Emerging opportunities for European companies

The annual plenary session of the National People’s Congress (NPC) in May marked a quantum shift in China’s strategy for macroeconomic growth. Emphasis has refocused on stabilising employment, securing basic livelihoods, eliminating poverty and preventing risk amid the global COVID-situation; all while coping with elevated external uncertainty. John Russell from North Head argues that this is a change of strategy from ‘economic efficiency’ to fairness and livelihoods; from licence for a minority to be rich to focussing on whole societal wellbeing, and addressing the inequality and opportunity gaps that have widened over past decades.

This new approach by the NPC is termed the ‘6+6’ strategy, and can be seen as a natural corollary of the 13th Five-year Plan’s focus on poverty alleviation. Premier Li prioritised the six hundred million earning less than Chinese yuan (CNY) 1,000 per month. The government is also committed to creating nine million new urban jobs and securing jobs for the 8.7 million college graduates. For the first time since 2002, China did not set an annual gross domestic product (GDP) target.

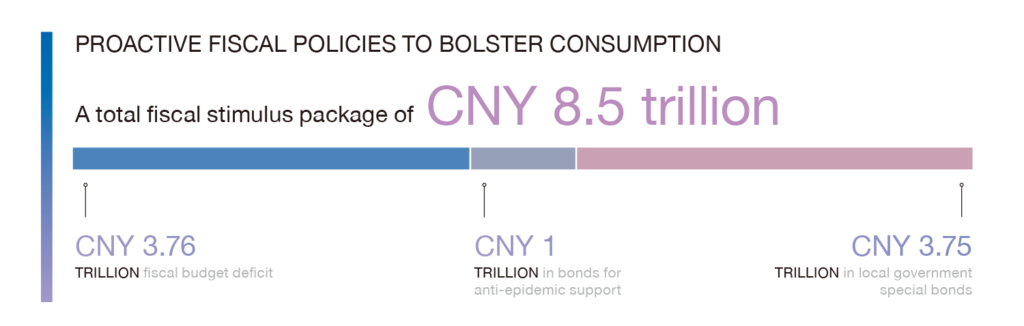

In response to COVID-19 economic impacts, the central government has increased the budget deficit, with an open-ended fiscal deficit target set for over 3.6 per cent of GDP. The fiscal stimulus is significantly less than that of the 2009 global financial crisis, but more prudently targeted to buttress jobs and the real economy. Fiscal initiatives include tax reductions and exemptions, increasing infrastructure spending, and supporting small and medium-sized enterprises (SMEs).

Six Guarantees and Six Stabilities

The “six guarantees and six stabilities”, also referred to as the “security in the ‘six areas’ and ensuring stability on the ‘six fronts’” or ‘6+6’ strategy, was a key theme throughout the NPC session and the 2020 Government Work Report.

- Six guarantees refer to protecting: job security; basic living needs; operations of market entities; food and energy security; stable industrial and supply chains; and the normal functioning of primary-level governments.

- Six stabilities are ensuring stability in: employment; the financial sector; foreign trade; foreign investment; domestic investment; and market expectations.

Employment driving consumption

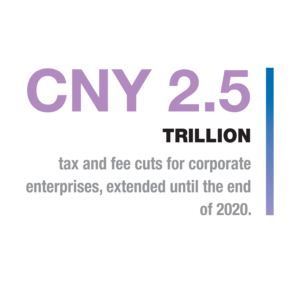

Well before the NPC session in May, the government’s actions had foreshadowed this shift and realignment. The ‘temporary relief’ interventions in the early months of the COVID-19 epidemic to sustain employment have expanded to CNY 2.5 trillion in tax and fee cuts for corporate enterprises, while their duration has been extended until the end of 2020.

Rather than large scale credit relaxation, the new 6+6 strategy prioritises reduced burdens on businesses, with the aim of bolstering job retention and consumption. With tens of millions of workers losing jobs due to business closures and disruption, the government now encourages and emphasises micro and SME businesses; which are viewed as agents for rapidly creating employment and boosting consumption. Also, inbound cross-border e-commerce is being promoted with incentives for SMEs to provide ancillary services in cities across China.

Core components of China’s 2020 roadmap

Core components of China’s 2020 roadmap for resetting China’s growth model include:

- Implementing proactive fiscal policies to bolster consumption: This pro-growth strategy includes a total fiscal stimulus package of CNY 8.5 trillion yuan, which includes a CNY 3.76 trillion fiscal budget deficit, CNY 1 trillion in bonds for anti-epidemic support, and CNY 3.75 trillion in local government special bonds. This expenditure corresponds with the fiscal deficit target.

