The Made in China 2025 (MiC2025) initiative will see as much as CNY 8 trillion invested over the next 10 years in order to transform China into a global, high-end manufacturing powerhouse. Cherry Li and Benjamin Jacobs of APCO Worldwide shine a light on China’s intelligent robotics industry—one of ten industries prioritised by the Chinese Government under the plan—and analyse the potential risks and opportunities for foreign manufacturers.

The Made in China 2025 (MiC2025) initiative will see as much as CNY 8 trillion invested over the next 10 years in order to transform China into a global, high-end manufacturing powerhouse. Cherry Li and Benjamin Jacobs of APCO Worldwide shine a light on China’s intelligent robotics industry—one of ten industries prioritised by the Chinese Government under the plan—and analyse the potential risks and opportunities for foreign manufacturers.

Intelligent robotics—an emerging field in smart manufacturing—makes use of pre-programmed, self-corrective robots to enable high-quality production that is unprecedentedly clean, safe and efficient. This article focuses on Chinese efforts to promote intelligent industrial robotics, which primarily pertain to the auto, chemical and electronics industries.

In these fields, advances in high-end sensors and the Internet of Things (IoT) have enabled close collaboration between humans and interconnected robots. European manufacturer KUKA, for instance, designs intelligent robots that work alongside humans, using the IoT to monitor the status of unfinished pieces in production lines. SAP’s HANA Cloud software analyses data in real-time to predict when machines might fail. Technological advances such as these have experts worldwide hailing intelligent robotics as the next Industrial Revolution. National governments that embrace this change with favourable robotics development policies stand to reap enormous economic benefits.

Intelligent industrial robotics in China

The reason for MiC2025’s emphasis on intelligent robotics is simple: China’s traditional manufacturing sector can no longer compete with Vietnamese and Indian labour prices, yet also cannot match the quality and efficiency that characterises European, American and Japanese manufacturing. In light of this economic conundrum, MiC2025 encourages the development and application of robotics in Chinese factories as a means of moving Chinese producers up the manufacturing value chain.

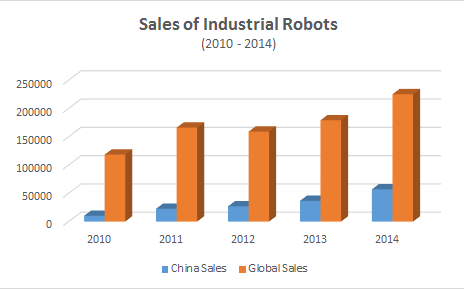

Over the past few years, the industrial robotics industry has experienced robust development worldwide. According to the International Federation of Robotics, the global sales volume of industrial robots reached 230,000 in 2014, and was expected to increase by 15 per cent in 2015. Manufacturers in developed economies such as America, Japan and Europe lead the industrial robotics industry with advanced core technologies and well-established brands.

Source: International Federation of Robotics http://www.ifr.org/

Source: International Federation of Robotics http://www.ifr.org/

China has seen rapid growth in its robotics market over the last few years; however, domestic manufacturers still struggle to compete with their international counterparts. While in 2014, nearly 50,000 industrial robots were sold in China, accounting for nearly a quarter of global sales, only 16,000 were produced by domestic manufacturers. MiC2025 aims to have Chinese manufacturers close this gap. Experts predict the Chinese Government will set aside CNY 500 billion for robotics development over the next few years, tripling sales volume and raising the output value of industrial robotics to approximately CNY 100 billion by 2020. This investment is also expected to encourage domestic technology upgrades in the robotics manufacturing industry, which is expected to achieve a value of approximately CNY 300 million during the 13th Five-Year Plan period. Finally, despite China’s relatively low robotics density (approximately one per cent), China is expected to be home to over one third of all industrial robots by 2018. These positive predictions indicate a bright future for robotics in China. Whether they come to fruition, however, will ultimately depend on Chinese policy implementation.

China’s robotics development policy environment and implementation

Although the 13th Five-Year Plan for the robotics industry is still being reviewed by the Ministry of Industry and Information Technology (MIIT), its release is expected by the end of March. In the meantime, local governments have begun to respond to MiC2025 by drafting implementation guidelines and rules. Local policies specific to intelligent industrial robotics mainly focus on creating changes within the supply chain, robotics users and service platforms.

