Will the cumulative wage withholding method decrease your disposable income?

As an employee, how has your daily life been impacted by China’s new individual income tax (IIT) reform since it came into effect in January? Are you paying less tax on the same amount of income received compared to last year? “It seems so, but I’m not sure,” a taxpayer working in Beijing told Deloitte. “The tax I paid in January was lower than my expectations but the amount has been increasing over the following months.” Well, it seems this also happened to other employees. Is this a result of the IIT reform? Is this correct under the amended IIT Law? Melody Ma and Rachel Yao of Deloitte Tax China illustrate how the IIT calculation on salaries and wages works under the amended IIT Law.

A new system for calculating IIT took effect from 1st January 2019. For resident taxpayers, IIT on salaries and wages will be assessed using a cumulative withholding method and paid on a monthly basis.

What’s cumulative withholding and how does it work?

The new rule provides that, for salaries and wages, the withholding agent should calculate monthly IIT by referring to the below formula and withhold the tax on a monthly basis.

Formula

Monthly taxable income = cumulative taxable income (as of the current month under the current employer) – cumulative standard deductions – cumulative tax-exempted income – cumulative itemised deductions – cumulative additional itemised deductions – other cumulative deductions in accordance with the law

Monthly tax payable = (cumulative taxable income * marginal tax rate – quick deduction) – cumulative tax paid

An example may better explain how the cumulative withholding mechanism works:

Sample Calculation

Employee A, monthly salary: Chinese yuan (CNY) 50,000

Statutory social security deduction: CNY 3,000/month

Additional itemised deduction: CNY 2,000/month

Standard deduction applicable: CNY 5,000/month

January tax payable = (50,000-3,000-2,000-5,000)*10%-2,520 = 1,480

February tax payable = (100,000-6,000-4,000-10,000)*10%-2,520-1,480 = 4,000

……

December tax payable = (600,000-36,000-24,000-60,000)*30%-52,920-79,080=12,000

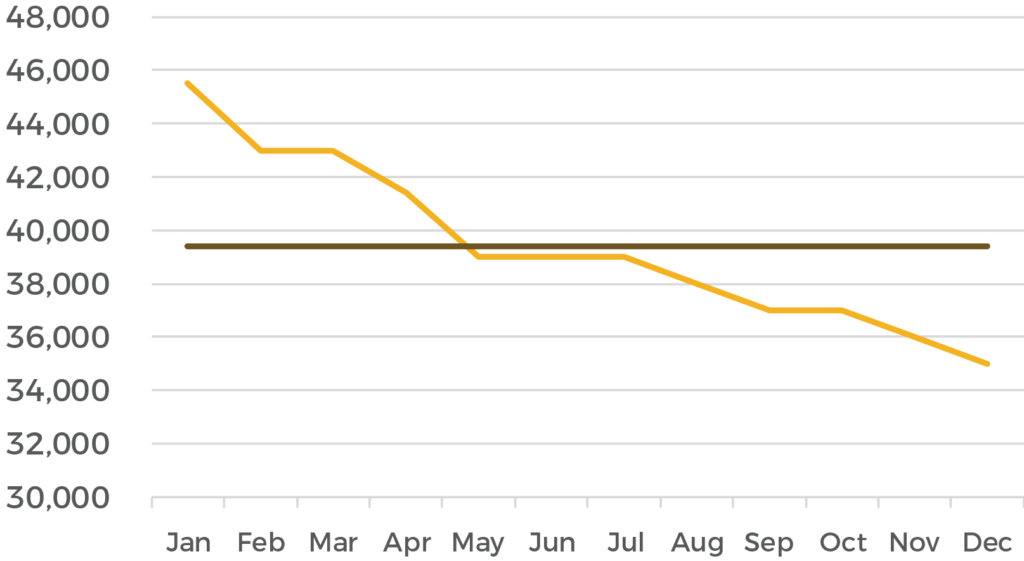

We know that, for resident taxpayers, the comprehensive income (including salaries and wages) is taxed on an annual basis. With cumulative withholding method, the cumulative salaries and wages are treated as ‘annual income’. The tax payable of the current month equals total tax on the accumulated ‘annual income’ minus accumulated tax already paid in the previous months. As this ‘annual income’ increases throughout the year, the marginal tax rate also increases (e.g. from 10 per cent in January to 30 per cent in December) and so does the tax payable on the ‘annual income’.

The monthly tax withheld under cumulative withholding method is not the final amount, provided that you keep receiving salaries and wages throughout the year. However, if you terminate your employment in the middle of the year and do not receive any salaries or wages for the remaining months—assuming there are no more adjustments to the taxable income or deductions already considered in calculating your tax, and you have no other source of income in the tax year—the tax you have already paid is the final amount you will owe. That means there is no need to file an annual reconciliation tax return after the close of the tax year, which will be a relief to both individual taxpayers and the tax authority. Naturally, the monthly disposable income after tax could decrease as the year progresses under the cumulative withholding method. However, taxpayers are not paying more than they should.

Worth noting in relation to the cumulative withholding mechanism is that any deductions claimed in the middle of the year—e.g. late submission of expenses for taking care of elderly parents, or additional itemised deductions, which can be submitted from January to July—could significantly decrease the taxable income and cause fluctuations in the net monthly salary.

Taxpayers that operate under the cumulative withholding mechanism should carefully monitor their cash flow, be prepared for the decreases in disposable salary and properly arrange consumption and investment.

Other thoughts

For foreign employees normally regarded as a non-domiciled taxpayer in China, the cumulative withholding method is only applicable when you are a resident taxpayer for the tax year concerned. If you are a non-resident taxpayer, your IIT on salaries and wages will still be calculated and withheld on monthly basis, just as before 2019. If you are treated by your employer as a non-resident from the beginning of the year, the calculation method for your tax cannot be converted to the cumulative withholding method during the tax year, even though you eventually become a resident taxpayer during that time. The amended IIT Law only allows taxpayers to adjust their tax liability through the annual reconciliation tax filing at the end of the tax year. Your tax residency is usually determined at the beginning of the year, based on a preliminary estimation of days spent in China in a tax year, and subsequently used for monthly tax filing. Your designation will impact your cash flow throughout the year.

Among the comprehensive incomes—salaries and wages, remuneration for independent services, author’s remuneration, and income from royalties—the cumulative withholding method can only be applied to salaries and wages. For the remaining comprehensive incomes mentioned above, though resident and non-resident taxpayers are differentiated, the withholding method cannot be accumulated on a monthly basis for calculating tax, even for resident taxpayers. Resident taxpayers who receive these types of comprehensive incomes and had IIT withheld from the source should file annual reconciliation tax returns to reconcile all comprehensive income received.

Deloitte China Tax and Business Advisory is the only ‘Big Four’ practice that works As One across the Greater China Region, including the Chinese Mainland, HK, Macau and Taiwan, to advise and assist clients on tax and business issues. Melody Ma (Tax Director) focuses on PR China IIT services to multinational companies, domestic companies, and individuals, and has extensive experience on tax compliance, tax and business advisory and tax planning. Rachel Yao (Senior Tax Manager) specialises in PR China IIT compliance and consulting services.

Recent Comments