In China, ‘fapiaos’ or invoices are the most important document for tax reporting. They are considered the ‘gold standard’ for a business’ taxable income. However, Axel Standard argues that this system does not always provide the most accurate picture of a firm’s revenues.

In China, ‘fapiaos’ or invoices are the most important document for tax reporting. They are considered the ‘gold standard’ for a business’ taxable income. However, Axel Standard argues that this system does not always provide the most accurate picture of a firm’s revenues.

Many outsourced accountants choose to perform accounting on the basis of fapiaos because it is the simplest way to meet tax compliance requirements in China. It also enables them to perform bookkeeping and tax filing services for as low as Chinese yuan (CNY) 500 per month. This method of accounting does not require the accountant to have an in-depth understanding of how the business operates, since everything they need for bookkeeping is on the fapiao.

Fapiao accounting refers to recognising revenue and costs solely based on available fapiaos. Accountants using this method do not conduct bookkeeping until they issue output fapiaos or receive input fapiaos – and from there they generate the required financial statements and calculate tax liability for the business.

However, this simple method of accounting significantly limits an accountant’s ability to work inside a business and prevent some of the common financial mistakes made by managers. These mistakes often result in the business paying tax early—hurting cash flow—or in many cases incorrectly calculating tax liability. This can result in either overpaying or incurring penalties for underpaying taxes. Most costly to businesses, however, is not having data which can portray a business’ actual financial state.

Fapiao accounting produces incorrect financial reports

When an accountant performs bookkeeping on the basis of fapiaos, the figures on the financial reports are often distorted for a certain period. Financial reports show when fapiaos were issued and not when the goods or services were delivered, or their associated costs. There is also a further delay in recognising costs and expenses, which accountants do not record until they receive input fapiaos from suppliers.

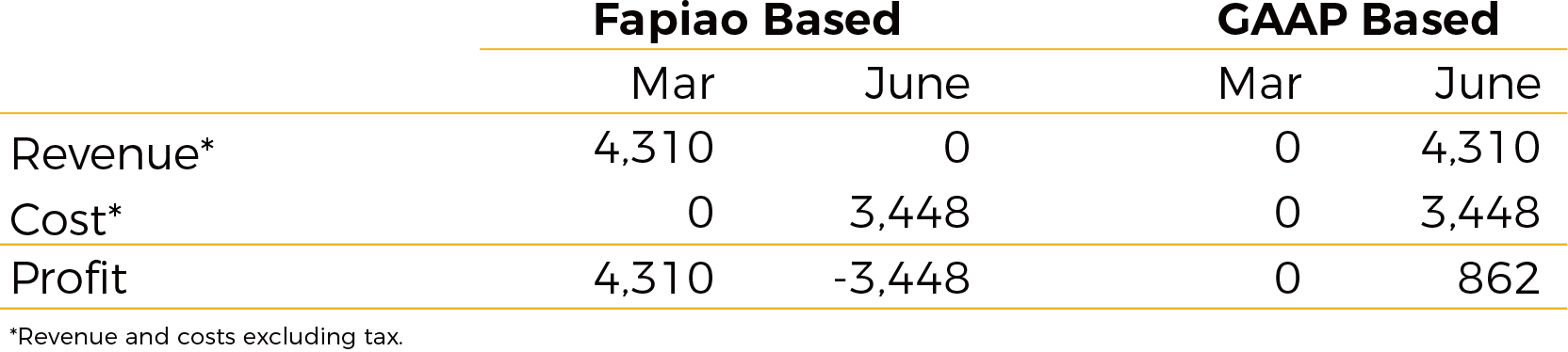

Example 1

When input fapiaos are delayed, financial reports do not accurately reflect the profitability of a company for a given period.

For example, a trading company receives CNY 5,000 payment in March and issues a VAT fapiao immediately. Products are delivered to customers three months later in June, and a CNY 4,000 special input VAT fapiao is received the same month from the supplier. The financial report shows overstated profits in March, followed by losses in June due to a sharp increase in costs being recorded that month.

March profits are overstated by CNY 4,310 because revenue is wrongly recognised based on the fapiao being issued. The true profitability across different periods becomes difficult to judge. Only when accounting is performed based on Chinese generally accepted accounting principles (PRC GAAP) are true profits presented on a company’s profit and loss (P&L) sheets.

