curbs greenhouse gas emissions by placing a fee on emitting and/or offering an incentive for emitting less”, which helps to make “economic development compatible with climate protection”. The price levels in a particular carbon market can determine the scheme’s ability to deter enterprises and society from continuing to choose less expensive but more polluting options. In this article, Huw Slater of ClientEarth looks at the latest China Carbon Pricing Survey to assess how China’s national carbon emission market is developing.

The China Carbon Pricing Survey provides the most in-depth and extensive summary of stakeholder views on China’s carbon market development. It has been conducted regularly since 2013, the year that China began rolling out a series of pilot carbon markets at the regional level.

The survey provides valuable insights into the challenges and opportunities faced by China’s significant emitters. The most recent report was conducted in November 2021 and launched in February 2022. It elicited expectations about the future of China’s carbon price from a wide range of representatives from China’s carbon-intensive industries that are already subject to or are soon expected to be subject to carbon pricing. This in particular includes the power generation sector, which was the first to be covered by China’s national emissions trading system (ETS) since it was launched in July 2021.

The survey received 417 responses from stakeholders in a range of sectors. Of the respondents, just over three-quarters (76 per cent) identified as being from carbon-emitting enterprises, including 49 per cent from companies already covered by either a regional carbon market or the national one.

Of the emitting enterprises, the highest representation is from the power generation sector (33 per cent of all respondents), followed by the building materials, including cement (20 per cent), steel (seven per cent), chemicals (six per cent) and non-ferrous metals (five per cent) sectors. A tenth of respondents are from companies providing carbon market-related services, including consultancy, verification, offset development and trading, while three per cent came from research institutes. Other responses came from academia, the financial industry and local government.

Key findings

Among the key findings of the survey, power sector respondents were asked about their company’s situation during the first compliance phase of the national carbon market regarding allowance allocation. Almost half suggested that they would have allowances surplus to their compliance needs (up from 25 per cent a year prior).

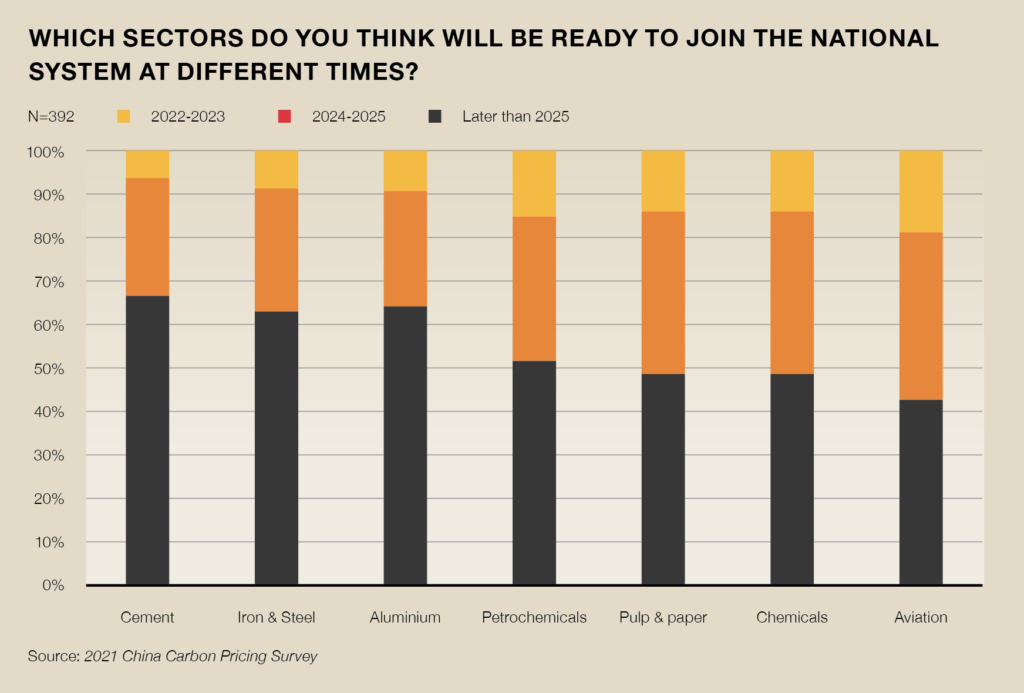

After power generation, the cement, iron and steel, and aluminium sectors stand out in terms of perceived carbon market readiness, with over a third of respondents optimistic that they will be ready to join the national ETS by as early as 2022, and the weighted average of expectations being that those three sectors will have joined by 2023. The other key four emitting sectors are expected, on average, to join by 2024.

