Key points on the four-year extension of China’s preferential policy for foreign national workers

China’s individual income tax (IIT) preferential policy for foreign national workers, which was set to expire on 31st December 2023, has been extended for another four years to 31st December 2027. Foreigners working in China can continue to enjoy tax exemption on eight categories of fringe benefits, including housing rental, children’s education costs and language training costs, among others. Qian Zhou and Katrina Huang of Dezan Shira explain the allowances involved and look at who stands to benefit the most from this extension.

On 18th August 2023, the Ministry of Commerce and the State Taxation Administration (STA) jointly released the Announcement on the Continuation of Implementation of Individual Income Tax Preferential Policies Such as for Foreign Nationals’ Benefits.[1]The Announcement officially extended the preferential IIT policy on foreign national workers’ fringe benefits to 31st December 2027. This came at the same time as China’s extension of another preferential tax policy, for the annual one-time bonus of both foreign and Chinese resident taxpayers, and the Greater Bay Area IIT subsidy, to the same date.[2]

The extension has brought immediate relief to some higher-earning foreign national workers, some of whom—especially those who bear the high cost of educating their children in China—would have seen a surge in their personal tax liability.

What are the tax-exempt benefits for foreigners working in China?

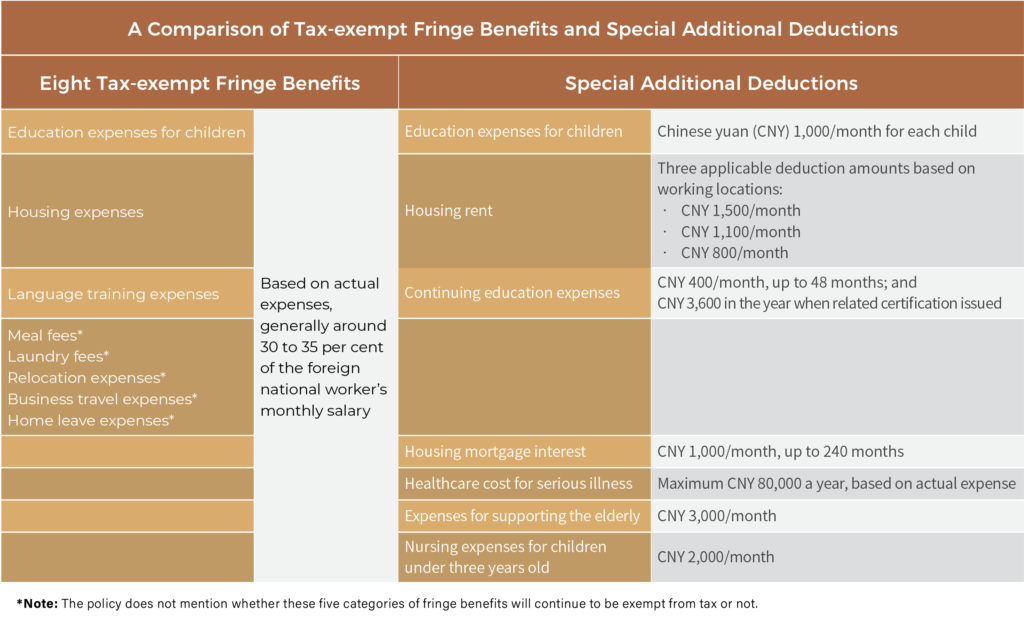

Foreign nationals working in China can enjoy tax-exempt benefits in the following eight categories:

- Housing rental expenses

- Education expenses for children

- Language training expenses

- Meal fees

- Laundry fees

- Relocation expenses

- Business travel expenses

- Home leave expenses

These benefits are technically known as benefits-in-kinds, or BIKs – which refer to additional perks not included in the salary and wages but paid on a reimbursement and non-cash basis. Such BIKs could be exempt from IIT provided that the expenses are reasonable in amount and there are corresponding supporting documents, such as invoices (fapiao), for each expense.

For example, Chinese tax bureaus may require rental agreements, valid commercial invoices, and other supporting documents to be submitted when the foreigner files the IIT returns before waiving the tax on the foreigner’s housing rental expense.