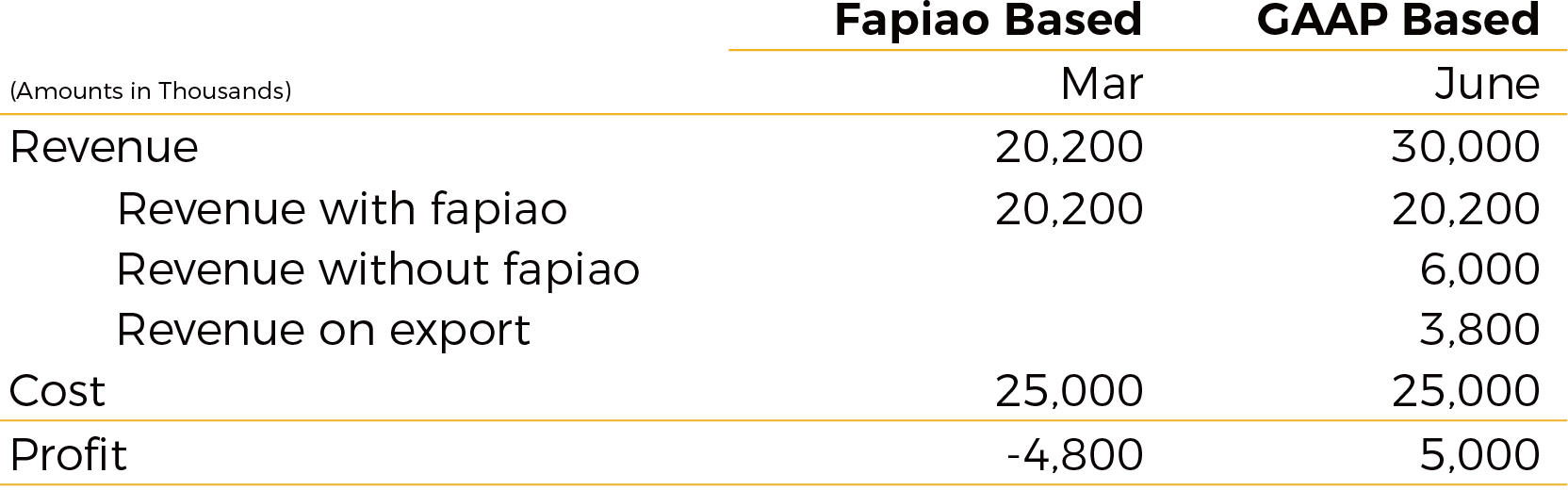

Example 2

In many cases, bookkeeping based on available fapiaos leads to transactions being left out of financial reports.

For example, a business received CNY 30,000 in sales in 2017, of which CNY 26,200 were domestic sales and CNY 3,800 exports. Domestic sales revenue consisted of CNY 20,200 with fapiaos issued and CNY 6,000 transacted without. The cost of the goods sold was CNY 25,000. An accountant who only reports revenue based on available fapiaos will underreport income from revenue without fapiao and exports. In Figure 2, that would equal CNY 9,800 and indicate a loss of CNY 4,800 on the P&L.

There are many reasons a business might not issue a fapiao. The customer might not need a fapiao or, if the sale was for export, a fapiao is not required. However, in order for the balance sheet to accurately reflect a business’ bank balance, the accountant will book the revenue for which a fapiao was never issued under deposits, pre-payments or other business liabilities on the balance sheet indefinitely.

Early tax payment

If the profits of one financial quarter are offset by losses in another during a financial year, the company must claim back the corporate income tax (CIT) prepaid quarterly the following year. This process can be time-consuming and requires the business to provide proof that it did lose money over the financial year. In many cases, the tax authorities will conduct a full-scope tax audit before refunding quarterly prepaid tax.

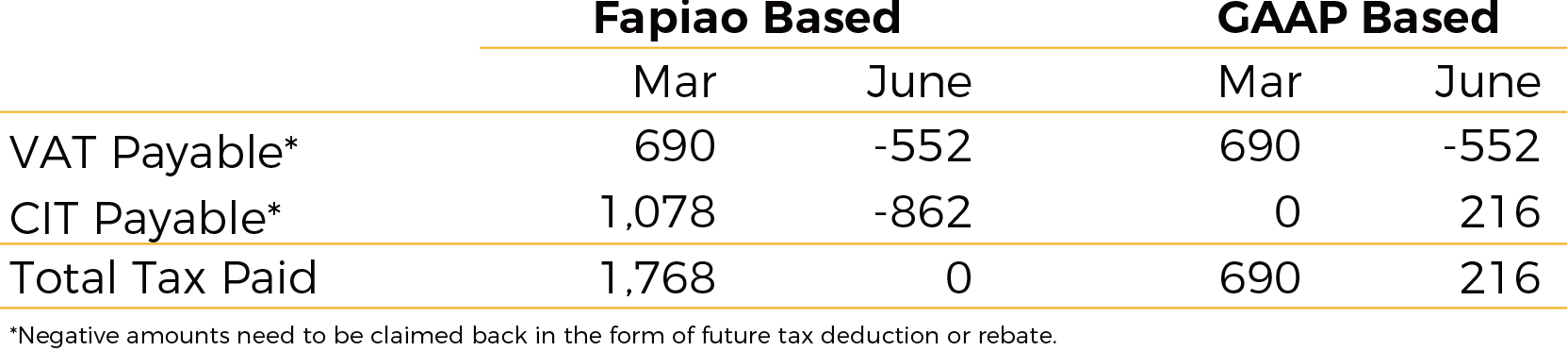

Example 1.1

In Example 1, when the business issued CNY 5,000 fapiao for a sale without a corresponding input fapiao, its total tax liability in March equals CNY 1,768. When the costs are booked in June, the true tax liability becomes CNY 354. The CNY 1,414 difference must be claimed back by the business in the form of future tax deductions or refunds.

