Mobilising the bond market for the Sustainable Development Goals

In 2021, social and sustainability bonds were introduced to the

China Interbank Bond Market through a ‘panda bond’ pilot programme launched by

the National Association of Financial Market Institutional Investors (NAFMII), with

technical support from the United Nations Development Programme (UNDP). Leveraging

global practices, the pilot aims to expand upon the Chinese green bond market

to include sustainability issues beyond climate and environment, and open new

opportunities to accelerate financing towards the UN’s Sustainable Development

Goals (SDGs).

Global trends of social and sustainability bonds

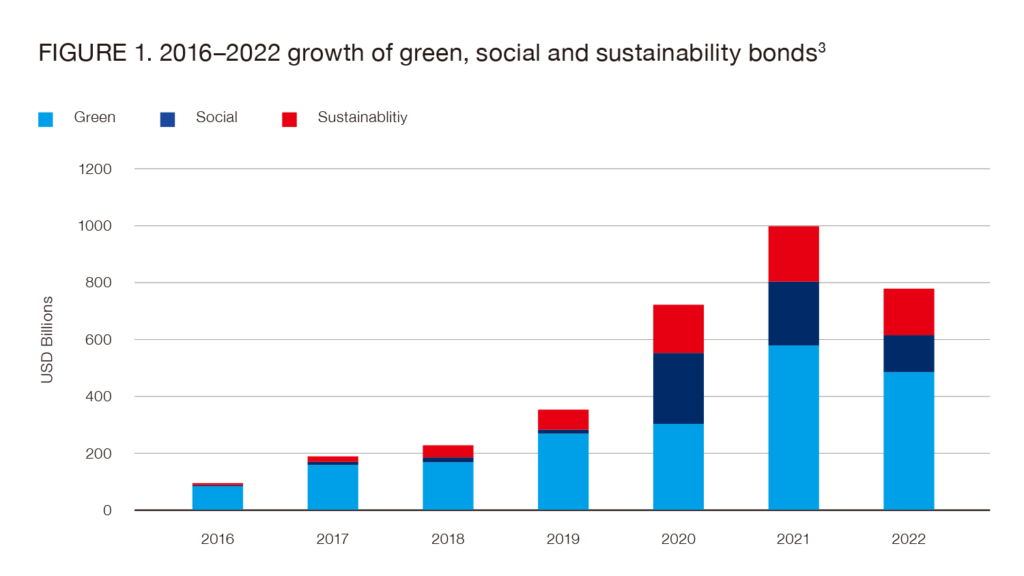

Despite the global economic downturn brought on by COVID-19, in addition to conflicts worldwide and their impact on energy and food prices and availability, the collective volume of social and sustainability bonds has grown significantly in recent years. It reached United States dollars (USD) 291.6 billion in 2022,[1] representing a volume increase of 31 times that of 2016.[2]

This surge of issuance is partly due to stakeholders’ increased attention to social issues, and to the overlap between social and environmental issues. This latter aspect came into sharper focus in 2020, when the pandemic revealed the fragility of our social systems and how our broken relationship with nature carries grave risks for us all. Since then, the combined share of social and sustainability bonds jumped to around 40 per cent of the sustainable bond market, [4]&[5] which for many years had been dominated by green bonds.

The resilienceshown by social and sustainability bonds amidst the market turmoil of the last two to three years is likely to continue, given the growing urgency among governments to deliver on their commitments to the SDGs, as well as rising environmental, social and governance (ESG) awareness among stakeholders.

The pilot programme on social and sustainability bonds in China

To enhance the role of the capital market in support of these national priorities, China has taken a ‘top- down’ policy-driven approach to boost its sustainable financial market. Among the first key steps were the following:

- In December 2015, the People’s Bank of China (PBoC) released a landmark document—Announcement 39, 2015—providing guidance for issuing green bonds on the interbank market.

- In 2016, the PBoC, along with six other ministries and government agencies, defined the overarching architecture for green bonds in the Guidelines for Establishing the Green Financial Systems, followed by a series of policy incentives and regulations targeting the bond market.

These regulatory innovations marked the start of rapid growth in China’s green bond market. Since 2016, it has boomed from barely any issuance to an accumulative USD 183 billion (Chinese yuan (CNY) 1.3 trillion) in outstanding volume by 2021.

In light of the positive results and financing gaps of using bond instruments to address environmental issues, it was recognised that the experience should be replicated across wider sustainability areas, like protecting and empowering vulnerable groups such as women and children, those living below the poverty line, and those lacking education or basic services. Therefore, in 2021, the NAFMII launched the Pilot Programme on Social Bonds and Sustainability Bonds, targeting overseas issuers in China’s inter-bank market. Bonds under this pilot apply to a wide range of projects, covering environment protection, pandemic prevention, elderly and childcare, facilities for people with disabilities, rural revitalisation, as well as fair access to healthcare and education, among other initiatives.

