Has anything changed?

As COVID-19-related challenges and trade tensions have occupied the larger share of business leaders’ attention in the past two years, some may have taken their eye off the regular problems encountered when conducting operations, such as administrative issues, workforce diversity and fraud prevention. The Global Economic Crime Survey 2022, a biennial survey undertaken by PwC and aimed at better understanding fraud, corruption and other economic crimes at companies, highlighted that external fraud continues to be a threat on a global basis. On behalf of PwC, Paul Tan outlines the common trends observed in fraud and corruption committed in China, as well as in Europe and other jurisdictions.

Globally, 46 per cent of respondents reported that they had experienced some form of fraud or other economic crime within the last 24 months. Cybercrime was reported as the most common and disruptive type of fraud experienced by organisations across most industries, after the impact of hackers rose substantially over the past two years. Furthermore, 21 per cent of respondents said they experienced cybercrime as a new type of fraud as a result of the disruption caused by COVID-19.

One outlier was the energy, utilities and resources sector, in which procurement fraud was cited as the biggest threat, rather than cybercrime. This perhaps reflects the sector’s smaller digital footprint and fewer customer interactions.

Financial fraud continues to prevail in China

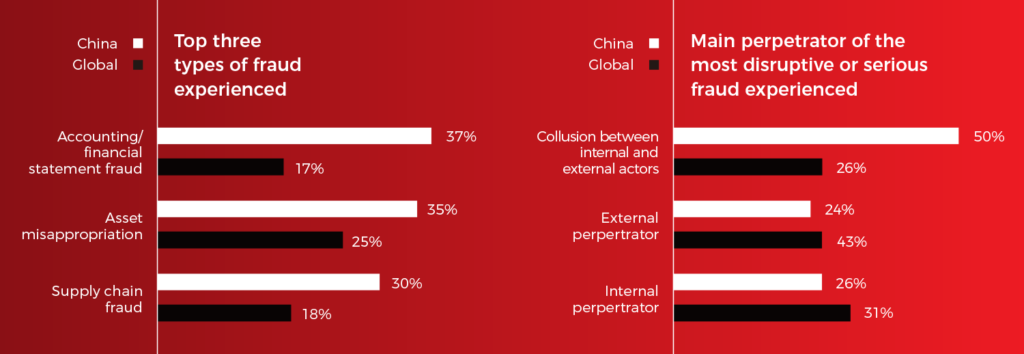

While a similar proportion of China respondents, 48 per cent, said they had experienced fraud or other economic crimes compared to the global average, it is notable that more traditional fraud issues continue to prevail in China. Instead of cybercrime, accounting and financial statement fraud was reported as the most common type experienced, and asset misappropriation as the most disruptive.

Prevalence of financial fraud in China continues to both pose a threat to the integrity of financial statements and to undermine trust in employees in key positions. As such, in recent times, there are high levels of scrutiny by external auditors when suspicions of fraud arise.

When fraud is detected, in addition to any direct financial statement impact, the external auditors are concerned about whether internal controls can be relied upon, as well as the integrity of management. They will expect an adequate and objective investigation into the matter. Key questions to be addressed include the pervasiveness of any issues, whether all bad actors have been identified, any deficiencies in the internal controls, and whether appropriate remediation steps are taken. In addition, the auditors will need to consider whether any laws or regulations may have been violated by the company and the consequent implications on the financial statements.

Fraud perpetrated through collusion remains top concern

In contrast to Europe, where 56 per cent of respondents reported that the most disruptive fraud incident was as the result of an external perpetrator (in the absence of collusion with internal parties), 43 per cent of global respondents said the same, versus only 24 per cent of China respondents.

Fraud hits companies from all angles, but collusion is particularly common in China. At least half of all China respondents reported that the most disruptive fraud they experienced was perpetrated through collusion between internal and external parties (up from 40 per cent two years previously).

As many companies rely heavily on third parties for doing business in China, fraud and corruption relating to collusion with external parties has long been an issue. It continues to be a key issue identified in risk assessments and is a top concern for many risk and compliance functions covering China. The issues most often encountered are: conflicts of interests (especially with service vendors and distributors); inflated procurement costs and vendor kickbacks; channelling of improper payments through dealers and agents; and payments for fictitious services in order to evade tax, manipulate financial statements or to generate cash.

One type of fraud scheme involving third parties commonly encountered by enterprises is collusion between employees and marketing vendors to misuse a company’s marketing budget. The root cause of this is usually inadequate controls and monitoring over large marketing budgets, leading to opportunities for abuse. Examples of poor controls include lack of segregation of duty (often the same person effectively selects the vendor, works with the vendor throughout service delivery, and confirms service completion); lax enforcement of purchase order requirements; and failure to retain adequate documentation that can later be audited.

Is fraud on the wane?

In China, strikingly, the 48 per cent of respondents that report having experienced fraud or other economic crimes in the last 24 months was a significant drop from 60 per cent in 2020.

This might be perceived as good news but, more likely, it could also suggest that companies have been less effective in detecting fraud and hence are less aware of fraud issues. Fewer China respondents reported having conducted routine internal audits over the past two years, which could be related to cross-border travel restrictions as a result of COVID-19. Another factor could be resource constraints. Of China respondents who identified supply chain fraud as one of their key concerns, 44 per cent reported that they are facing heightened exposure because of insufficient resources in managing fraud risks. Another 39 per cent shared that they have moved resources away from fraud controls in order to manage other issues.

Based on whistleblower reports received by multinational companies, fraud has not been on the wane in China. On the contrary, the traditional fraud schemes continue to be commonplace, often perpetrated through a combination of use of related parties or collusion with third parties, falsified documentation, fictitious or inflated transactions, and off-book transactions.

Furthermore, the shift towards digital platforms and online activities creates more opportunities for fraud. For instance, recent trends include falsification relating to virtual seminars in order to justify meeting expenses, ‘manufactured’ digital user activity to inflate reported user numbers, and tender manipulation through exploiting loopholes in online bidding systems.

The impact of change

Companies should anticipate that any economic disruption will lead to more fraud taking place. As businesses struggle to keep their lights on during times of economic disruption, resources and controls that were in place to mitigate fraud risk might have been altered or relaxed in order to expedite business processes, lower costs and to stay agile in an unstable market. In addition, management and employees may face greater difficulty in reaching targets legitimately, as well as increased financial pressure, creating incentive to commit fraud.

Fraud typologies often evolve over time as the external environment changes and technologies advance. However, fraud will not suddenly go away. It is, as a result, important for companies to stay aware of emerging trends in the local market and be vigilant for signs of smoke.

With respect to technology-enabled fraud, the best means of defence and detection, naturally, is digital technology and analytics. However, organisations should also bear in mind that any solutions deployed should be fit-for-purpose and tailored according to their business size and nature, and the local market.

This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, legal or other professional advice. Please refer to your advisors for specific advice.

Paul Tan is a partner in the Forensic Services practice of PwC China. PwC China’s Forensic Services team, based out of Shanghai, Beijing, Shenzhen and Hong Kong, has extensive experience in assisting clients to address fraud and other economic crime issues, in performing risk assessments, and in managing third party risks. We are a team of nine partners and approximately 100 professionals, and we leverage technology, analytics and digitization to solve client issues more efficiently and effectively.

Recent Comments