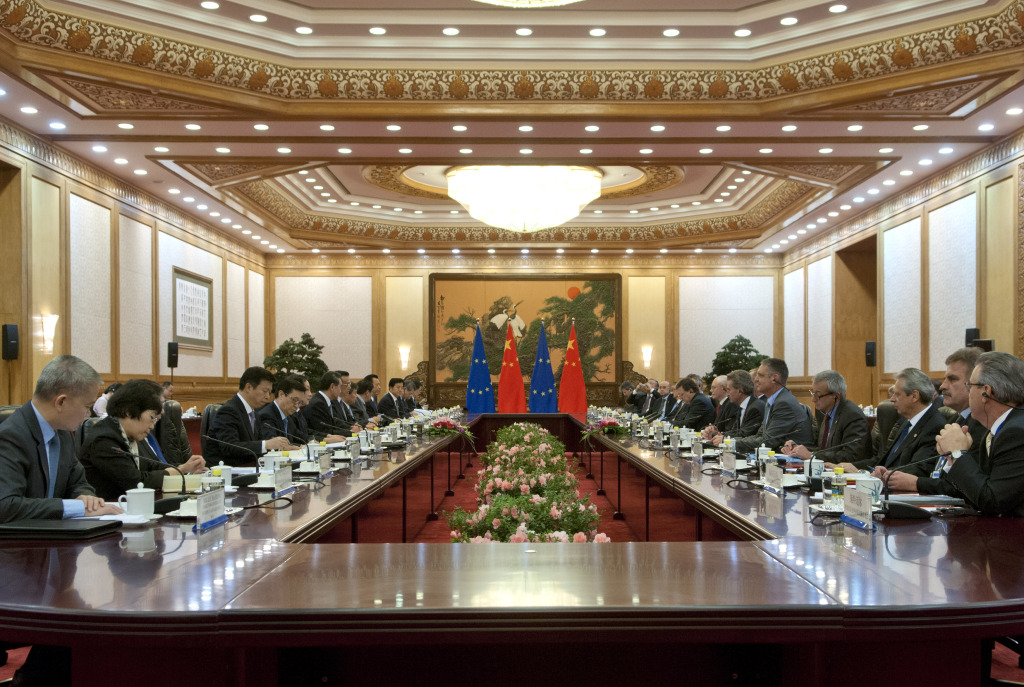

Chinese Minister for Trade Gao Hucheng shakes hands with former EU Commissioner for Trade Karel De Gucht, 21st November, 2013. Photo (c) European Union, 2014.

What’s in it for you?

Companies investing abroad can encounter problems which, for a variety of reasons, cannot always be solved through domestic legal systems. These problems range from the rare, but dramatic, occurrences of expropriations without proper compensation, discrimination and unfounded revocation of business licences, to not being able to make international transfers of capital or payments necessary for the making or the operation of an investment.

This situation is clearly detrimental to companies investing abroad, but it doesn’t benefit recipients of foreign direct investment (FDI) either – China’s challenging investment environment is causing a number of European companies to scale back investment plans[1] or even look elsewhere.[2]

The EU-China Bilateral Investment Agreement (BIA) currently under negotiation is aimed at addressing these issues for the mutual benefit of both sides. In this article the European Commission’s DG TRADE describe the BIA in more detail and explain what the benefits will be for your company.

European authorities want to make sure our companies present in China can tap into the full potential of the world’s second largest economy. But for this, they need to be treated fairly and benefit from an environment that is transparent and predictable. They need access to the market equal to that afforded to domestic companies, and appropriate legal protection.

For this reason, the European Commission wants to establish with China an investment protection treaty for all companies from across the European Union (EU).

What can an investment treaty do to protect your investment?

We want China to commit to a number of fundamental principles that will apply to each European investor. We talk about:

- non-discrimination;

- fair and equitable treatment;

- free transfers of funds related to investments; and

- a prohibition of direct or indirect expropriation without compensation.

What do these principles mean in practice?

Non-discrimination: The objective is to ensure a level playing field. European Union investors based in China should be treated the same way as Chinese or other foreign investors in China. Any justified exceptions from this rule will need to be specified in the agreement.

Fair and equitable treatment: This commitment serves to prevent use of force, threats or harassment against investors. Foreign companies need to be granted access to justice and treated in accordance with due process of law, in a transparent and non-arbitrary fashion.