In addition, there are some specific requirements for each category. For example, for home leave expenses, only the travel expenses for the foreign national from China to their/spouse’s home country for up to two trips per year could be exempt from IIT.

What is China’s current income tax policy?

Until 31st December 2027, non-China domiciled tax residents (who do not have a domicile in China and live for 183 days or more in China in a given tax year) are entitled to one of the two tax benefits:

- The tax-exempt benefits-in-kinds (BIKs); or

- The seven special additional deductions:

- Children’s education expenses

- Continuing education expenses

- Housing mortgage interest

- Housing rent

- Healthcare costs for serious illness

- Expenses for taking care of the elderly

- Nursing expenses for children under three years old

The foreigners’ BIKs, which were due to expire at the end of 2023, will be effective till the end of 2027, while the seven additional deductions are consistently available for both foreign and Chinese tax residents in China. The two policies cannot be simultaneously enjoyed. Once decided, the foreign tax resident in China cannot change their preference within a given tax year.

*Note: The policy does not mention whether these five categories of fringe benefits will continue to be exempt from tax or not.

Foreign national workers’ tax-exempt fringe benefits can be fully deducted based on the actual cost of each expenditure, provided it is a “reasonable” amount and accompanied by a corresponding invoice or other proof of payment. The “reasonable amount” is judged based on the local living standard, consumption level, market price, and so on. In practice, a proportion below around 30 to 35 per cent of the foreign worker’s monthly salary is regarded as “reasonable” by Chinese tax authorities.

However, most special additional deductions (except for healthcare costs, which are deducted based on actual expense with a cap at CNY 80,000 a year) are deducted based on a standard basis – namely on a fixed amount. For many foreign national workers who have a higher income and level of expense, the tax-exempt fringe benefits are considered more beneficial than the pre-tax special additional deductions.

Who will benefit from China’s extended tax policy on foreigners’ IIT fringe benefits?

All foreign nationals working in China, as well as companies trying to retain foreign talent, will benefit from the extended preferential tax policy. Foreigners facing high costs of educating their children in China, as well as international schools. may especially welcome the policy extension.

In China’s first-tier cities like Beijing and Shanghai, a single foreign child’s tuition fee at an international school—often the only option available to foreign nationals—can be anywhere between CNY 200,000 to CNY 350,000 per year. The special additional deduction standard for children’s education fees for tax residents in China is CNY 1,000 a child per month – this can be much smaller than the foreigner’s actual expenses for children’s education.

Now, with the continually effective tax-exempt fringe benefit to offset the high cost of children’s education, foreign employees can save a fortune on taxes, which is also positive for the international school sector in China.

Making new HR and payroll policy adjustments

Companies with foreign employees who are already enjoying or are eligible to enjoy the tax exemption on some BIKs may need to communicate with their employees to arrange some benefits that are in line with current policies to help their foreign employees save tax. For companies that are not qualified to arrange BIKs for their employees —for example, those who have poor tax records and have been denied this right—they may instead consider helping their foreign employees with China tax residency to claim the seven special additional deductions.

Companies that made preparations for the original IIT policy change (such as amending the labour contracts, restructuring salary packages and staff allocation) scheduled for the end of 2023 may need to roll back the decisions for the time being and save the plans for possible future needs.

Note: This article was originally published on Dezan Shira’s China Briefing website: https://www.china-briefing.com/news/china-extends-iit-preferential-policy-foreigners-tax-exempt-fringe-benefits-end-of-2027/

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen and Hong Kong. We have offices in Vietnam, Indonesia, Singapore, the United States, Germany, Italy, India and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand and Bangladesh.

[1] Announcement of the Ministry of Finance and the State Administration of Taxation on the continuation of the implementation of the personal income tax policy for foreign individuals, STA, 18th August 2023, viewed 28th September 2023, <https://www.chinatax.gov.cn/chinatax/n363/c5211240/content.html>

[2] Announcement on the continuation of the annual one-time bonus personal income tax policy, Ministry of Finance, 18th August 2023, viewed 28th September 2023, <http://szs.mof.gov.cn/zhengcefabu/202308/t20230828_3904328.htm>

Recent Comments