The design of the pilot took into consideration both domestic practices and international standards. On a conceptual level, the pilot aims to reflect the convergence between the 17 SDGs and China’s 14th Five-year Plan. On the technical level, it builds on the NAFMII’s existing procedures for bond registration and issuance, while taking reference from the four core elements of the International Capital Market Association Green Sustainability Social bond principles—use of proceeds, project evaluation and selection, management of proceeds and reporting—external evaluation and certification mechanisms, and a framework issuance mechanism. With the UNDP’s technical assistance, the pilot took core elements from the SDG Finance Taxonomy (China)[6] and adopted key principles, including ‘Do No Significant Harm’, “serving vulnerable groups”, and using SDG targets as impact indicators.

Outlook and recommendations

Since the pilot was launched in November 2021, two private companies and a multilateral development bank have issued sustainability bonds. With increasing awareness of broader SDG coverage beyond environmental protection, and the inter-linkages between different SDGs reflected in recent policy discussions such as the “integration between green finance and inclusive finance”, interest in social and sustainability bonds is likely to grow. To further scale up the market, three steps have been outlined for stakeholders to consider for future action:

- Improve policy support for social and sustainability bonds and create interoperable sustainable finance standards at the global level. China has relatively sound standards and supporting policies for green bonds, which are gradually being aligned with international practices. However, standards for other aspects of sustainable development are needed. Drawing on experience accumulated during NAFMII’s pilot programme, further steps should be taken to build robust standards for social and sustainability bonds, along with market incentives, policy regulations and disclosure requirements.

- Increase capacity building and technical assistance for issuers to improve impact management and reporting. Compared with green bonds where impact quantification is relatively more mature, impact measurement and disclosure for social and sustainability bonds remain challenging. To tackle this, various international bodies, such as the International Capital Market Association, have already introduced useful methodologies and tools. In support of these, issuers can also refer to the 169 targets of the SDGs and guidance from the appropriate UN bodies when defining impact indicators.

- Leverage the role of institutional investors, by measures such as encouraging them to take active stewardship and discuss sustainable development factors with issuers, as well as to push issuers to report information relevant to sustainable development; strengthen risk management throughout the whole life cycle (ex-ante, proceeds managing, and ex-post) of the bond; and provide purchasers with information on their entity-level sustainability performance.

Such further steps are vital, for only by ensuring adequate financing for the SDGs can we truly leave no one behind and safeguard life on earth by 2030. The UNDP and the NAFMII stand ready to continue supporting all parties in building a more sustainable, inclusive bond market.

Note: This article is abstracted from a UNDP and NAFMII issue brief published in December 2022. To read the full brief: https://www.undp.org/china/publications/issue-brief-pilot-social-and-sustainability-bonds-chinas-inter-bank-market

The UNDP works in about 170 countries and territories, helping to end poverty, reduce inequalities and exclusion, as well as protect the planet, in line with the SDGs. Together, these efforts aim to ensure that improvements in human wellbeing remain within ecological boundaries. We also help countries to develop policies, leadership skills, partnering abilities and institutional capabilities, as well as build resilience, in order to achieve the Sustainable Development Goals. The UNDP has been working in China for over 40 years, partnering to advance various phases of China’s development. The UNDP continues to be at the forefront of initiatives with China both to achieve the SDGs domestically and through China’s global cooperation.

The National Association of Financial Market Institutional Investors (NAFMII) was founded in September 2007, under the approval of the State Council of China. The NAFMII aims to propel the development of the China OTC financial market, which is composed of interbank bond market, inter-bank lending market, foreign exchange market, commercial paper market and gold market.

As

a self-regulation organisation in China, the membership of the NAFMII includes

policy banks, commercial banks, credit cooperative banks, insurance companies,

securities houses, fund management companies, trust and investment companies,

finance companies affiliated with corporations, credit rating agencies,

accounting firms and companies in non-financial sectors.

[1] Sustainable Debt Global State of the Market 2022, Climate Bond Initiative (CBI), 2023, viewed 9th May 2023, <https://www.climatebonds.net/files/reports/cbi_sotm_2022_03d.pdf>

[2] Calculated based on data from CBI Interactive Data Platform, viewed 9th May 2023, <https://www.climatebonds.net/market/data/>

[3] Complied by author based on data from Climate Bond Initiative (CBI). The 2016–2021 data is from CBI Interactive Data Platform. Available at: https://www.climatebonds.net/market/data/. The 2022 data is from Sustainable Debt Global State of the Market 2022, Climate Bond Initiative (CBI), 2023, viewed 9th May 2023, <https://www.climatebonds.net/files/reports/cbi_sotm_2022_03d.pdf>

[4] Calculated based on data from Sustainable Debt Global State of the Market 2021, CBI, 2022, viewed 9th May 2023, <https://www.climatebonds.net/files/reports/cbi_global_sotm_2021_02h_0.pdf>

[5] For easier comparisons with historical data, the sustainable bond market here only covers green, social and sustainability bonds (GSS bonds) – the majority in volume terms. Other instruments with current limited scale, including sustainability-linked bonds, blue bonds, gender bonds, and so on, are not included in our data analysis.

[6] Technical Report on SDG Finance Taxonomy, UNDP, 1st June 2020, viewed 9th May 2023, <https://www.undp.org/china/publications/technical-report-sdg-finance-taxonomy>

[7] SDG Impact Standards, SDG Impact (n.d.), viewed 9th May 2023, <https://sdgimpact.undp.org/practice-standards.html>

Recent Comments