Since the first quarter of 2014, the Shanghai Government has issued three circulars regarding changes to the industrial land supply rules.

Since the first quarter of 2014, the Shanghai Government has issued three circulars regarding changes to the industrial land supply rules.

As of 1st July, 2014, the granted land use terms for industrial projects in Shanghai were reduced from 50 years to no more than 20.[1] This has triggered extensive concerns among foreign-invested companies, particularly those considering greenfield investment or business expansion in Shanghai. In addition to Shanghai, a number of cities like Beijing, Hangzhou and Zhuhai, issued similar rules. On 1st September, 2014, the national measures that strengthen industrial land supply took effect. In the following article Cody Chen and Yang Cui from Taylor Wessing interpret the new rules of the game.

Legislative background: not an overnight change

Since the PRC State-owned Land Use Rights Grant and Transfer Provisions were issued in 1990, China has undergone a vast urbanisation process and land supply-related revenue has become the financial cornerstone of local governments. However, in the last 20 years there has not been much progress in solving related long-term problems, which include under-priced industrial land; excessive granting of land use rights leading to scarce land resources; low use efficiency; low output; and increasing soil and ground water pollution. The Chinese Communist Party’s response at their Annual Conference in November 2013 was an explicit requirement to adopt “higher industrial land prices”, a “stricter construction land supply mechanism”, and “measures to increase efficiency in the usage of State-owned construction land”.[2]

Since 2008 the Ministry of Land and Resources (MLR) has been calling for more thrift and efficient use of land. Following the Shanghai local rules, the MLR officially issued the Measures on Thrift and Efficient Use of Land (MLR Measures) in May 2014, which became effective on 1st September, 2014.

Apart from Shanghai, which seems to have adopted the pilot changes, a number of cities, like Beijing, Hangzhou and Zhuhai, issued similar rules. Now the MLR Measures have come into effect, we may reasonably expect a nationwide roll-out of the industrial land supply reform we have seen in Shanghai.

New rules

Shortened industrial land use terms

Since China first adopted the legal concept of ‘granting’ State-owned land use rights to individual investors in 1990, the law has maintained that the granted term for industrial land usage is up to 50 years. Therefore, from a purely legal perspective, Chinese law has never stipulated that the industrial land use term should be fixed at 50 years. Because we have rarely seen a single case where an investor accepted industrial land with a use term less than 50 years, this has led to the assumption that the use term for industrial land is, and should be, 50 years.

In Shanghai, as of 1st July, 2014, the maximum term for industrial land use is now 20 years. In the Beijing Economic and Technology Development Zone and Shandong Linyi city, 20 years has also been adopted as a cap for industrial land use terms. In Hangzhou and Zhuhai, it is 30 years.

At the national level, the MLR Measures provide that local governments may implement shorter land use terms within the statutory permitted maximum term of 50 years. Until further updates are issued, local governments will retain autonomy in this respect.

Promoting the land lease model

The Implementation Regulations on PRC Land Administration Law issued in 1998 stipulate that, an investor can obtain land use rights from the government by allocation, granting or lease of land. Allocated land use rights—where land use is basically free—is only available to State and military-owned public interest projects. Granted land use rights have been the dominant approach for enterprises in practice. Land lease only seems to exist in statutory law though, various local land bureau officials with whom we spoke either appeared to have no idea about leased land use rights, or declined to comment since it had never been implemented in reality.

Nowadays both the MLR Measures and some local rules promote ‘lease’-related approaches for investors to obtain land use rights. These include:

- standard plant lease;

- leased land use rights; and

- lease before grant.

Standard plant lease is a classic lease concept governed by the PRC Contract Law. Such leases, based on the PRC Property Rights Law, usually include the land use rights and the buildings.

Leased land use rights only, however, is a completely different legal concept. Based on the statutory rules, both national and local, enterprises may also obtain leased land use rights and enjoy exclusive use for the duration of the lease. Such exclusive use rights can be proven by a State-owned land use right certificate, with the lessee free to construct buildings on the land and obtain building ownership in its own name.

Lease before grant means that the local land authority first leases the industrial land to an investor, with specified pre-conditions to be met in the lease contract before granting land use rights.

Stricter planning indices

The statutory defined planning indices for industrial land mainly include investment intensity, plot ratio,[3] building density, supporting facility ratio (percentage of non-production building area compared to the total construction area of the plant) and greenery ratio.