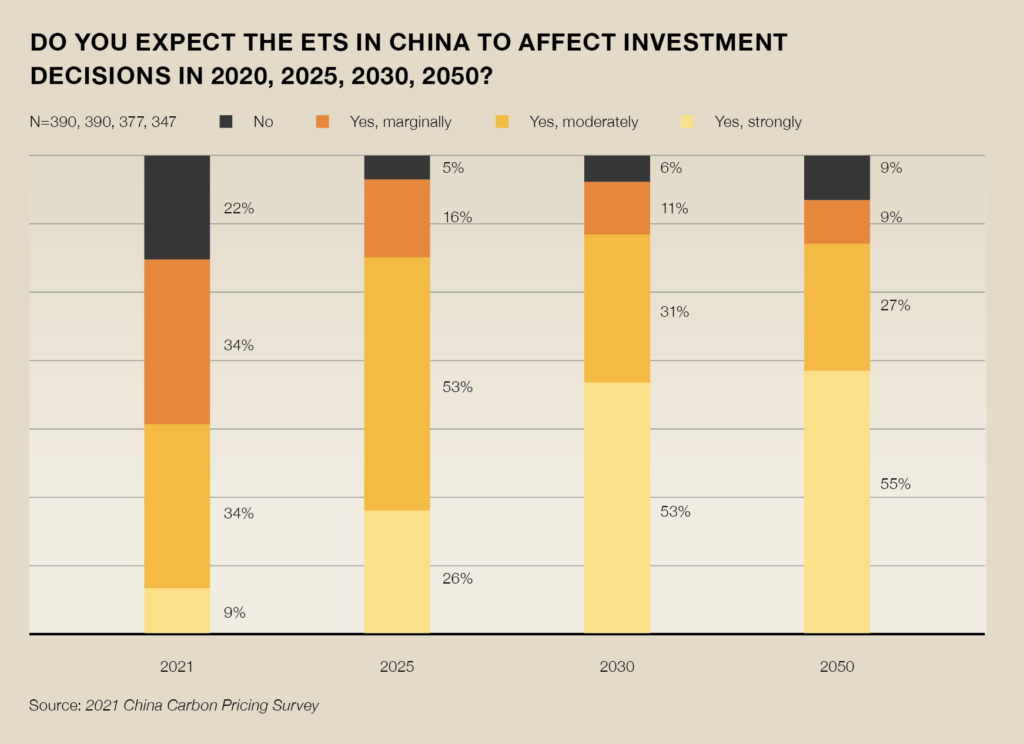

Respondents expect the effect of carbon pricing on investment decisions to greatly increase between the time of the survey and 2030. About four out of every five respondents to the question, “Do you expect the ETS in China to affect investment decisions in 2025”, expect investment decisions to be at least moderately affected. Only five per cent of respondents who answered this question expect investment decisions to remain unaffected by 2025.