Following MiC2025’s release, Shanghai’s government acted fast in issuing the Rules of Special Support on First Breakthrough and Application Models of High-End Intelligent Equipment, subsidising 30 per cent of first sales for breakthrough technology and 20 per cent of investment for application models

In December 2015, Foshan’s government released a policy which pledged to support over 3,000 local enterprises in achieving intelligent upgrades with special funds for automation from 2015 to 2017. In January 2016, Dongguan’s government announced that it will provide a maximum CNY 5 million reward for companies conducting projects with Dongguan-made robotics.

Despite the emergence of a number of local documents detailing MiC2025 implementation, the Chinese Government will likely still encounter problems putting the plan into action. First of all, a lack of broader supportive policies and mechanisms in other areas may affect MiC2025’s effectiveness. Although the policies listed above provide general guidelines and support for smart manufacturing and intelligent robotics, funding these policies and ensuring that robots are properly applied in factories will require close coordination in the areas of taxation, finance, technology and talent. Second, making policies in accordance with local circumstances is critical. Industrialisation levels and regional focuses differ across China; local governments that blindly invest in robotics as a way to curry favour with central government officials will waste resources and produce low-quality products. Whether the government properly incentivises prudent investment and implementation will ultimately determine the success of the MiC2025 plan.

Implications for foreign robotics manufacturers

China’s robotics policy environment presents both opportunities and risks for foreign-invested companies operating in China. Abundant potential demand and favourable robotics policies make China an attractive destination for robotics manufacturers today. Currently, foreign-made robotics dominate 70 per cent of the Chinese market and, even though Chinese companies are catching up, foreign companies with sophisticated technologies will still enjoy a favourable market share in the near term. Additionally, technical superiority also enables foreign manufacturers to take the initiative in cooperating with Chinese partners when developing innovative robotics parts, materials and operation systems.

China’s robotics policy environment presents both opportunities and risks for foreign-invested companies operating in China. Abundant potential demand and favourable robotics policies make China an attractive destination for robotics manufacturers today. Currently, foreign-made robotics dominate 70 per cent of the Chinese market and, even though Chinese companies are catching up, foreign companies with sophisticated technologies will still enjoy a favourable market share in the near term. Additionally, technical superiority also enables foreign manufacturers to take the initiative in cooperating with Chinese partners when developing innovative robotics parts, materials and operation systems.

Despite these substantial opportunities for development, foreign companies still face significant risks in the Chinese market. When collaborating with Chinese partners, they may find themselves confronted with intellectual property (IP) issues. Although China has been making efforts to address IP concerns over the last few years, Chinese IP laws and regulations remain vague and underdeveloped. Many foreign companies—especially those that are technology-intensive—frequently suffer patent violations regarding designs, trademarks and software. Although foreign robotics manufacturers are confident that innovation will be protected at home, the Chinese robotics landscape presents an entirely different picture.

Finally, in addition to concerns over IP, the expectation of increasingly fierce competition from domestic companies merits the attention of foreign robotics manufacturers. Amid the current robotics craze, almost all policies favour domestic companies in two ways.

First, national and local governments have provided Chinese producers enormous financial incentives for research and development, talent recruitment and training. For companies that purchase domestic robots, local governments have started to compensate for lay-offs and replacement expenses. This means that as the Chinese robotics industry develops further, foreign robotics manufacturers will begin to encounter challenges from state-backed domestic competitors.

Second, foreign companies in various industries might be pressured to purchase domestic robots in order to obtain favourable treatment from the Chinese Government. Depending on whether Chinese manufacturers are successful in converting MiC2025 funds to high-quality, high-efficiency production, these risks could threaten the operations of MNCs in China in the medium-to-long term.

In sum, the intelligent robotics industry is already transforming global manufacturing, and China’s sudden emergence onto the world stage provides tremendous opportunities for both Chinese and foreign manufacturers. While the ultimate efficacy of MiC2025 remains unknown, China has demonstrated its intention to develop a powerful domestic robotics industry. Remaining wary of risks, advanced foreign robotics manufacturers should recognise the potential for rapid growth in the Chinese market, and should pursue careful collaboration with Chinese partners in the common interest of both expanding profit margins and propelling China’s economic transition further along.

Founded in 1984, APCO has grown into one of the largest independent communication, stakeholder engagement and business strategy firms in the world, with 35 offices and more than 600 people worldwide. We challenge conventional thinking and inspire movements to help our clients succeed in an ever-changing world. Stakeholders are at the core of everything we do – we turn the insights that come from our deep stakeholder relationships into forward-thinking, creative solutions that always push the boundaries. By combining diverse global viewpoints and local insights, we help our clients plan for what’s next.

Recent Comments