On both the national and local level, there is a trend towards imposing more stringent planning indices for industrial land. For example, in Shanghai the minimum plot ratio was increased from 0.8 to 1.2 under the new rules. This is not practically possible for certain industries, such as heavy machinery. Based on unofficial government sources, the chemical industry is the only possible exception for the newly-adopted minimum plot ratio due to mandatory fireproof codes.

New land use rights grant contract in Shanghai

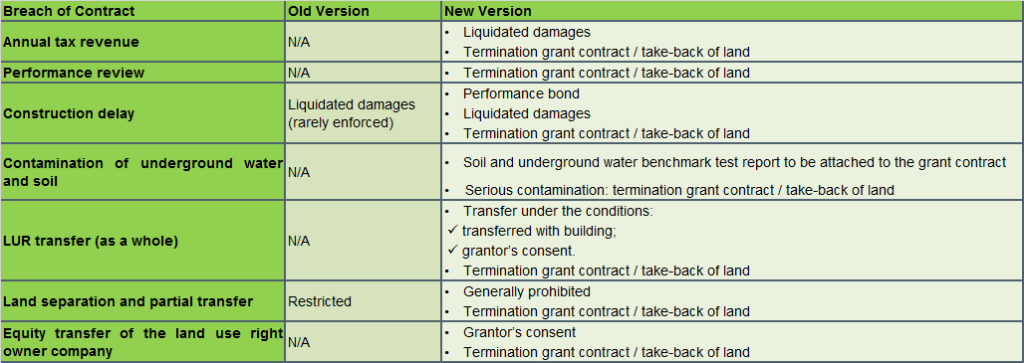

As of 1st July, 2014, Shanghai adopted a new version of the grant contract for State-owned construction land for industrial purposes. The new version places more restrictions on investors (grantees), some of which could be questionable as to their compliance with basic Chinese laws including the Property Right Law. The fact that one is unable to negotiate the grant contract has added to concerns among foreign industry. New contractual restrictions include performance reviews of a grantee’s turnover and tax revenue and prior consent by local government for property and equity transfers. Violation of contractual obligations may lead to termination of the grant contract and take-back of the land by the government, adding further uncertainty to an investor’s long-term business plan. The table below summarises the major differences—in terms of breach of contract consequences—between the old and new versions.

Build-to-lease

There is a clear trend that the Chinese Government will continue to tighten up industrial land supply rules, both legally and economically. Under pressure from central government, more provinces and cities may follow Shanghai’s pilot reform.

The result could be that we see less greenfield investment in the form of land acquisition, and certain industries and projects could relocate outside Shanghai where 50-year land use terms still exist. More investors may also consider other alternatives, such as acquisition or leasing of existing factory plants.

Build-to-lease may become increasingly popular among foreign investors. Under this model, both the land use rights and factory buildings are owned by the industrial zone. It differs from the standard plant lease model in that the entire factory plant is tailor made by the owner for the investor. Based on a well-drafted build-to-lease contract, the investor should be able to have a say in the entire process of engineering design and construction management.

Another advantage of this model is that the investor does not need to pay all at once for the fixed-assets expenditures. It is financially better for the investor to be able to amortise such costs into rent payable. For a long-term sustainable business plan, the build-to-lease model is also better than a normal plant lease. A build-to-lease contract usually has a much longer lease term with a mutually agreed and enforceable renewal mechanism. A landlord under the build-to-lease model always needs to think twice before terminating a contract or not renewing the lease, simply due to the tailor-made nature of the plant.

Tips for greenfield projects in China

- Thoroughly research and analyse local land supply policies. Look into possible local policy changes in the next year ahead, upon concluding an investment agreement.

- Negotiate a detailed investment agreement with the local government or industrial zone, including contractual protection in case of policy changes.

- Closely monitor the legal and policy development and communicate with the selected industrial zone, ideally via a designated project team.

Cody Chen is a partner at Taylor Wessing in Shanghai. Taylor Wessing is a full service law firm with approximately 900 lawyers in Europe, the Middle East and Asia, with offices in Shanghai and Beijing. For more information please visit www.taylorwessing.com .

[1] Based on the circulars, other industrial land, including industrial land used for standard plant and research and development headquarter projects, might still enjoy the maximum term, i.e. 50 years.

[2] In China, State-owned construction land includes industrial land, residential land, commercial land, etc.

[3] Plot ratio refers to the ratio of a building’s total floor area (gross floor area) to the size of the piece of land upon which it is built.

Recent Comments