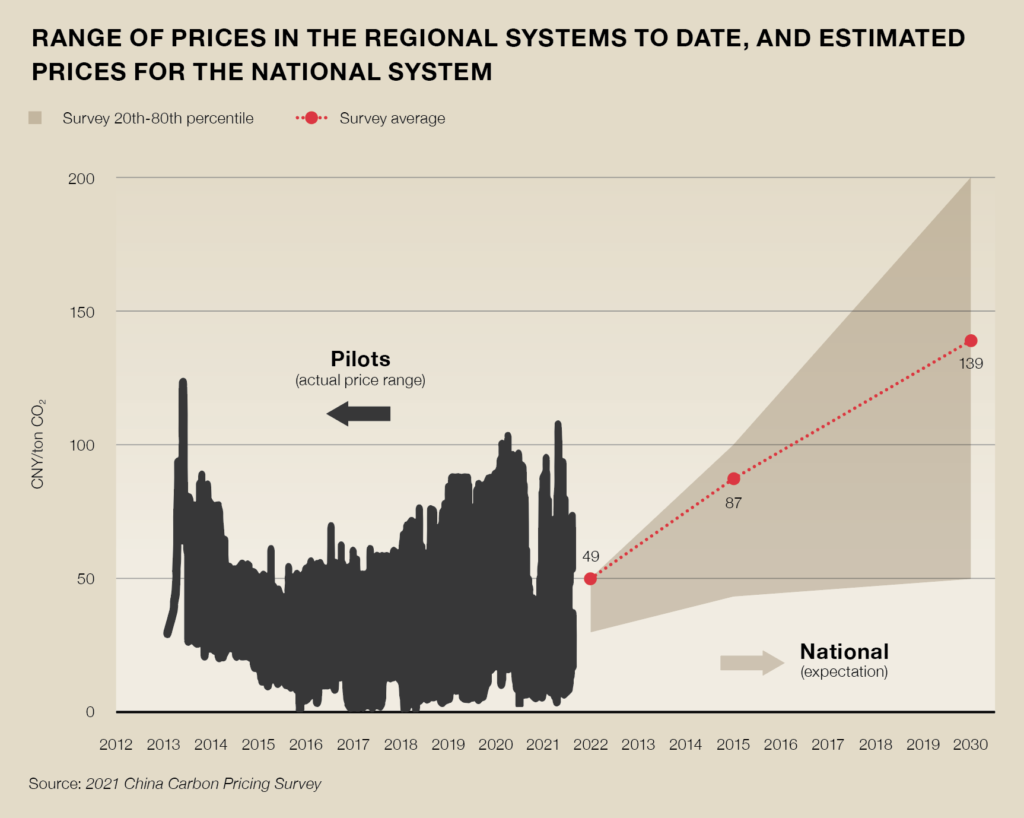

The survey results indicate an expectation of steadily rising prices, but with significant variance over the levels. The average price expectation in the national market is again expected to be Chinese yuan (CNY) 49 per tonne of emissions (/t) in 2022, rising to CNY 87/t in 2025 and CNY 139/t by the end of the coming decade.

Approximately 85 per cent of respondents to the 2021 survey expect China to achieve its carbon emissions peak before, or no later than, the stated 2030 goal. Only 15 per cent expect China’s emissions to peak by 2025 or earlier. This is a significant drop on the 36 per cent that indicated this expectation in the previous survey.

The outlook

The China Carbon Pricing Survey comes at a time of global interest in China’s actions on climate change, given the start of trading in China’s national ETS in 2021, which followed President Xi Jinping’s 2020 commitment that China will strive to achieve peak carbon dioxide emissions before 2030 and carbon neutrality by 2060.

In addition, at the 2021 United Nations General Assembly, President Xi announced that China would stop building new coal power plants abroad. Then, a couple of months later at the 26th Conference of Parties (COP26) in Glasgow in November 2021, China and the United States released a Joint Glasgow Declaration on Enhancing Climate Action in the 2020s. While China was generally seen as playing a constructive role at COP26, increasing attention being paid to China’s domestic efforts to reduce reliance on coal. Most analysis of long-term pathways see carbon pricing playing a key role in these efforts.

There are high expectations among stakeholders for China’s carbon market due to the central government demonstrating its strong commitment to controlling carbon emissions. All key sectors are expected to be covered by 2025. In addition, as carbon prices have risen rapidly in the European Union’s ETS—the most established ETS globally—the survey shows similar price increases are expected in China too.

Mr Qian Guoqiang, deputy general manager of the environmental think tank SinoCarbon, has expressed his confidence in China’s national ETS: “I am thrilled that the national carbon market has started trading in 2021. This is a positive signal. The construction of the national carbon market is a process of learning by doing and gradually improving. Under the guidance of China’s carbon neutrality goal, this process will be accelerated. I believe that China will definitely build one of the most active and influential carbon markets in the world.”

The survey results make clear that, as the climate transition gathers momentum in China and around the world, European companies should factor in a significant price on carbon when making investment decisions.

Huw Slater is an energy and climate policy specialist at ClientEarth in Beijing. He is also the former chair of the European Chamber’s Carbon Market Working Group.

The Carbon Market Sub-working Group is comprised of 60 member companies representing all aspects of the carbon market, including project developers, carbon funds, investors, lawyers, auditors and consultants as well as financial institutions and companies under compliance obligations. Sub-working group activities include networking events and advocacy meetings with Chinese and European officials. For more information, please contact Susana Xu (sxu@europeanchamber.com.cn).

Recent Comments