For VAT:

Output VAT is always recognised upon issuing a fapiao. Even when accounting on the basis of PRC GAAP, output VAT must be paid regardless of whether the input VAT fapiao has been received. Overpaid VAT can be deducted from future payments.

For corporate income tax:

The company has to pay CNY 1,078 of CIT for Q1 2017, while its true CIT liability is only CNY 216 in Q2 2017 if bookkeeping and fapiao issuance are done according to PRC GAAP.

If the business reports a tax loss for 2017, the business would need to apply for a CIT refund in 2018 for the amount it overpaid in Q1 2017. This often requires the tax authorities to conduct a full scope tax audit to prove the business did indeed incur losses before they can refund CIT.

Underreporting tax Liability

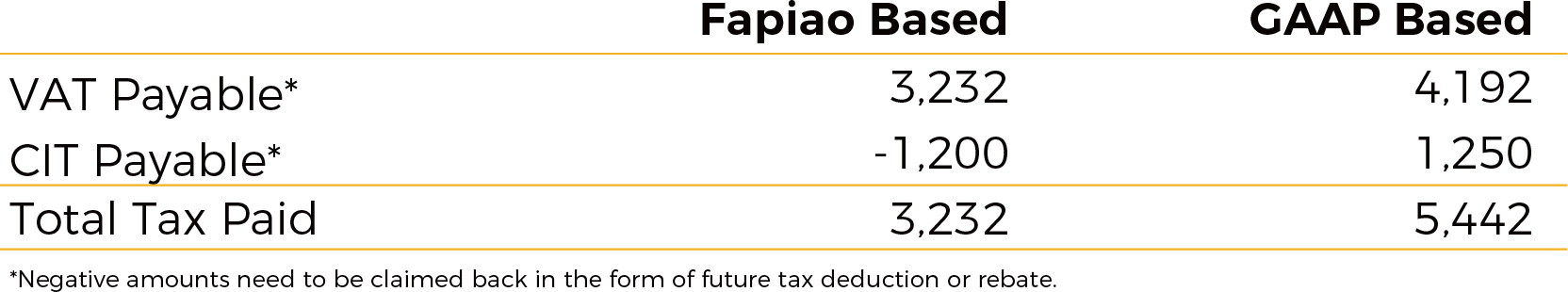

In Example 2 earlier, the business underreported its revenue by CNY 9,200, resulting in a net loss of CNY 4,800. For a standard domestic product sale, the tax shortage of the unreported revenue will equal 41 per cent (16 per cent VAT + 25 per cent CIT) of the unreported total.

Example 2.1

The company’s total tax shortage from the underreported revenue (equal to CNY 9,800) from Example 2 is CNY 2,210 for the 2017 financial year.

As of mid-2016, the tax authorities employ legislation aimed at monitoring revenue and expenses flowing through a business’ bank accounts and comparing the amounts with their declared tax liability. Any unreported revenue, for example, booked in the ‘other’ category on the balance sheet, will encourage the tax authorities to audit the business.

Such tax shortages can lead to penalties, such as:

- 0.5 – 5 times the tax liability amount, in addition to the total amount (based on tax amount and at the discretion of the tax authority);

- 0.05 per cent of tax overdue per day, and;

- Imprisonment in serious cases.

When an accountant performs bookkeeping solely based on the availability of fapiaos, they rely on the business manager to inform them of the revenue for which fapiaos are not available.

Conclusion

It sounds counterintuitive to transition away from accounting conducted on the basis of the ‘gold standard for a business’ tax liability’. But it is important that, as businesses grow, they move beyond simple compliance. This means taking steps to involve accountants in transactions as they occur and transition to bookkeeping on the basis of accrual according to PRC GAAP.

Notes:

PRC GAAP – the Peoples Republic of China, Generally Accepted Accounting Principles

ACCRUAL – Accounting method that records revenues and expenses when goods or services are actually delivered, regardless of when cash and fapiao are exchanged.

Axel Standard (www.axelstandard.com) is a platform of world-class bilingual business software as a service (SaaS) and an alliance of cloud accountants and advisors that help ease the way business is done in China. Our SaaS applications cover areas such as accounting, inventory management, expense claims, to name just a few. Businesses have the flexibility to select and integrate multiple applications to create a highly adaptable and quickly implemented business solution. Cloud accounting professionals on the platform are powered with the applications to better help foreign businesses streamline operations, visualise financials, optimise tax planning and grow profits by ‘working inside businesses’.

Recent Comments