- Supporting high-tech growth engines as a means of industrial upgrading: The government pledged support for ‘new infrastructure and ‘new urbanisation’ initiatives which will prioritise high tech construction nationwide. As a new engine of growth for China’s economy, the New Infrastructure Initiative (NII) is intended to accelerate both domestic demand and manufacturing capacities. The initiative will see China develop its 5G network, plus rapid take-up of associated technologies such as big data, artificial intelligence design and industrial upgrading.

- Greater recognition of the roles of multinationals, foreign trade and investment. Foreign trade and investment are considered ‘stabilisers’ in the 6+6 strategy. This reflects the Chinese Government’s recognition that foreign businesses are key drivers of domestic economic growth. Accordingly, the governments at central and local levels should become more ready to support foreign businesses generally, and to maintain their operations in China, including their supply chains on the mainland.

- Bolstering financing for SMEs: The People’s Bank of China (PBOC) issued measures, alongside other central government authorities,[1] to ensure continued financing for China enterprises, with calls for a total of CNY 300 billion in special finance bonds to support loans to micro and SMEs, as well as policies to encourage venture and angel investors.

- Increasing free-trade, greater market access as growth drivers: Minister of Commerce Zhong Shan has emphasised the importance of easing market entry, shortening the negative list for foreign direct investment (FDI) and implementing the Foreign Investment Law. Increasing the number of economic development zones is a component of China’s pro-free trade strategy. The 2020 Government Work Report outlined support for a new Hainan free trade port in addition to new pilot free trade zones and integrated bonded areas in the central and western regions, and further comprehensive trials on opening up the service sector. The China Development Bank will provide a total of no less than CNY 100 billion in funds to economic and technological development zones. The funds will support the development zones to optimise their investment environment and promote high-quality growth.

China-European Union Relations

As a foil to deteriorating relations with the United States (US), China will continue to focus on the European Union (EU) for growing economic and political links. Such a situation should leverage the EU’s position. China’s priorities for Europe also fit conveniently under the umbrella of the Belt and Road Initiative (BRI).

Yet, EU-China relations are also in flux – attitudes to Chinese investment into Europe have hardened over recent years while negotiations on a bilateral investment agreement continue to be ponderously slow. Differences over Hong Kong, Xinjiang, and COVID-19 are contentious, as with the US. Moreover, the US has been pressuring the EU to take a tougher stance on China, while concurrently threatening to initiate trade actions against the EU itself, or individual member states.

China and the EU have persistent differences over market access and investment policies. In past years business interests such as the European Chamber have advocated for greater reciprocity. Following the June EU-China summit, European Commission President Ursula von der Leyen remarked that the EU and China “continue to have an unbalanced trade and investment relationship,” referring to ongoing frustration regarding these market access and investment disparities.

Nonetheless, the EU is obliged to traverse a tightrope: needing both China and the US and reluctant to alienate either. With the US progressively disengaging internationally, China and the EU now find themselves as partners by circumstance for upholding multilaterism, support for the World Health Organization, advancing the climate change agenda and serving as the prime defenders of the 2015 Iran Nuclear Accord.

Opportunities and recommendations for European business

Given the breadth and persistence of China-US disputes, European companies potentially stand to gain disproportionately from the following areas:

With recognition that MNC and foreign businesses are ‘stabilisers’ for the Chinese economy and key drivers of domestic economic growth, governments at central and local levels should progressively be more supportive for foreign businesses generally. For many manufacturing and technology companies, this entails support to maintain their supply chains on the mainland.

- China companies cannot fully master the full scope of the NII, with gaps in specific technology sectors. This will create opportunities for advanced manufacturing, technology companies and specialist services providers.

- The expansion of China’s Cross-border Retail Import Pilot will potentially attract a new wave of European companies to enter the Chinese market; particularly that of SMEs. Anciillary effects may be that supply chains are enhanced for European companies already established in China.

- Advantages will accrue if companies adapt their present market positioning and messaging, particularly to government, by incorporating some pertinent elements of the 6+6 growth strategy, emphasising their contributions to employment, livelihoods, capacity-building and driving growth as a foreign company.

- To position itself as a trusted partner in the China market, MNCs can demonstrate their value to central and relevant local governments by emphasising their commitment to remain in China, compliance with Chinese regulations and readiness to meet social responsibilities.

As always in China, to optimise opportunities and minimise risk, European MNCs must stay vigilant for upcoming policy and regulatory trends, changes and compliance demands.

Note: This is an abridged version of an article by North Head, the full version of which can be accessed on their website.

North Head is a public affairs and strategic communications consultancy based in Beijing. This is an abridged version of an article that can be obtained at www.northhead.com For more details contact the managing director, John Russell, at jrussell@northheadcomms.com

[1] The China Banking and Insurance Regulatory Commission (CBIRC), the National Development and Reform Commission (NDRC), the Ministry of Industry and Information technology (MIIT), the Ministry of Finance, the China Securities Regulatory Commission (CSRC) and the State Administration of Foreign Exchange (SAFE).

Recent Comments