This does not mean that laws cannot change in a way that affects investors. It means, though, that any measure taken by the legislator, administration or judiciary follows the rule of law.

Free transfers related to investments: EU investors will be able to transfer capitals and payments relating to their investment freely in and out of China. Any exceptions to this rule, such as temporary safeguard measures or difficulties with the balance of payments, need to be clearly specified beforehand.

Protection against unlawful expropriation: Expropriation as such is not illegal. However, it cannot be done arbitrarily. It can only happen for a public purpose, in a non-discriminatory fashion, in accordance with due process of law, and against payment of compensation. Be it direct expropriation with a formal transfer of property title or only a de facto measure that deprives the investor of his ability to use or dispose of his assets, the company should be appropriately compensated.

EU-China Summit, 21st November, 2013, when negotiations for the BIA were launched. Photo (c) European Union, 2014.

What will happen if the host state does not respect the rules?

If an investor believes that the host state has breached one of these key guarantees, he or she will be able to ask for an external and politically neutral arbitration known as investor-to-state dispute settlement (ISDS).

Before such a tribunal, investors will have to prove that the host state has breached one or more of the key guarantees causing significant economic damage. If the ISDS tribunal agrees with the investor, the host country will need to pay compensation.

In many countries investment agreements are not directly enforceable in domestic courts. An investor who gets in trouble cannot invoke the specific investment protection rules before the domestic court to get redress. That’s the main reason why we include ISDS in our international treaties. It allows investors to rely on the rules that were specifically designed to protect their investments.

European Union investors, and especially companies from the Netherlands, Germany and the United Kingdom, are amongst the most frequent users of the ISDS system accounting for more than half of all the ISDS cases worldwide.

Will the BIA improve market access opportunities for EU investors?

Better and more access for EU investors to the Chinese market is our number one priority. We want to get rid of quantitative restrictions and discrimination against European services providers and investors active in other sectors such as manufacturing and mining. Also, we want to make sure the authorisations and licenses are delivered without discrimination or opaque procedures.

Will small companies also benefit?

The legal framework will improve for all companies, big or small.

Small and medium-sized businesses (SMEs) will be able to use all the enforcement possibilities offered by the ISDS mechanism, including potentially some specific SME-friendly arrangements.

For instance, the EU wants to offer SMEs an option to use mediation that is generally less costly, more consensual and easier to use for an SME. We are also supporting the idea of offering SMEs arbitration tribunals composed of a single arbitrator, instead of the usual panel of three. This should lower costs and help to ensure that small companies benefit from the agreement that we negotiate.

Are there already any existing measures to protect investors in China?

All EU Member States, except Ireland, already have bilateral investment protection treaties with China. These agreements include the typical investment protection standards described above. However, they grant different levels of protection for EU investors depending on where they come from in the EU. These agreements apply only to companies already established in China and do not help potential newcomers. Once the EU-wide agreement is ready, it will replace the existing national treaties to ensure equal treatment and broader rights for all EU investors in China.

What is the timeline of the negotiations?

The negotiations started in November 2013. After three rounds of negotiations, the EU-China discussions are still at a very early stage. It would be premature to indicate a specific timeline for their conclusion. As the real negotiation phase is certainly still ahead of us, emphasis is put on the quality of the outcome rather than on speed.

Can EU industry do anything to support the negotiations?

We want to make sure the deal reflects the real needs of our investors in China. For this reason the European Commission would welcome your comments:

- What are your first-hand experiences regarding the investment environment?

- What specific barriers and difficulties did you face when first entering the Chinese market and/or in your daily contacts with Chinese authorities?

- Which are the sectors that need to be considered as priority?

You can send your comments to the Trade Section of the EU Delegation in Beijing: Francisco.Perez-Canado@eeas.europa.eu, or Radek.Wegrzyn@eeas.europa.eu and to DG TRADE in Brussels: Alexandra.Koutoglidou@ec.europa.eu

[1] European Chamber of Commerce in China, Business Confidence Survey 2014, P. 27, http://www.europeanchamber.com.cn/en/publications-business-confidence-survey

[2] European Chamber of Commerce in China, Business Confidence Survey 2014, P. 33, http://www.europeanchamber.com.cn/en/publications-business-confidence-survey

Recent Comments